Evaluating Grand Canyon Education (LOPE): What Recent Recognition Means for Its Current Valuation

Thinking about what to do with Grand Canyon Education (LOPE) stock? You are not alone. The company has just been spotlighted in recent coverage as a market-beating name, thanks to its efficient business model and improving returns on capital. While there is no dramatic headline event or company-specific announcement driving shares this week, the nod brings the fundamentals front and center for investors considering if there is another leg higher in LOPE’s impressive run.

While the broader coverage is positive, it comes after a year where Grand Canyon Education’s stock has already posted strong gains, up 50% over the last twelve months and just over 27% since the start of the year. Momentum has picked up across the past quarter as well. All this positive movement is happening as the company’s revenue and net income continue to climb, suggesting operational success isn't just a talking point in the recent commentary.

Now the real question is whether Grand Canyon Education has more room to run from here, or if investors have already priced in the future growth these fundamentals seem to promise.

Most Popular Narrative: 3.7% Undervalued

The most widely followed narrative suggests Grand Canyon Education is trading below its estimated fair value, with analysts expecting further growth from ongoing operational improvements and business expansion.

Expansion of hybrid campus and specialized healthcare pathways, such as ABSN, occupational therapy, and manufacturing apprenticeships, is unlocking new verticals with strong employer demand. This growth is increasing overall enrollment, diversifying revenue streams, and enhancing operating leverage, all of which support both top-line and earnings growth.

Are you ready to uncover the financial engine powering this undervalued stock? One set of bold projections, if accurate, could mean this company is primed for a valuation shakeup. Click through to see the exact future growth assumptions and what makes this narrative stand out from the Wall Street crowd.

Result: Fair Value of $213.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, declining traditional enrollments and shifting student preferences toward alternative credentials could slow Grand Canyon Education’s revenue growth in the future.

Find out about the key risks to this Grand Canyon Education narrative.Another View: A Different Valuation Story

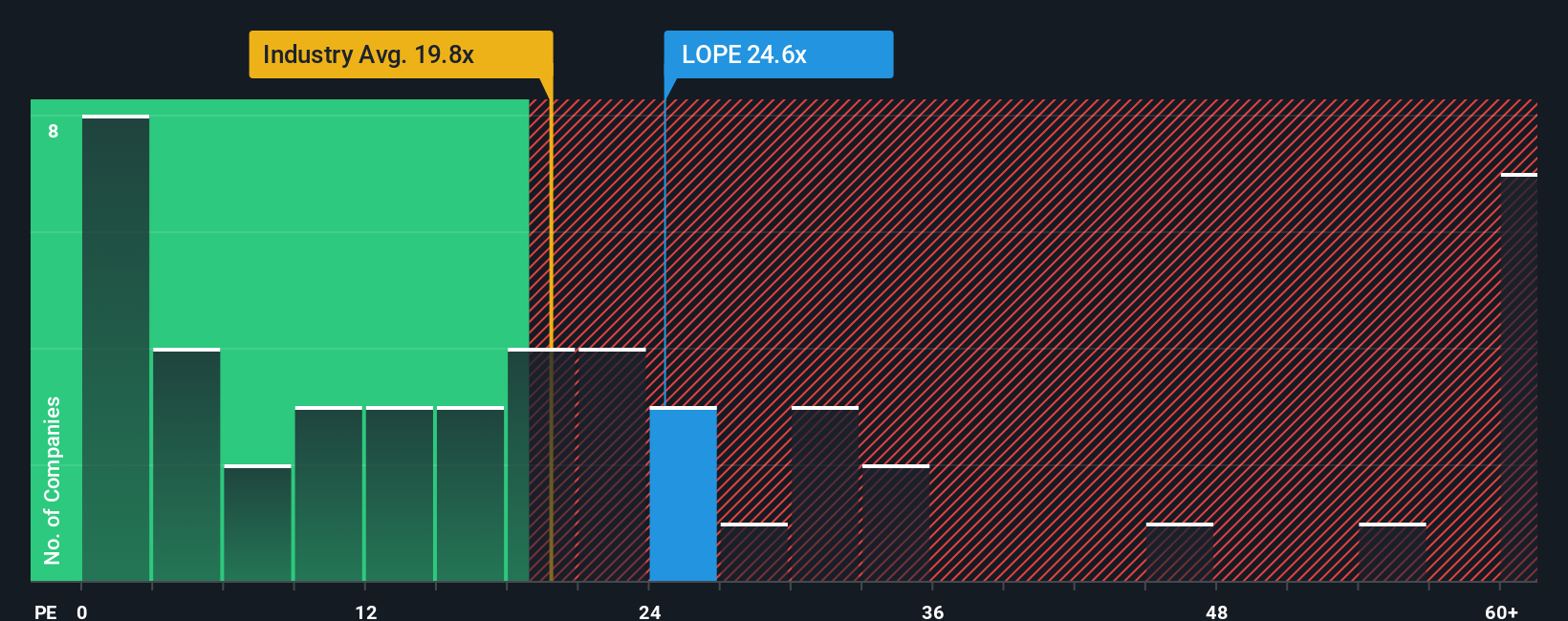

A look through a different lens suggests Grand Canyon Education is expensive compared to the broader industry. While earnings quality is high, this method hints that shares could be overvalued by this approach. Which view will prove correct?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Grand Canyon Education Narrative

If you want to dig deeper or think a different story is unfolding, you have the tools to build your own analysis in only a few minutes. This way, you can Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Grand Canyon Education.

Looking for more investment ideas?

Great stocks do not wait around. Sharpen your portfolio by checking out powerful opportunities now that others might overlook. Give your investment strategy the edge it deserves.

- Spot small-cap companies showing surprising financial grit by sifting through our penny stocks with strong financials.

- Uncover tomorrow’s breakthroughs in medicine with targeted picks from our healthcare AI stocks.

- Strengthen your returns with shares offering reliable income using our handpicked selection of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal