Matson (MATX) Valuation in Focus After Broker Downgrades on Renewed Tariff Pressures

Matson (MATX) is back in the headlines, but not for reasons most shareholders would hope. The company has recently been dealing with renewed tariff pressures, and that has led brokers to revise their earnings expectations lower for the current quarter. As a result, there is a lot of talk about what these ongoing trade uncertainties might mean for Matson’s operational efficiency and short-term profitability.

The concerns over tariffs and the resulting volatility have put real pressure on Matson’s stock price this year. Shares are down nearly 16% in the past year and have lost almost a quarter of their value year to date. Even with these headwinds, the company has a long-term track record of delivering value, with its stock up over 44% in three years and 187% in five years. That history of growth adds some complexity to the current moment, when momentum has clearly faded in the face of external risks and shifting sentiment.

After a tough run this year, is the recent drop a sign Matson is undervalued, or is the market simply pricing in more challenging times ahead for the company?

Most Popular Narrative: 9% Undervalued

The current most popular narrative implies Matson is trading below its estimated fair value, reflecting confidence in its future prospects despite projected earnings declines and industry headwinds.

Investments in fleet modernization and LNG-ready vessels enhance Matson's operational efficiency and regulatory readiness, reducing long-term operating costs and likely securing higher net margins as emissions standards tighten industry-wide.

Curious why analysts believe Matson deserves a premium, even as profits are forecast to contract? Want to know which bold projections about future profitability, revenue, and cost efficiency are shaping this valuation? The real story behind the 9% undervaluation might surprise you. Dive into the narrative and see what’s behind the headline numbers.

Result: Fair Value of $115 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent tariff uncertainty and a heavy focus on just a few trade lanes could still challenge Matson’s growth and the bullish valuation case.

Find out about the key risks to this Matson narrative.Another View: Our DCF Model Speaks

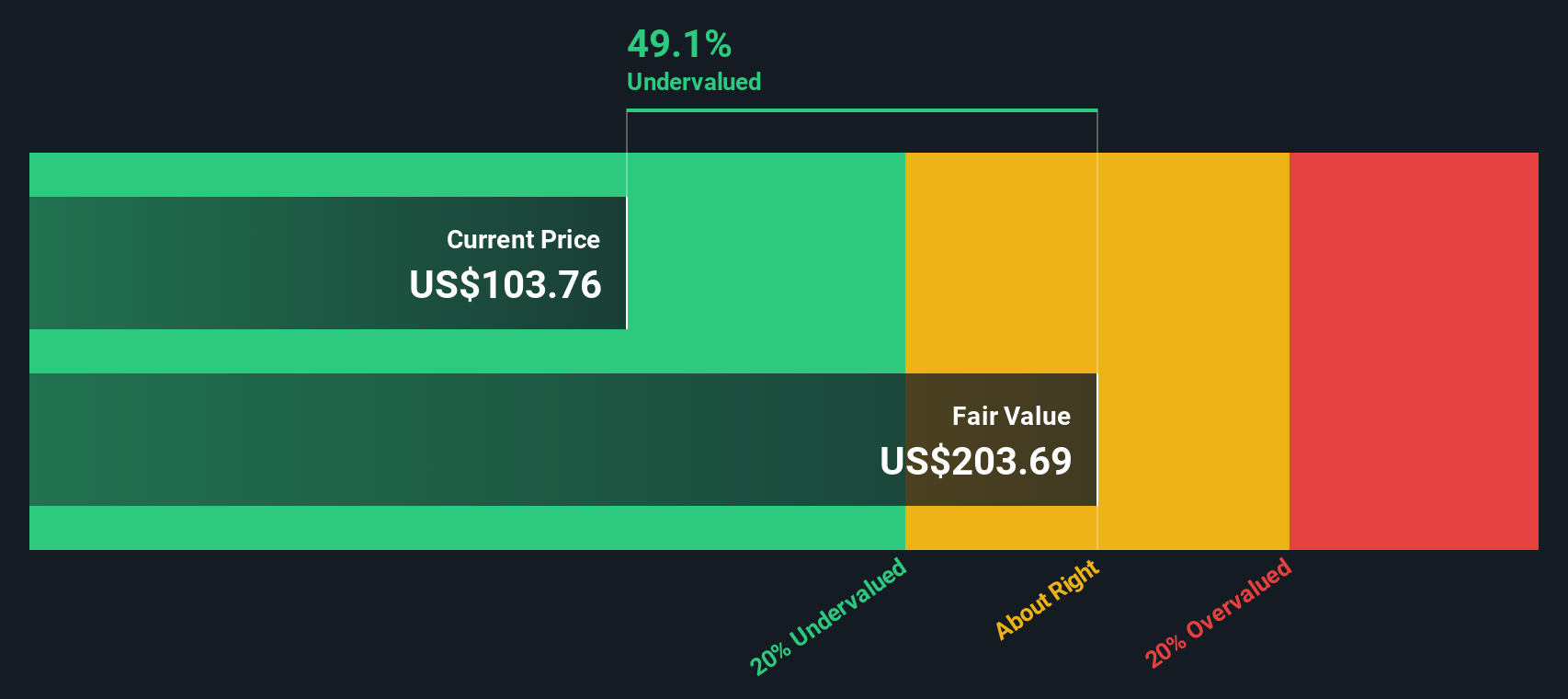

While analysts put Matson's fair value above current prices, our SWS DCF model suggests the stock is trading even further below its intrinsic value. Does this model capture potential that others are missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Matson Narrative

If you prefer your own analysis or want to explore the figures further, you can put together your personal narrative in just a few minutes using our tools. Do it your way

A great starting point for your Matson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your next move even smarter by checking out handpicked markets that match your interests and ambitions. You could be missing opportunities that are making waves right now.

- Uncover tomorrow’s leaders in artificial intelligence by checking out a selection of promising companies positioned for breakthroughs in automation and data-driven innovation with AI penny stocks.

- Supercharge your potential for high yields by seeking out established companies offering attractive payout ratios through dividend stocks with yields > 3%.

- Tap into undervalued opportunities trading below their real worth and see which businesses deserve a closer look by starting your journey with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal