Is Kirby (KEX) Using Buybacks to Reinforce Confidence or Signal Shifting Growth Priorities?

- On September 8, 2025, the Board of Directors of Kirby Corporation (NYSE:KEX) authorized a share repurchase program allowing the company to buy back up to 8,000,000 shares.

- This substantial buyback initiative often signals management’s confidence in Kirby’s future performance and can potentially enhance value for existing shareholders by reducing the share count.

- We’ll explore how Kirby’s newly announced share repurchase plan may affect its long-term investment narrative and projected growth path.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Kirby Investment Narrative Recap

To be a shareholder in Kirby, you have to believe in the value of its inland marine and distribution business, supported mainly by US petrochemicals and data center-driven power demand. The newly announced 8,000,000-share buyback signals management’s ongoing confidence, but for now, it does not materially change the primary near-term catalyst, limited industry barge supply, or the biggest risk of softer chemical shipping volumes tied to macro uncertainty.

One relevant recent development is Kirby’s ongoing buyback activity, with over 7.3 million shares repurchased as of August 2025. This ongoing return of capital supports sentiment, but the central catalyst remains the tight fleet supply and its potential influence on rates as US manufacturing investment continues.

On the flip side, investors should be aware that persistent labor and inflationary cost pressures could squeeze margins if demand softens in coming quarters...

Read the full narrative on Kirby (it's free!)

Kirby's narrative projects $3.9 billion revenue and $445.6 million earnings by 2028. This requires 6.1% yearly revenue growth and a $142.6 million earnings increase from $303.0 million.

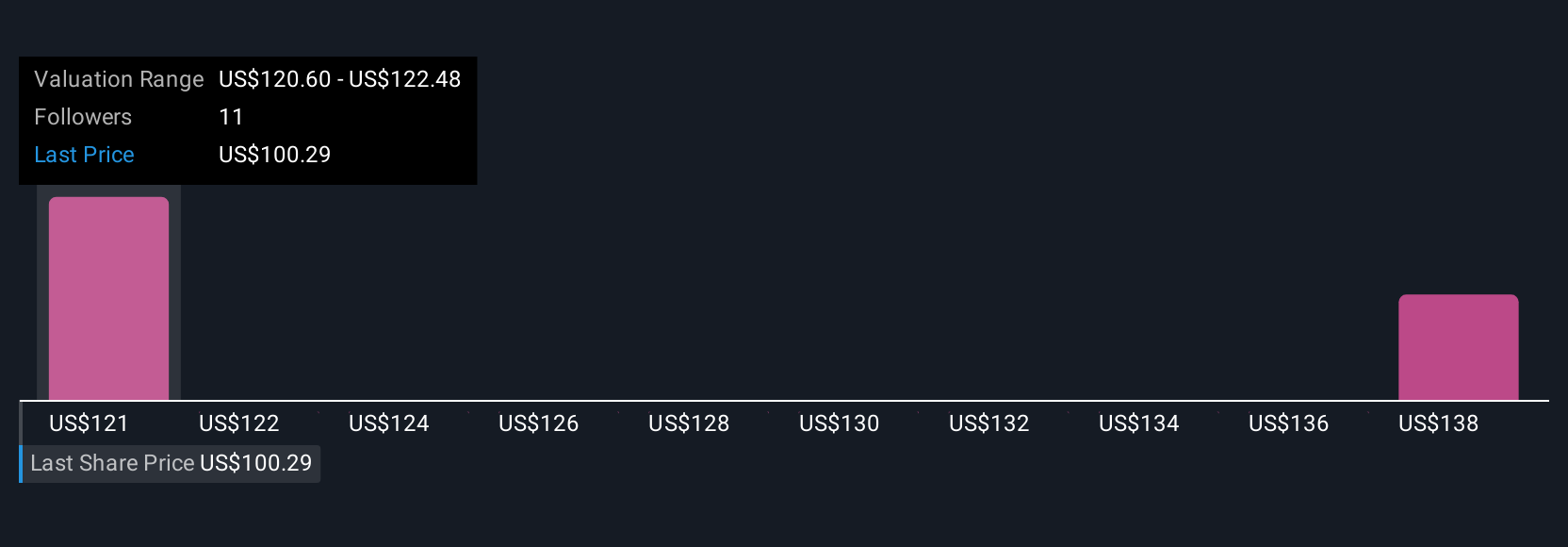

Uncover how Kirby's forecasts yield a $115.75 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span US$59.52 to US$115.75 per share. While some see upside from tight vessel supply and buybacks, others focus on industry-specific risks that could affect Kirby’s results; compare these perspectives to inform your decisions.

Explore 2 other fair value estimates on Kirby - why the stock might be worth 33% less than the current price!

Build Your Own Kirby Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kirby research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Kirby research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kirby's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal