Williams-Sonoma (WSM): Parsing Valuation Signals After Quiet Momentum in the Market

Williams-Sonoma: Investors Take Notice After Recent Moves

Williams-Sonoma (WSM) has drawn investor attention lately, even in the absence of any headline-grabbing events. Sometimes, a stock’s quiet moves without a clear trigger can be just as intriguing as major announcements, prompting shareholders and would-be investors to reconsider what’s driving sentiment and what could be on the horizon. With markets constantly weighing growth and value, Williams-Sonoma’s recent performance has become a talking point for those wondering if an opportunity is brewing under the radar.

Looking at the numbers, Williams-Sonoma has gained significant ground over the past year, with a 56% total return and positive momentum picked up in the past three months. While annual revenue and profit growth have been steady, no major developments or abrupt news have jolted markets. Most price action has been a function of ongoing business performance. That said, the strong run in recent months may signal that investors are warming to Williams-Sonoma’s long-term prospects or reassessing its risk profile.

After this run-up, should investors view Williams-Sonoma as a stock trading below its true value, or is the market already drawing in next year’s potential growth?

Most Popular Narrative: 0.5% Undervalued

The most popular narrative suggests Williams-Sonoma is trading just below its estimated fair value, based on a blend of future earnings growth, profit margins, and risk factors.

Continued investment and advances in AI-powered tools and digital platforms are driving higher conversion rates, improved customer experience, and measurable productivity gains. These factors support both revenue growth and expanded operating leverage at the margin level.

Think you know why analysts believe Williams-Sonoma deserves this price target? There is more than meets the eye. Behind this valuation are bold assumptions, including a projected margin squeeze and a premium multiple not typically given to most retailers. What causes analysts to rate this growth story above sector averages? Uncover the financial levers and controversial projections that shape this hotly debated fair value.

Result: Fair Value of $204.32 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent global tariff volatility or continued weakness in the housing market could quickly shift the bullish outlook that currently supports Williams-Sonoma’s trajectory.

Find out about the key risks to this Williams-Sonoma narrative.Another View: Industry Pricing Raises Questions

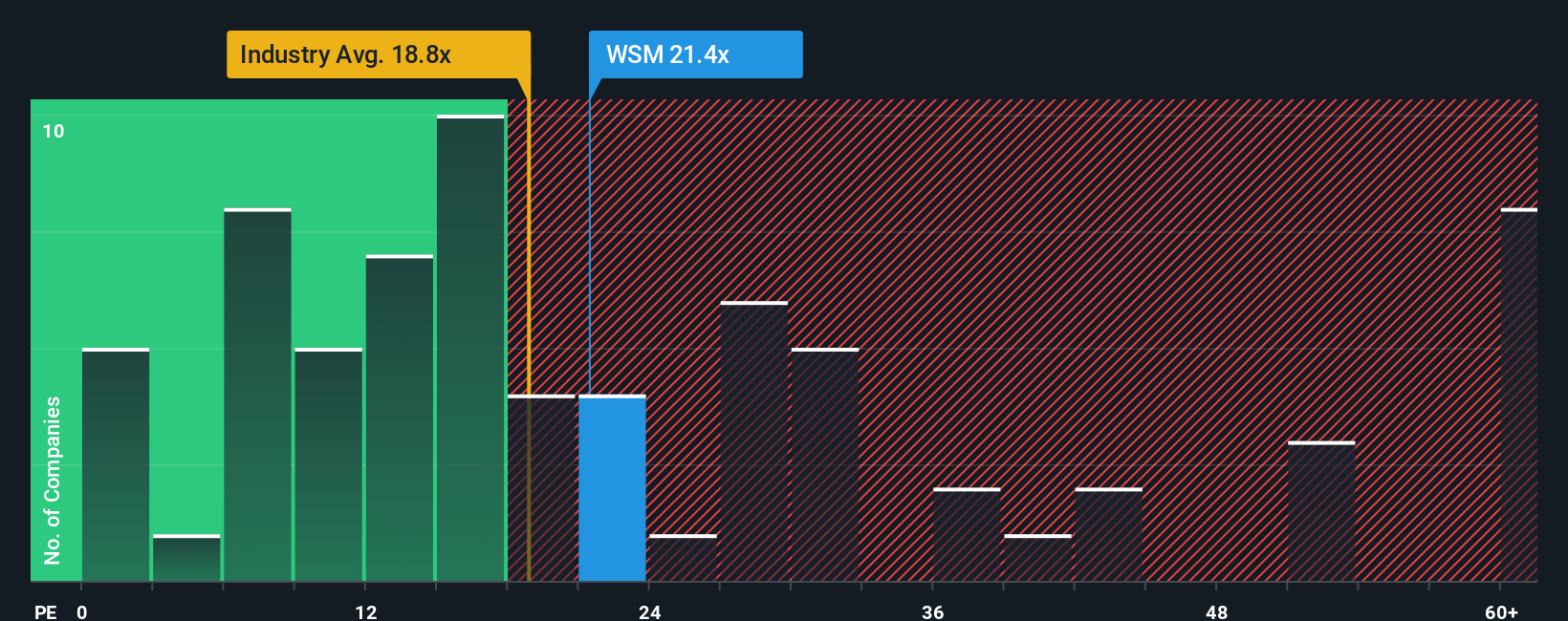

Looking at Williams-Sonoma from a different angle, some see its current price as expensive compared to the industry average when using market pricing techniques. This raises the question of whether the market is overlooking some risks or if the momentum is justified.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Williams-Sonoma Narrative

If you think there’s more to the story or want to dig into the numbers on your own terms, you can quickly build and share a personal take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Williams-Sonoma.

Looking for More Investment Ideas?

Don’t let unique opportunities slip by while focusing on just one stock. Amplify your investing strategy by targeting high-potential themes that fit your goals and interests.

- Pinpoint stocks offering attractive yields by checking out companies with dividend stocks with yields > 3%. These companies are built to reward you with dependable income.

- Join the momentum around innovation and stay ahead by tracking AI penny stocks. These stocks are set to redefine entire industries with smart technology.

- Tap into hidden bargains and uncover growth potential through undervalued stocks based on cash flows, which might be flying under the market’s radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal