US Undiscovered Gems for September 2025

As the United States market reaches new heights with major indices like the Dow, S&P 500, and Nasdaq closing at record levels, investor optimism is buoyed by expectations of potential interest rate cuts from the Federal Reserve. Amid this backdrop of economic anticipation and market enthusiasm, identifying promising small-cap stocks can be particularly rewarding as these companies often offer growth potential that aligns well with evolving economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | NA | 3.34% | 3.70% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| First Northern Community Bancorp | NA | 8.05% | 12.27% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| Sound Group | NA | 6.23% | 45.48% | ★★★★★★ |

| FRMO | 0.10% | 42.87% | 47.51% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Nutex Health (NUTX)

Simply Wall St Value Rating: ★★★★★★

Overview: Nutex Health Inc. is a healthcare services and operations company in the United States with a market capitalization of $477.18 million.

Operations: Nutex Health generates revenue primarily from its Hospital Division, contributing $592.98 million, and its Population Health Management Division, which brings in $31.30 million.

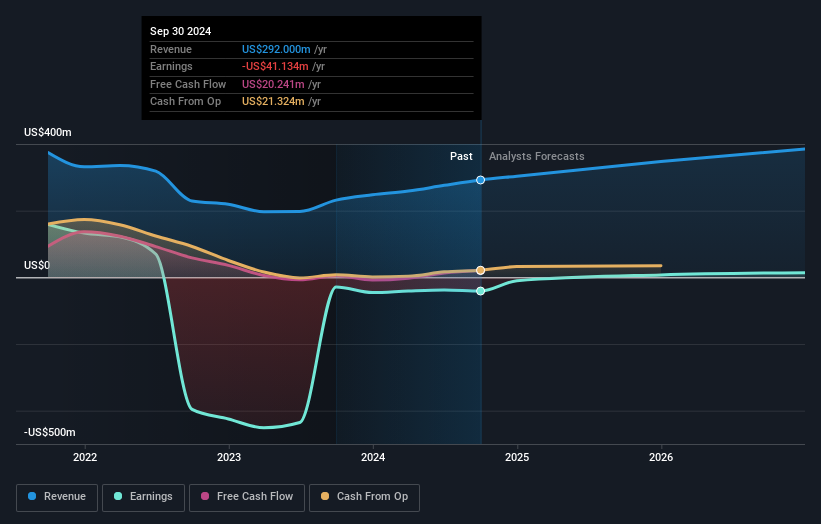

Nutex Health, a dynamic player in the healthcare sector, has seen its debt to equity ratio improve significantly from 87.9% to 15.5% over five years, indicating a stronger financial footing. The company is trading at an attractive value, reportedly 94.3% below its estimated fair value, and boasts high-quality earnings with interest payments well covered by EBIT at 9.6 times coverage. Despite recent profitability and expected revenue growth of 22.7% annually over three years, Nutex faces challenges such as potential profit margin declines and regulatory risks tied to arbitration-driven revenues that could affect cash flow stability.

Interface (TILE)

Simply Wall St Value Rating: ★★★★★★

Overview: Interface, Inc. designs, produces, and sells modular carpet products across various regions including the United States, Canada, Latin America, Europe, Africa, Asia, and Australia with a market capitalization of approximately $1.58 billion.

Operations: Interface generates revenue primarily from two segments: the Americas, contributing $835.26 million, and Europe, Africa, Asia, and Australia (EAAA), which brings in $516.95 million.

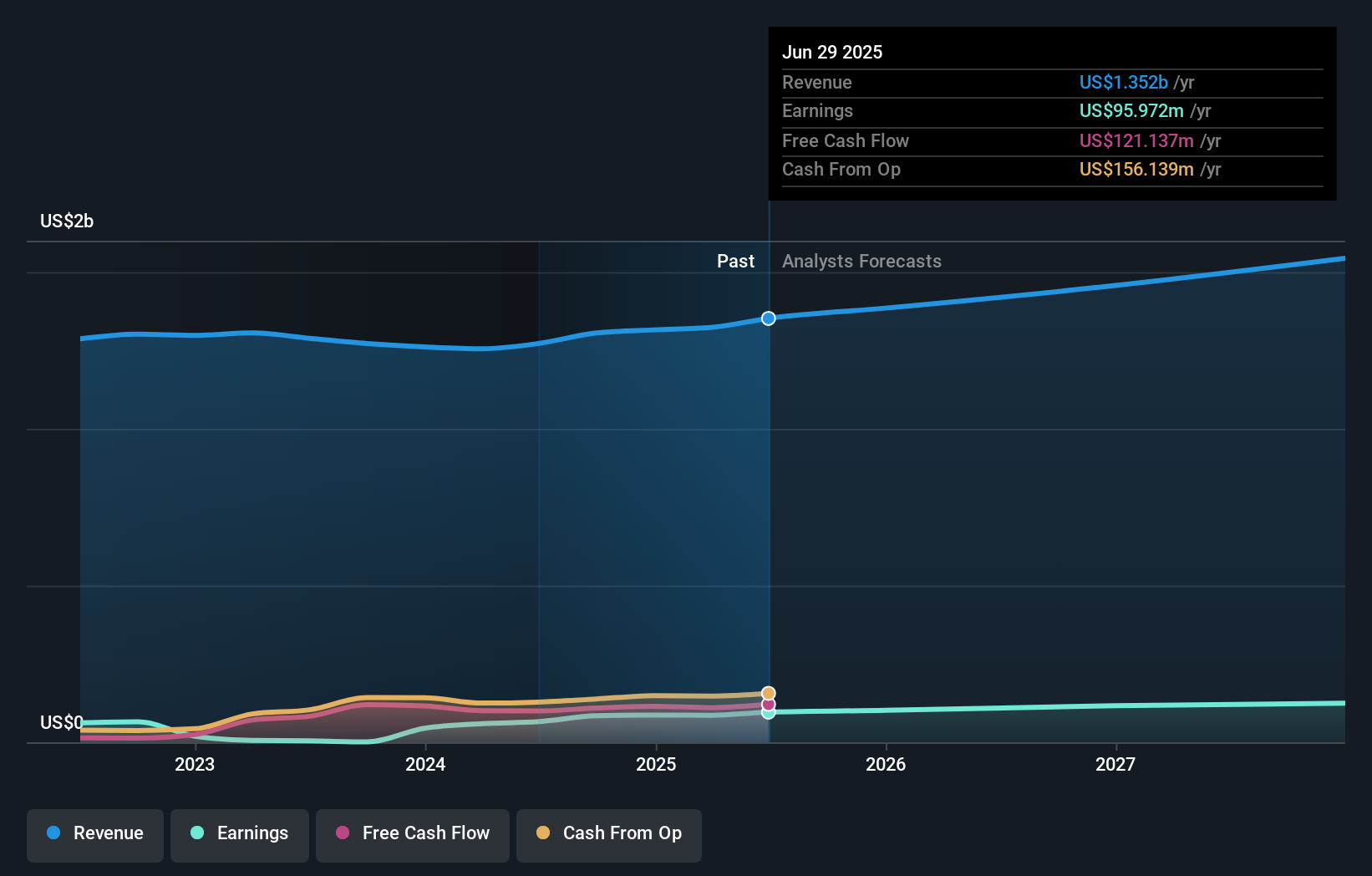

Interface, with a focus on sustainable flooring, has seen earnings grow by 45% over the past year, outpacing the industry average. The net debt to equity ratio stands at a satisfactory 31.8%, showing prudent financial management. Interface's recent product launch of the Stellar Horizons™ carpet tile collection underscores its design leadership and commitment to sustainability. The company repurchased 217,500 shares recently for US$4.45 million as part of a larger buyback initiative totaling US$21.62 million since May 2022. Despite challenges from low-cost competitors and market reliance, Interface is trading at an attractive value relative to its peers.

Global Ship Lease (GSL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Global Ship Lease, Inc. operates by owning and chartering containerships under fixed-rate charters to container shipping companies globally, with a market capitalization of approximately $1.13 billion.

Operations: The company generates revenue primarily through its transportation shipping segment, amounting to $730.28 million.

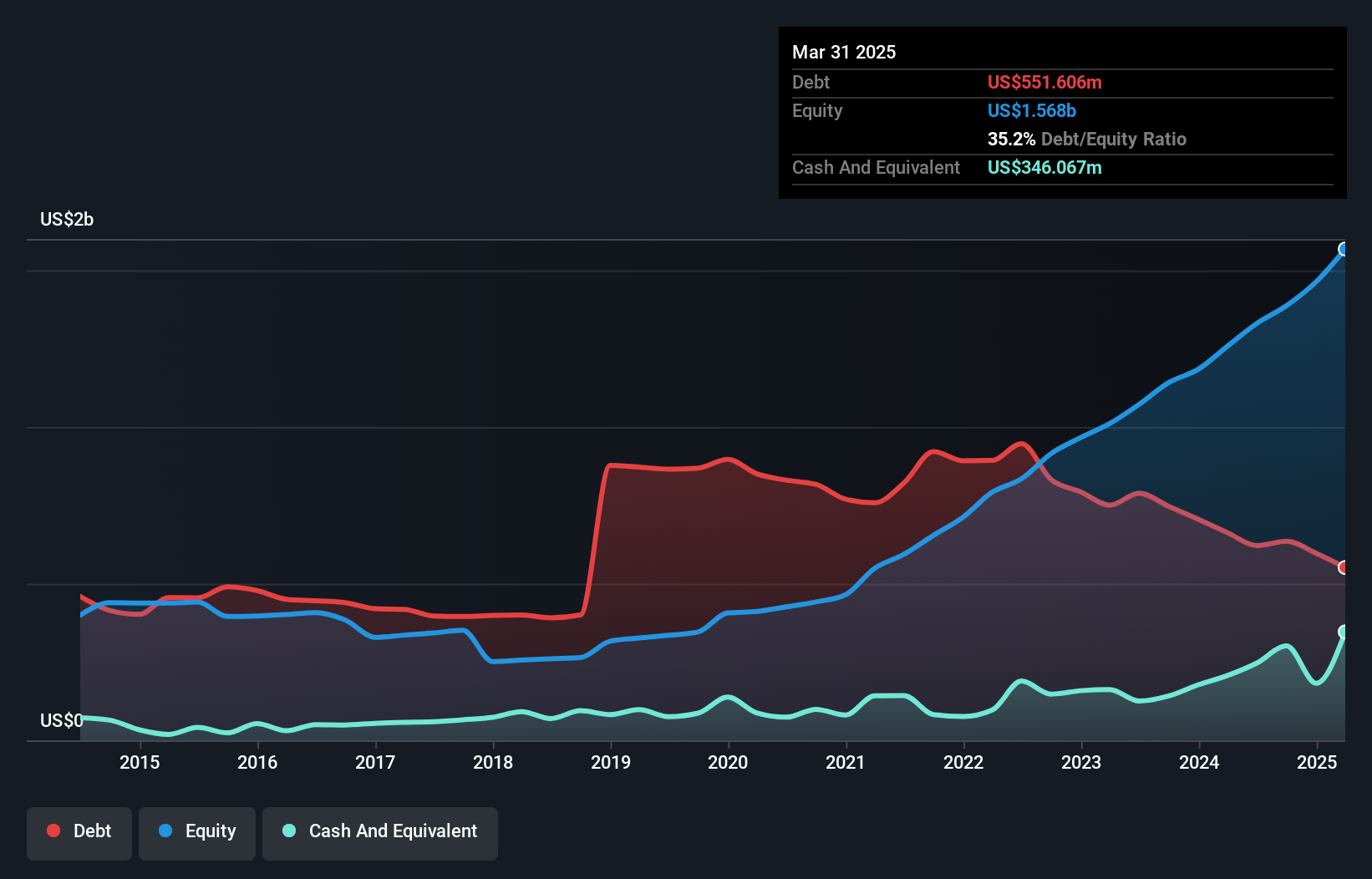

Global Ship Lease, a player in the containership space, has shown robust performance with recent earnings growth of 18.8%, outpacing the shipping industry's -5% downturn. Their net income for Q2 2025 was US$95.44 million, up from US$88.03 million a year earlier, while revenue reached US$191.86 million compared to US$175 million previously. The company boasts a satisfactory net debt to equity ratio of 6.5%. Despite forecasts suggesting an average annual earnings decline of 12.6% over three years, GSL trades at good value and has reduced its debt to equity ratio significantly from 194.9% to 33.3% over five years.

Key Takeaways

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 277 more companies for you to explore.Click here to unveil our expertly curated list of 280 US Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal