Kimbell Royalty Partners (KRP): Assessing Valuation as Stock Remains Quiet Without Major News

Kimbell Royalty Partners (NYSE:KRP) has recently caught the attention of investors, not because of a sudden headline-grabbing event, but due to subtle shifts in its stock performance that have some market watchers taking a closer look. For shareholders and would-be buyers alike, moments like this often prompt an important question: is the market signaling something beneath the surface, or is this just routine fluctuation? With shares trading quietly and no major news breaking, it is easy to wonder if a real opportunity might be quietly emerging.

Taking the bigger picture, Kimbell Royalty Partners has seen relatively muted movement this year. The stock is down just under 1% over the past twelve months, following a year-to-date slide with mild declines over the past month and quarter. Despite these recent dips, its performance over the past five years remains positive, and annual revenue and net income growth numbers suggest the business is still making underlying progress, even if the market momentum has softened.

With that in mind, is Kimbell Royalty Partners undervalued after this period of drift, or is the market already factoring in every bit of future growth?

Most Popular Narrative: 21.9% Undervalued

The prevailing view is that Kimbell Royalty Partners is significantly undervalued, with consensus fair value estimates sitting well above the current share price.

“Kimbell's disciplined, accretive acquisitions in high-quality, diversified basins like the Permian and Haynesville continue to expand its production base and royalty volumes. This should drive revenue and distributable earnings higher. The company's asset-light business model and recent reductions in cash G&A per BOE enhance operating leverage, translating into higher and more sustainable net margins and cash distributions.”

Want to peek behind the curtain on why analysts see hidden upside? Their case rides on ambitious growth forecasts and an aggressive profit turnaround. What bold assumptions are baked into that eye-popping valuation? Intrigued? The answer lies in the impressive targets for future earnings and margins that drive this estimate.

Result: Fair Value of $17.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slowing growth in key basins or rising acquisition costs could quickly challenge the current optimism and require a reassessment of the company’s outlook.

Find out about the key risks to this Kimbell Royalty Partners narrative.Another View: A Market-Based Check

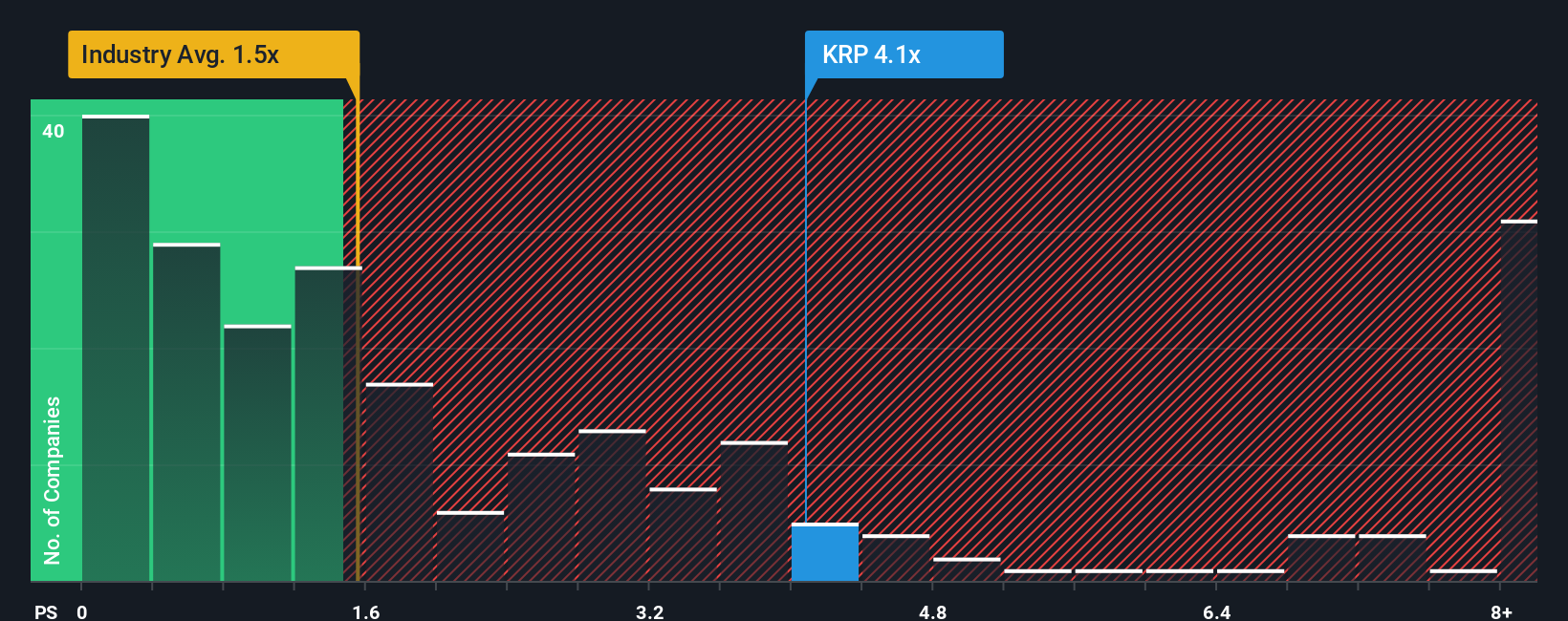

Not everyone sees upside here. If you look at how the company trades compared to revenue, shares actually look expensive relative to others in the industry. Could the market be cautious for a reason?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kimbell Royalty Partners Narrative

If you are keen to dig into the details and challenge the consensus, you can easily craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Kimbell Royalty Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why stay on the sidelines? Boost your portfolio by exploring handpicked themes that could drive the next significant market moves. Take action on unique opportunities before others do.

- Explore opportunities in small-cap standouts showing strong financial performance by using our penny stocks with strong financials.

- Focus on companies leading the artificial intelligence transformation across industries and make the most of the rapidly evolving AI landscape with our AI penny stocks.

- Discover potential bargains and identify stocks trading below what their cash flows suggest by trying our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal