Where Does Revolve Stand After This Month’s 19.5% Rally?

If you have been watching Revolve Group stock lately, you are not alone. After all, the last month has seen it surge 19.5%, snapping a rough patch that saw year-to-date returns tumble to -30.1%. Even with that bounce, investors are left wondering whether this growth is a new trend or just a blip in a turbulent year.

Some of that recent enthusiasm can be traced to market chatter about shifting consumer trends and the buzz surrounding digital retail resilience. Longer-term, the picture is more muddled. Yes, Revolve has posted a 27.8% gain over five years, but the three-year return sits at -14.2%. For those deciding whether to buy, hold, or fold, the question is what all this means for the stock’s current value.

Here is where things get interesting. According to valuation models assessing six key metrics, Revolve Group scores a 0 out of 6 on undervaluation tests. In other words, by those traditional yardsticks, the stock does not appear undervalued on any front right now.

But numbers are only part of the story. In the next section, we will break down those six valuation checks, examine what they mean for Revolve, and consider how effective they really are. Stick around, because after that, we will reveal an even more insightful way to think about valuation for a company like this.

Revolve Group scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Revolve Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular way to estimate what a company is really worth. It looks at the cash the business is expected to generate in the future and then discounts those projections back to today’s dollars to figure out an intrinsic value per share.

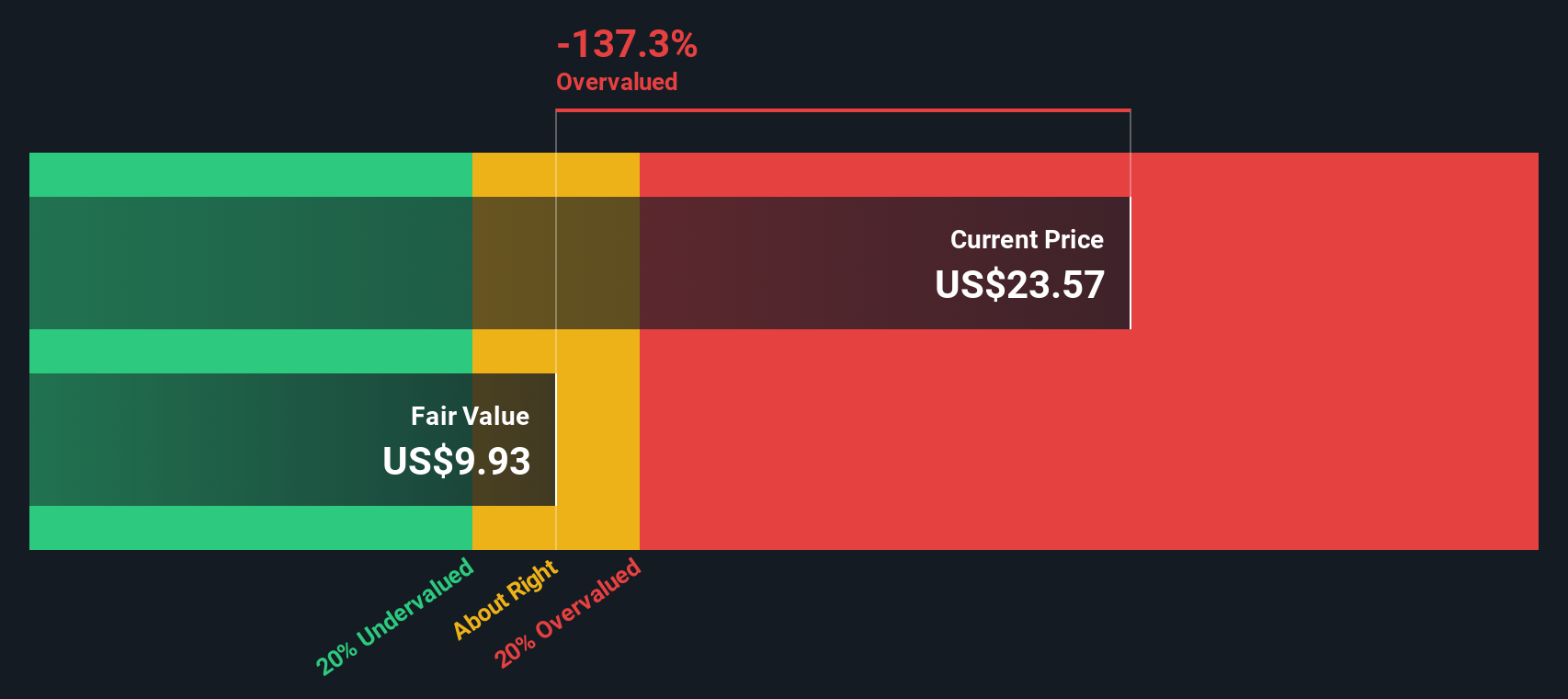

For Revolve Group, current Free Cash Flow sits at about $64.9 million. Analyst forecasts project that by 2026, annual free cash flow will be $50.5 million. By 2035, Simply Wall St’s extended estimates see it growing slightly to $44.8 million. These projections do not show much consistent growth, with future cash flows expected to trend downward or remain flat over the next decade.

After crunching all these numbers, the DCF model estimates Revolve Group’s fair value at $9.99 per share. Compared to the current share price, this implies the stock is trading at a premium, with a calculated overvaluation of 134.9%. Based on this analysis, the market price appears significantly higher than what the underlying cash flows would support.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Revolve Group.

Approach 2: Revolve Group Price vs Earnings

For profitable companies like Revolve Group, the Price-to-Earnings (PE) ratio is a popular and trusted standard for assessing valuation. It allows investors to compare what they are paying for each dollar of current earnings, making it especially useful for businesses with steady profits.

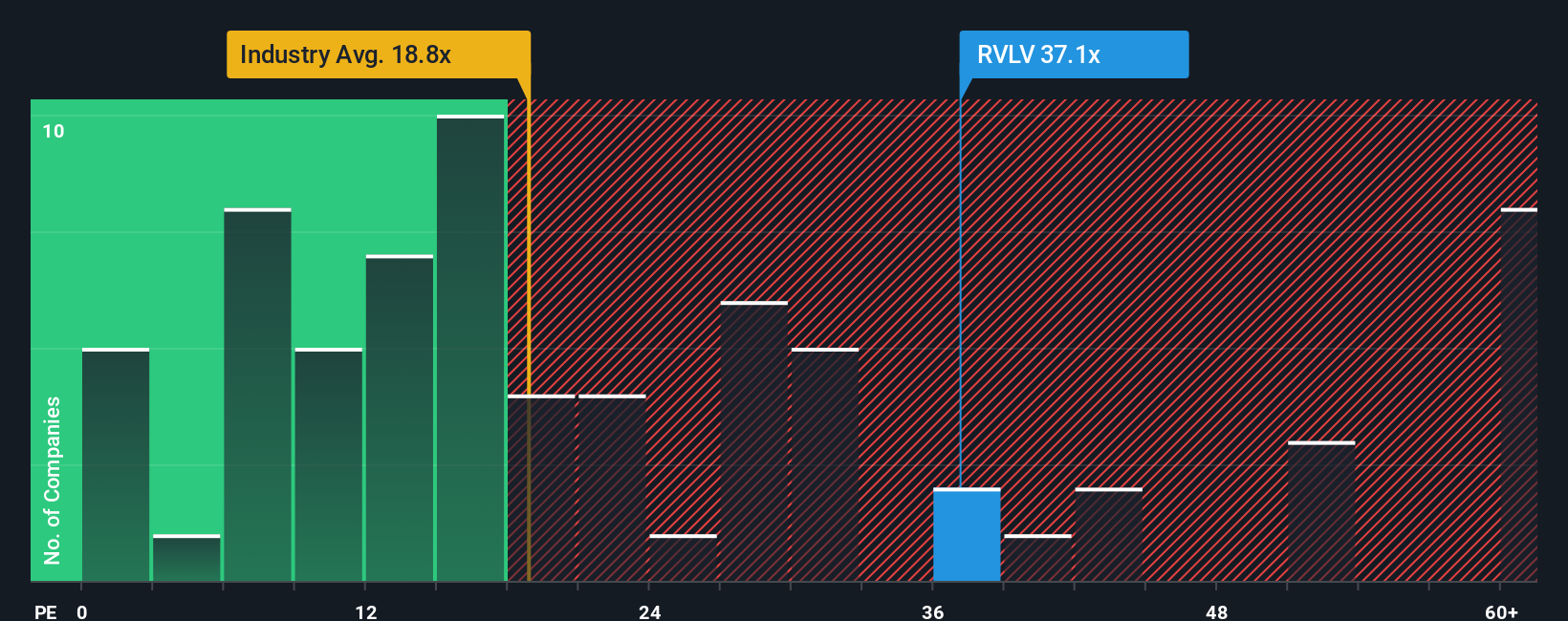

Generally, growth prospects and risk profiles play a major role in defining what a "normal" or "fair" PE ratio should be. Stocks with high growth expectations often command higher PE ratios, while higher perceived risks or slower growth typically translate to lower multiples. Industry context also matters, as some sectors naturally support higher PE ratios than others.

Revolve Group’s current PE ratio stands at 36.9x. That is quite a leap above the industry average of 19.4x and also higher than the peer average of 18.3x. This might signal overvaluation at first glance, but to get a more accurate picture, we turn to Simply Wall St’s “Fair Ratio.” This metric is designed to reflect the PE ratio you would reasonably expect for a business, factoring in not just the industry and peer comparisons, but also company-specific elements like growth, profit margins, size, and risk profile.

In Revolve’s case, the Fair Ratio is calculated at 16.9x, which is much lower than today’s market multiple. Since the company’s PE ratio is well above this fair value estimate, it suggests the stock is currently trading at a premium by this measure.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Revolve Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story, built around a company’s financial future, where you tie together your assumptions about revenue, earnings, and margins to calculate what you believe the stock is really worth. Instead of just relying on static numbers or models, Narratives help you link Revolve Group’s unique journey as a business with your investment outlook, shaping your own fair value estimates.

Narratives are designed to be accessible for everyone and are featured on Simply Wall St’s platform in the Community page, used by millions of real investors. They make buy or sell decisions clearer by letting you compare your Fair Value with the current Price, showing at a glance when a stock matches your expectations or not. The best part? Narratives update in real time when news breaks or earnings are announced, meaning your view always reflects the latest information.

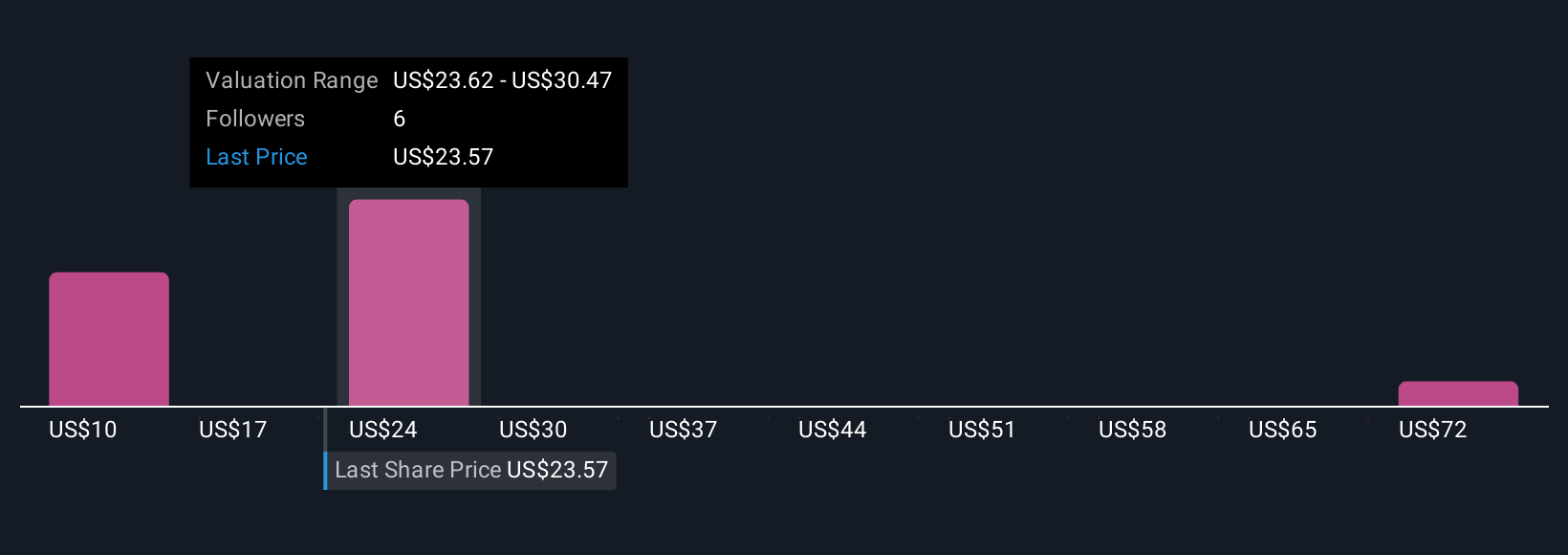

For example, investors can have very different Narratives for Revolve Group. Some believe strong international expansion and digital innovation will drive a fair value above $30 per share, while others see risks and set it closer to $19. Narratives empower you to see both the upside and downside, helping you invest with confidence no matter what story you believe.

Do you think there's more to the story for Revolve Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal