Credit Acceptance (CACC): Evaluating the Valuation Story Behind Recent Share Price Momentum

Credit Acceptance (CACC) rarely grabs front-page headlines, but investors may be tuning in after the company's shares have quietly advanced over the past month. With no single event lighting up the newswires, the move might catch your attention if you’re wondering whether something under the surface is driving optimism, or if the price action is simply a byproduct of shifting sentiment in financial markets. Sometimes, a stock does not need breaking news to become interesting, especially when its valuation story is as unique as Credit Acceptance’s.

In the broader context, Credit Acceptance’s stock has gained around 15% for the year, continuing a steady climb that diverges from its more volatile multi-year track record. Momentum has recently picked up, with a 10% rise over the past month contrasting with more muted performance earlier in the year. Meanwhile, annual revenue growth is up by 37% and net income has also risen, hinting at some underlying business strength despite an overall three-year return that remains slightly negative.

Given this renewed momentum, the key question is whether Credit Acceptance is genuinely undervalued right now, or if the market’s recent rally already reflects expectations for future growth.

Most Popular Narrative: 9.8% Overvalued

According to the most popular narrative, Credit Acceptance is currently trading above what analysts regard as its fair value. Their valuation reflects expectations for impressive future revenue but also acknowledges possible headwinds that may temper optimism.

Ongoing growth in the non-prime borrower segment and persistent income inequality in the U.S. are likely to support stable or increasing demand for Credit Acceptance's auto loan products, expanding the company's addressable market and sustaining long-term revenue growth.

Curious what’s powering analyst conviction in this valuation? There is a bold bet on evolving borrower demand and rapid technology investments, but the true shocker lies in the projected transformation of profits and margins. These are fueled by assumptions you might not expect. Want the full financial story behind the forecast? Dive in to see what really moves Credit Acceptance’s fair value.

Result: Fair Value of $467.5 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent credit risks and falling market share in subprime loans could easily undermine the bullish case for Credit Acceptance.

Find out about the key risks to this Credit Acceptance narrative.Another View: Discounted Cash Flow Model Shows a Different Picture

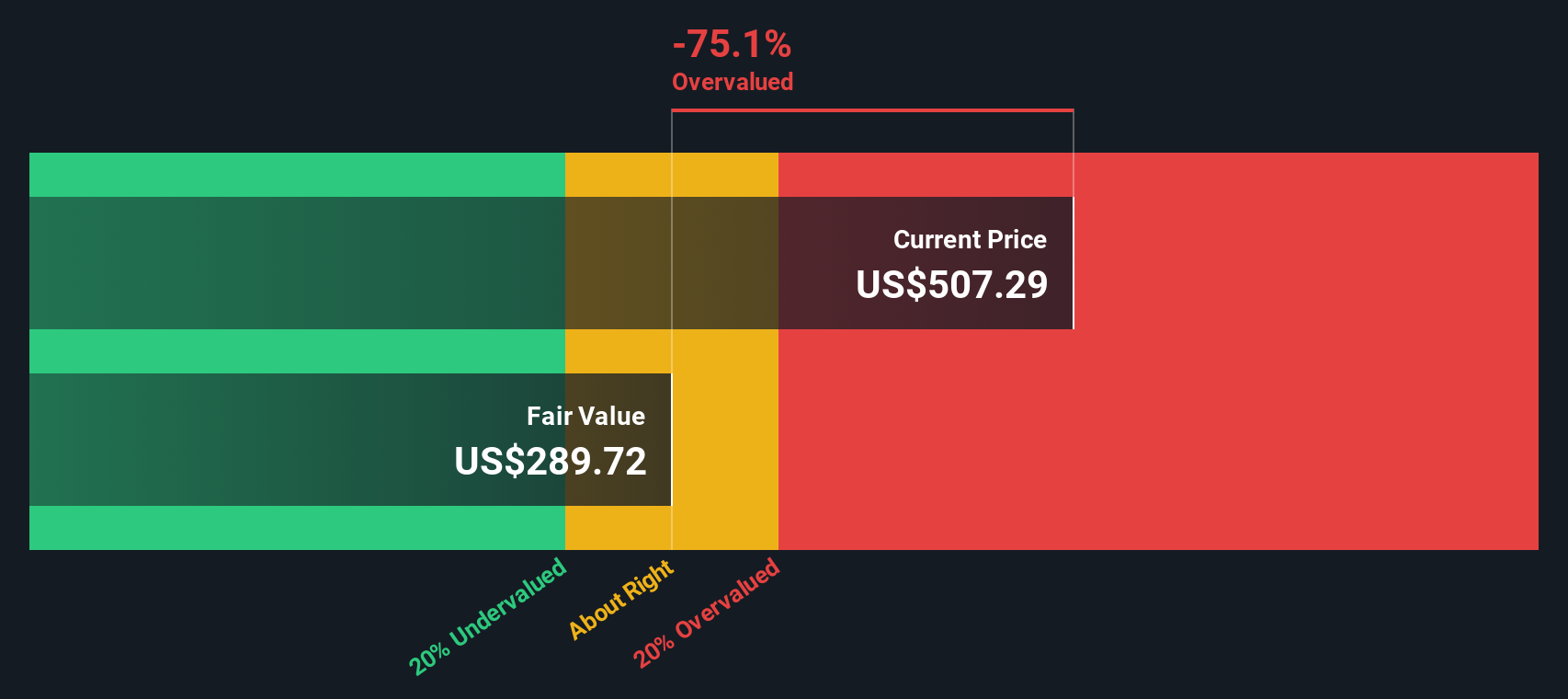

While analysts point to current market pricing as fair, our DCF model tells a very different story. It suggests that the stock may actually be trading far above its estimated intrinsic value. Which perspective will prove right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Credit Acceptance Narrative

If the consensus does not fit your perspective, or you would rather form an independent view, it only takes a few minutes to craft your own analysis and put your take to the test. Do it your way

A great starting point for your Credit Acceptance research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their watchlist fresh. Broaden your horizons and get ahead of the next big market move by tapping into unique stock picks tailored just for you on Simply Wall Street. Don’t let smart opportunities slip by. These themes could shape your next win:

- Uncover growth stories with strong financials by scanning penny stocks with strong financials leading the charge in tomorrow's market breakthroughs.

- Lock in greater income potential as you check out dividend stocks with yields > 3% offering reliable yields above 3% for income-focused portfolios.

- Step into cutting-edge tech with AI penny stocks powering growth in artificial intelligence and transforming industries worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal