FTI Consulting (FCN): Exploring Valuation as Market Weighs Recent Share Price Drift

Most Popular Narrative: 9.7% Undervalued

According to the most widely followed narrative, FTI Consulting shares are seen as nearly 10% undervalued. The narrative suggests that there may be untapped potential yet to be reflected in the current share price.

The consulting industry's trend toward consolidation and the challenging macro climate are expected to drive "shakeouts" among weaker competitors. This could strengthen FTI's competitive position, client retention, and potential for market share gains, which may lead to sustainable margin expansion and earnings growth.

Curious about what’s fueling this bullish outlook? The fair value hinges on bold profit forecasts and some intriguing shifts in the company’s business model. Want to see how the analysts connect all the dots and why they believe today’s price doesn’t tell the whole story? The narrative reveals a detailed mosaic of growth and margin assumptions you won’t want to miss.

Result: Fair Value of $185 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, increased automation or unpredictable regulatory shifts could dampen demand for FTI's services and challenge the bullish outlook that analysts present.

Find out about the key risks to this FTI Consulting narrative.Another View: Discounted Cash Flow Tells a Different Story

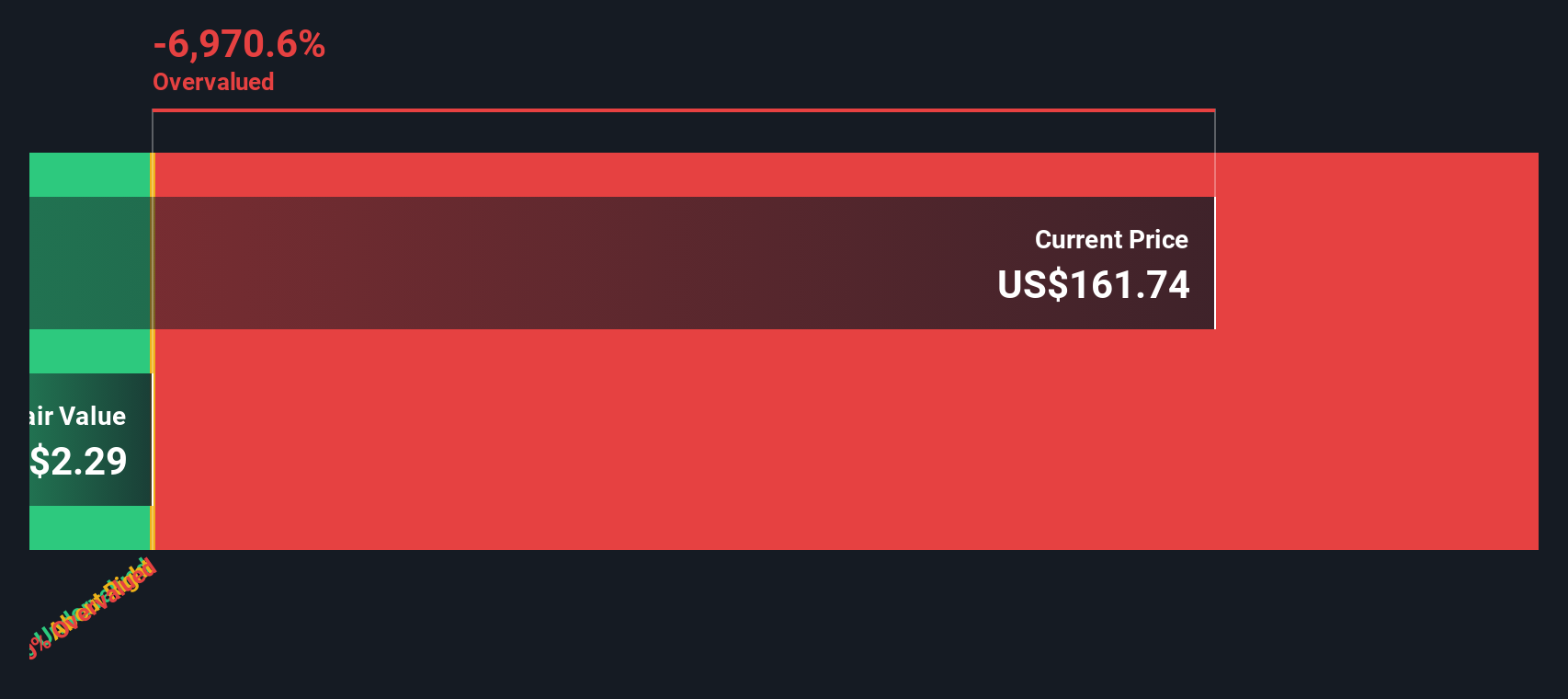

While analysts see FTI Consulting as undervalued based on future earnings and margin growth, our DCF model presents a starker picture and suggests the stock could be overvalued. Which perspective do you trust most?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own FTI Consulting Narrative

There’s always room for your own perspective. If the narrative here doesn’t quite fit your view, dive in and shape your own take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding FTI Consulting.

Looking for more investment ideas?

Smart investors know the biggest opportunities are not always obvious. Broaden your investing horizons right now and uncover unique stocks that could help set your portfolio apart before the market catches on.

- Spot undervalued gems supported by robust future cash flow projections and seize your chance with undervalued stocks based on cash flows before others take notice.

- Capitalize on tomorrow’s medical revolution by accessing promising companies harnessing artificial intelligence in healthcare, all delivered through healthcare AI stocks.

- Hunt for next-wave potential among budget-friendly shares with solid financial fundamentals using penny stocks with strong financials, and get ahead of the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal