Strong Q2 Results and Ongoing Insider Sales Might Change the Case for Investing in USLM

- United States Lime & Minerals recently reported strong second-quarter results, marked by higher sales volumes, increased average selling prices, and the announcement of a regular quarterly dividend.

- At the same time, President & CEO Timothy Byrne sold 39,525 shares, adding to an ongoing trend of executive insider sales over the past year.

- Let's examine how the company's robust quarterly financial performance shapes its investment narrative amid continued insider selling activity.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is United States Lime & Minerals' Investment Narrative?

Owning shares in United States Lime & Minerals means believing in its ability to keep generating growth as a U.S. lime supplier, with the lime market itself projected for modest but steady expansion through 2035. The company’s latest quarter provided tangible positives, sales and profits both rose sharply, supported by price increases and strong demand, while regular dividends reinforce management’s commitment to capital returns. These results bolster confidence in near-term catalysts, such as continued growth from infrastructure and construction activity, and underline the company’s established profitability. However, the notable insider sales, particularly the CEO’s repeated transactions, add a fresh note of caution on management’s long-term outlook or potential internal concerns. While these sales aren’t always a signal of business trouble, they can sometimes move sentiment and warrant extra attention to risk. At the moment, the impact of these actions on fundamentals doesn’t appear material, but they could weigh on shares if similar activity persists or is seen as signaling a change in outlook. On the other hand, investors should be aware that persistent insider selling can signal internal caution or changing priorities.

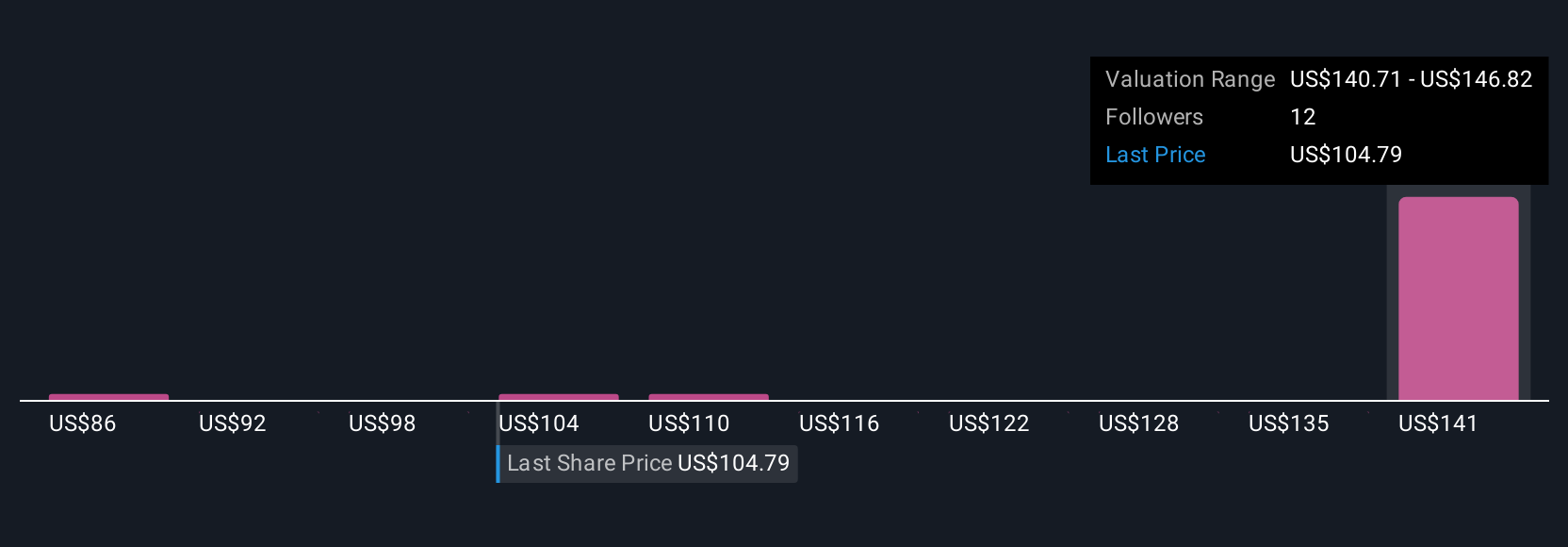

Despite retreating, United States Lime & Minerals' shares might still be trading 6% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 4 other fair value estimates on United States Lime & Minerals - why the stock might be worth 30% less than the current price!

Build Your Own United States Lime & Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United States Lime & Minerals research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United States Lime & Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United States Lime & Minerals' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal