Kulicke and Soffa Industries (KLIC): Analyzing Valuation After Recent Signs of Investor Interest

Price-to-Sales of 3x: Is it justified?

Kulicke and Soffa Industries appears fairly valued when comparing its current price-to-sales (P/S) ratio to broader industry benchmarks. Its P/S ratio stands at 3x, which is lower than the U.S. semiconductor industry average of 4x and the estimated fair P/S ratio of 3.7x, but higher than the peer group average of 2.7x.

The price-to-sales multiple reflects how much investors are willing to pay per dollar of sales. This measure is especially relevant for companies like KLIC, which are experiencing fluctuating profitability. Since revenue tends to be more stable than earnings in cyclical sectors, the P/S ratio provides an essential lens for comparative valuation.

This suggests the market is not pricing in much upside for future sales, despite forecasts calling for faster revenue and earnings growth versus the market. While KLIC is cheaper than the sector overall, it does come at a small premium to direct peers. This leaves the debate open regarding future growth potential or risk appetite.

Result: Fair Value of $38.15 (ABOUT RIGHT)

See our latest analysis for Kulicke and Soffa Industries.However, persistent weakness in recent annual returns and significant earnings volatility could quickly undermine the fair value case if momentum does not improve.

Find out about the key risks to this Kulicke and Soffa Industries narrative.Another View: Discounted Cash Flow Sends a Different Signal

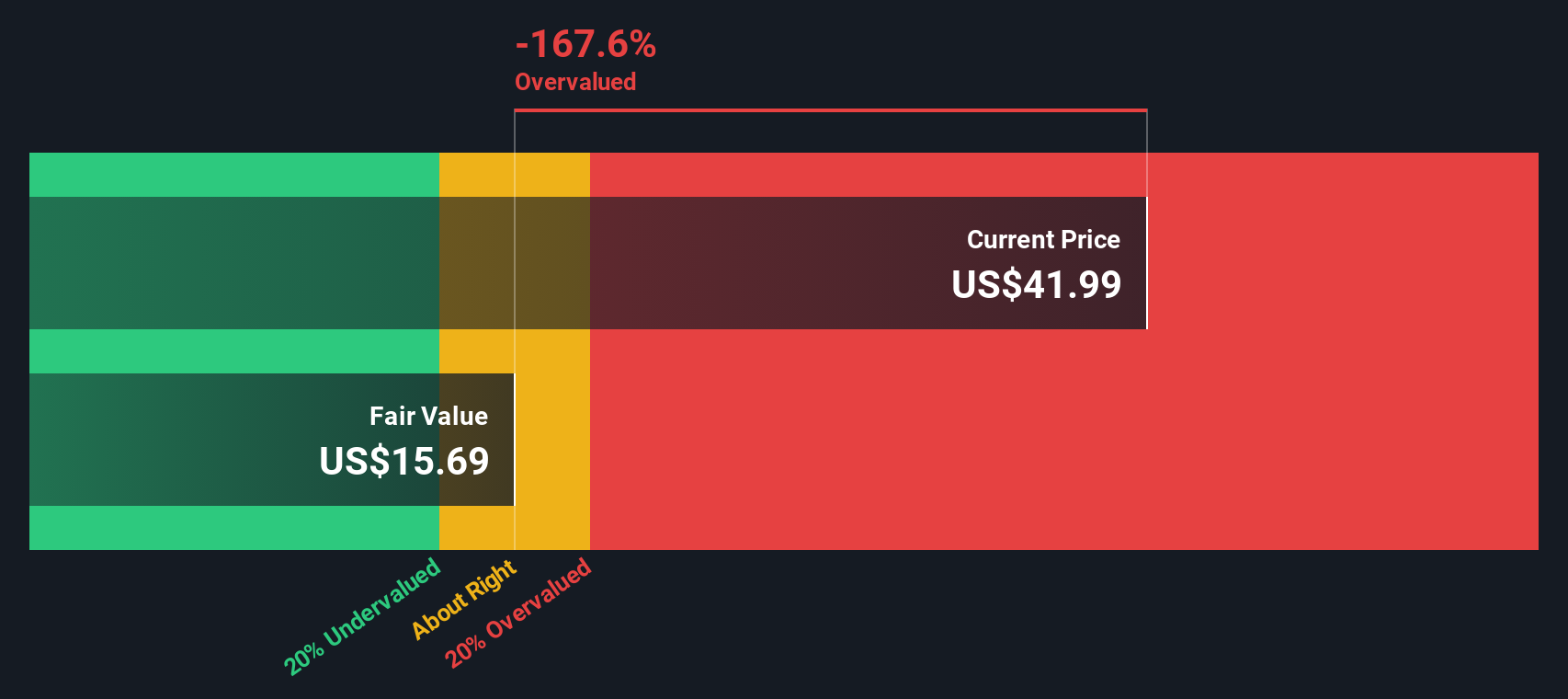

The SWS DCF model offers a different take and suggests that Kulicke and Soffa Industries could actually be trading above intrinsic value. This challenges the idea of fair value based on sales multiples. Which method will prove closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kulicke and Soffa Industries Narrative

If you see things differently or would rather dig into the numbers yourself, you can build your own narrative in just a few minutes. Do it your way.

A great starting point for your Kulicke and Soffa Industries research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not let your search for opportunities end here. Put your curiosity to work with the Simply Wall Street Screener and uncover stocks you might have missed. Take action now to find companies that fit your strategy and keep your portfolio ahead of the pack.

- Target reliable income streams by evaluating the latest opportunities among dividend stocks with yields > 3% offering yields above 3%, perfect for steady returns.

- Tap into the AI revolution by seeking out AI penny stocks at the forefront of innovation, setting new standards in technology and growth potential.

- Spot value that the market is overlooking by searching for undervalued stocks based on cash flows primed for future gains based on solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal