Can PennyMac Financial (PFSI) Expand Its Reach and Balance Risk With New Non-QM Products?

- PennyMac Financial Services recently announced that its Correspondent Group will launch a new suite of non-qualified mortgage (non-QM) products on September 22, aiming to provide flexible financing for borrowers outside traditional agency criteria.

- This move introduces options like DSCR loans for property investors and income documentation flexibility for self-employed professionals, highlighting an effort to broaden access in the mortgage market.

- We'll explore how expanding into non-QM products could influence PennyMac's investment narrative and its approach to serving underserved borrower segments.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

PennyMac Financial Services Investment Narrative Recap

Shareholders in PennyMac Financial Services are typically betting on the company's ability to balance volatile mortgage volumes with efficiency gains and a strong servicing portfolio, while navigating risks from interest rate swings and competition. The recent launch of non-QM products broadens potential revenue streams and may be a modest short-term catalyst, but the most important near-term driver continues to be mortgage origination volumes, which remain sensitive to interest rates. Overall, this new offering is unlikely to materially change the biggest risk of ongoing rate-driven market pressure in the short run.

Among recent announcements, PennyMac’s closure of its US$650 million 6.750% Senior Notes due 2034 in August stands out. While this bolsters liquidity and provides repayment flexibility, rising fixed costs from such financing could influence profitability, especially if mortgage activity remains subdued.

However, investors should also be mindful that, even with product launches targeting new borrower segments, the company’s earnings volatility remains closely tied to...

Read the full narrative on PennyMac Financial Services (it's free!)

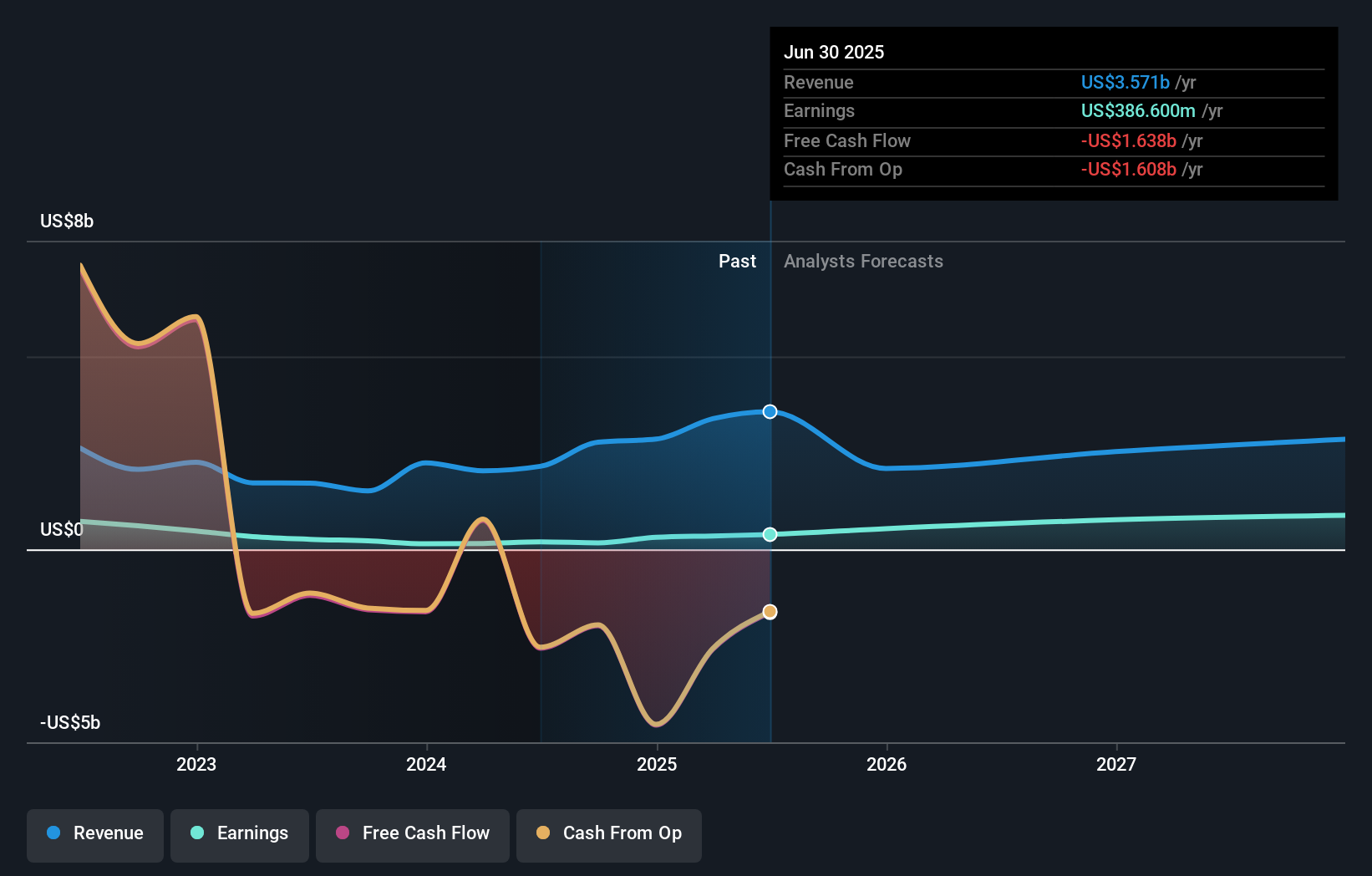

PennyMac Financial Services is projected to achieve $2.5 billion in revenue and $1.1 billion in earnings by 2028. This outlook assumes an annual revenue decline of 11.0% and an earnings increase of $713.4 million from the current $386.6 million.

Uncover how PennyMac Financial Services' forecasts yield a $122.29 fair value, in line with its current price.

Exploring Other Perspectives

All 10 fair value estimates from the Simply Wall St Community converge at US$122.29 per share. With community opinions showing little variation, keep in mind that the biggest short-term risk is mortgage volume sensitivity to rates and market shifts could quickly reframe these fair value figures.

Explore another fair value estimate on PennyMac Financial Services - why the stock might be worth as much as $122.29!

Build Your Own PennyMac Financial Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PennyMac Financial Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PennyMac Financial Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PennyMac Financial Services' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal