JinkoSolar (NYSE:JKS) Valuation in Focus After Robust Global Shipments and Upbeat Growth Guidance

Most Popular Narrative: 33% Undervalued

The prevailing narrative currently values JinkoSolar Holding as significantly undervalued, with the consensus view suggesting room to run if earnings and growth forecasts are delivered over the next several years.

“The company is capitalizing on the increasing demand for high-power products, particularly third-generation TOPCon products with enhanced efficiency and performance, expected to boost revenue through premium pricing opportunities and market share gains.”

Curious how analysts arrive at such a bullish price target? The answer hinges on ambitious projections for future sales, profit margins and a valuation multiple that is rarely seen outside of high-growth tech. Want to see what numbers are fueling expectations of a dramatic re-rating? Find out the specific and surprising assumptions behind this valuation narrative.

Result: Fair Value of $37.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, setbacks such as ongoing trade policy shifts and sliding U.S. demand could challenge JinkoSolar’s forecast and put recent optimism to the test.

Find out about the key risks to this JinkoSolar Holding narrative.Another View: Discounted Cash Flow Model

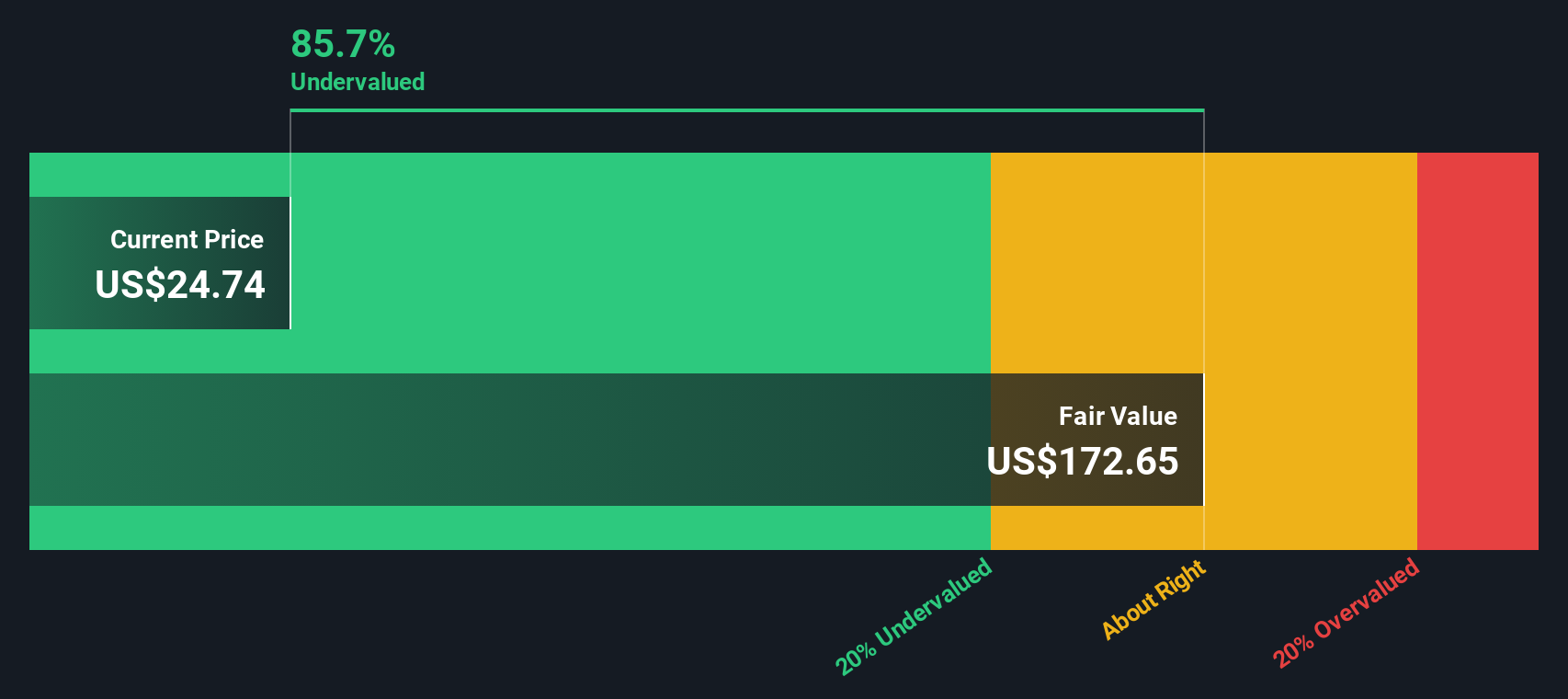

Looking from another angle, our DCF model paints a very different picture. This approach weighs the company’s expected cash flows, and in this case, suggests the shares are significantly undervalued compared to current trading levels. Which method better reflects reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own JinkoSolar Holding Narrative

If you see things differently or want to dig into the data on your own terms, you can build a fresh take in just minutes. Do it your way

A great starting point for your JinkoSolar Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more smart investment ideas?

Don’t let unique opportunities pass by. The Simply Wall Street Screener gives you the edge when seeking your next standout stock or bold portfolio move.

- Uncover tomorrow’s big players by scanning undervalued businesses with strong cash flows using our undervalued stocks based on cash flows.

- Spot the potential of healthcare leaders powered by artificial intelligence, and get ahead of the curve with our healthcare AI stocks.

- Target steady returns and stability by filtering for companies offering robust yields through our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal