A Look at Enova International's Valuation Following Its Expanded Credit Facility and Enhanced Financial Flexibility

If you have been watching Enova International (ENVA), this recent move on its debt facility is hard to ignore. The company just struck a deal to increase its secured asset-backed revolving credit facility by $160 million, extend the maturity by over three years, and reduce its interest spread. For investors weighing their next move, this changes the conversation around Enova’s balance sheet strength and its potential runway for expansion, especially for those interested in their ability to deploy capital efficiently in the coming years.

This financing shift did not go unnoticed. Enova International’s stock is up 22% over the past three months and has soared 54% in the last year, riding a wave of renewed confidence following consistent double-digit annual revenue and earnings growth. With management showing it can negotiate favorable terms, momentum around ENVA is clearly building, and the market is watching to see how this next phase might impact future returns.

With shares on the move and the company improving its financial flexibility, is there more upside ahead or is the market already pricing in that growth?

Most Popular Narrative: 9.7% Undervalued

The dominant narrative values Enova International at nearly 10% below its fair value, suggesting there could be room for upside if the narrative’s projections play out. Analysts expect this discount is rooted in ambitious, but data-driven assumptions about the company’s earnings and revenue trajectory.

The ongoing migration of small businesses and consumers toward digital lending, supported by preferences for speed and convenience, continues to drive strong demand and originations for Enova. The company is well-positioned with its online-only business model. This underpins sustained top-line growth as reflected in record origination and revenue increases.

Craving insight into what could drive Enova’s next move? The most closely followed valuation narrative leans on bold forecasts regarding the company’s future financial metrics. Want to uncover the surprising assumptions behind this nearly double-digit undervaluation, especially those high-profile growth estimates? The details might change your view on Enova’s true market potential.

Result: Fair Value of $131.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, stricter lending regulations or a sudden spike in borrower defaults could quickly challenge even the most optimistic growth scenarios for Enova International.

Find out about the key risks to this Enova International narrative.Another View: Industry Comparison Offers a Different Perspective

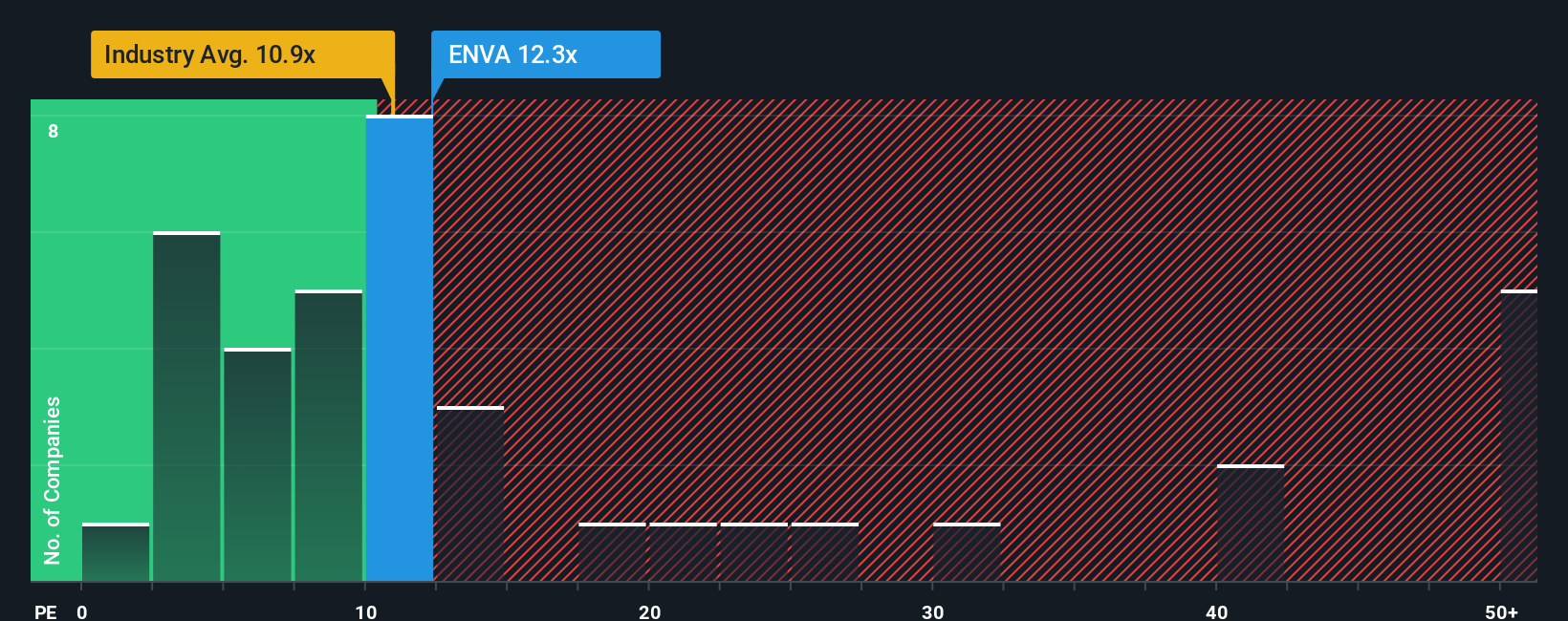

While analysts see upside based on future growth, looking at ENVA’s valuation relative to the broader US Consumer Finance industry tells a different story. In this context, the shares appear on the expensive side. Could the market’s optimism be running ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Enova International Narrative

If you see things differently or want to dig into the numbers your own way, you can craft a personalized Enova International story in just a few minutes. Do it your way.

A great starting point for your Enova International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for your next inspiration to strike. Seize smart opportunities now with Simply Wall Street's suite of powerful stock screeners designed to suit different investing goals.

- Tap into rapidly growing, undervalued companies and unlock a world of potential by using our undervalued stocks based on cash flows.

- Stay ahead of the technology curve and position your portfolio at the intersection of science and innovation with our quantum computing stocks.

- Boost your passive income with companies that consistently offer high dividend yields by starting with our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal