Frontdoor (FTDR) Is Up 7.4% After Analysts Slash Growth Outlook—Has The Bull Case Changed?

- In recent news, Frontdoor, Inc. reported that its earnings have grown rapidly, with a 31% increase over the past year and a very large rise in earnings per share over three years, while analyst forecasts now point to significantly slower annual earnings growth of just 3.5% for the next three years, well below the broader market's expected pace.

- This dramatic shift in growth outlook highlights a potential disconnect between Frontdoor’s recent performance and its anticipated future prospects, raising questions for investors about the company’s longer-term earnings trajectory.

- We’ll explore how sharply reduced forward earnings expectations could alter Frontdoor’s investment narrative and investor sentiment going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Frontdoor Investment Narrative Recap

For someone to be a shareholder in Frontdoor today, they would need to believe the company can navigate slowing earnings growth and capitalize on its technology and product partnerships to reignite its core home warranty business. The recent analyst downgrade to 3.5% annual earnings growth is significant, but it does not materially change the key short-term catalyst: a possible housing market recovery driving higher warranty attach rates; however, the biggest risk remains persistent member count declines, which may become harder to offset with pricing or new products if these trends continue.

Among several company updates, the expanded partnership with Moen to roll out smart water monitors stands out. This move is directly relevant because it could enhance Frontdoor’s appeal in the digital space, support member retention, and potentially attract new customers, factors which tie into whether the company can turn around its core membership trend and deliver on its revenue growth ambitions.

In contrast, while Frontdoor’s latest numbers may appear strong on the surface, investors should be aware that…

Read the full narrative on Frontdoor (it's free!)

Frontdoor's outlook projects $2.4 billion revenue and $279.0 million earnings by 2028. This assumes a 7.2% annual revenue growth rate and a $22 million earnings increase from current earnings of $257.0 million.

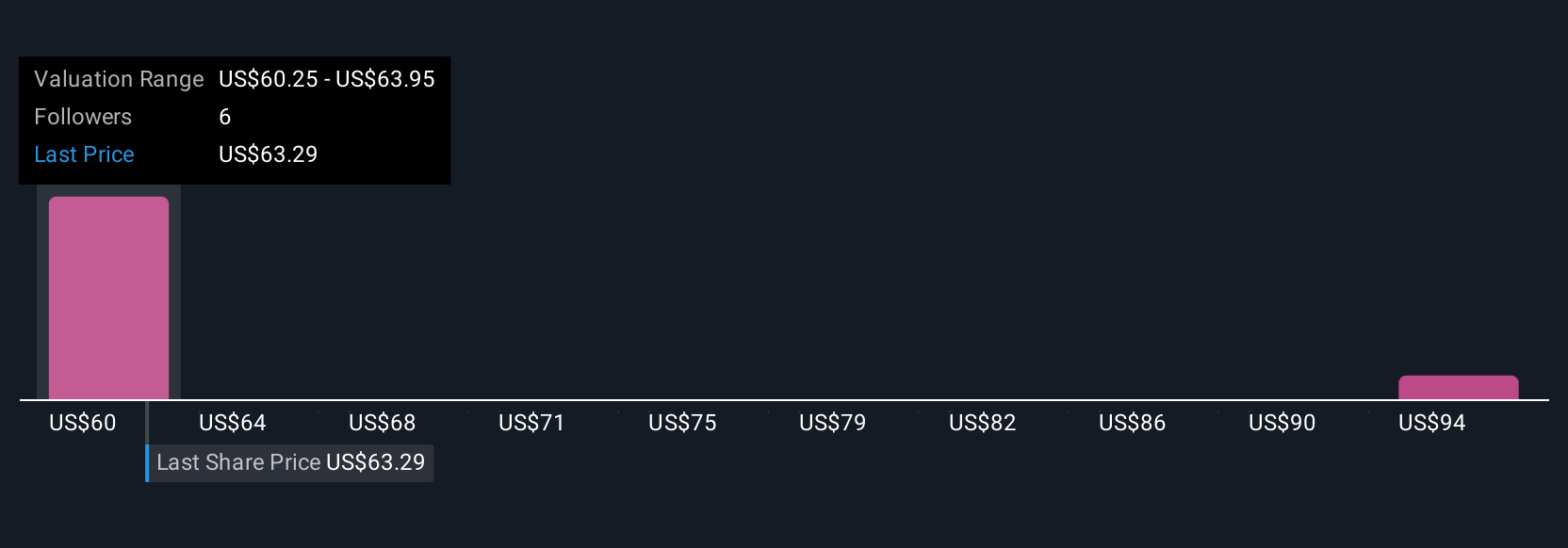

Uncover how Frontdoor's forecasts yield a $60.25 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Two distinct fair value estimates from the Simply Wall St Community place Frontdoor between US$60.25 and US$101.54 per share. With persistent member count declines cited as a core risk, readers can explore how divergent opinions may reflect deeper questions about future growth and profitability.

Explore 2 other fair value estimates on Frontdoor - why the stock might be worth 8% less than the current price!

Build Your Own Frontdoor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Frontdoor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Frontdoor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Frontdoor's overall financial health at a glance.

No Opportunity In Frontdoor?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal