Carlisle Companies (CSL): Evaluating Valuation After Fresh Buyback Authorization and Enhanced Shareholder Returns

If you’re wondering what just happened with Carlisle Companies (CSL), you’re not alone. The company’s board has approved a new share repurchase program, giving management the green light to buy back up to 7.5 million additional shares. This move supplements an active buyback program and underscores Carlisle’s consistent effort to return value to shareholders. Earlier this year, the company completed a $700 million buyback and recently announced a 10% dividend increase.

This kind of shareholder-focused strategy tends to get Wall Street’s attention, and for good reason. Shares of Carlisle Companies moved up 2.6% on the news, which adds to its momentum over the past month and shows investors are weighing the impact of strong capital deployment. While the last year has been mostly flat for CSL, longer-term holders have seen rewards, as returns over three and five years make for compelling reading. The company’s commitment to buybacks is clearly part of a bigger picture.

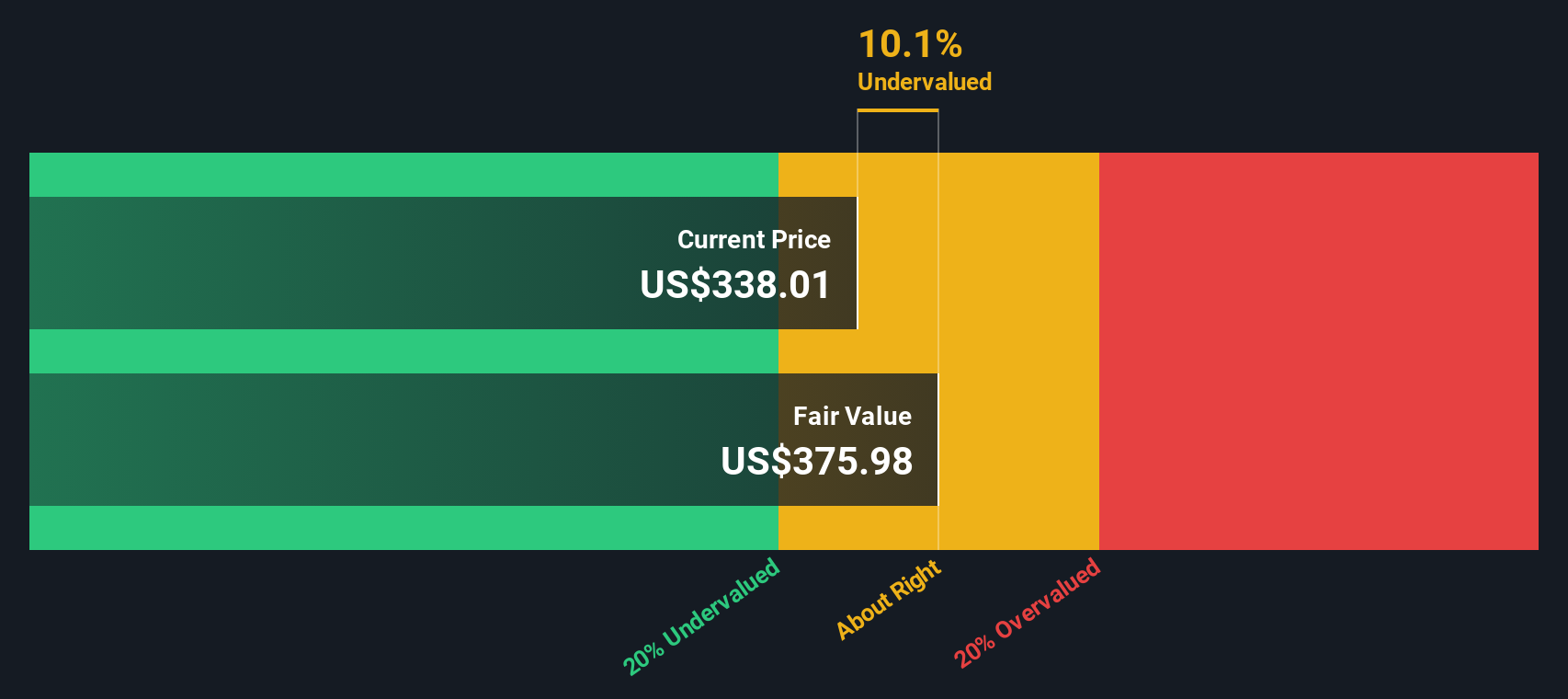

After this quick jump and a strong recent run, the real question is whether Carlisle Companies is still trading at an attractive price, or if the market has already factored in all the future growth potential.

Most Popular Narrative: 7.7% Undervalued

The prevailing narrative sees Carlisle Companies as undervalued by nearly 8%, based on its projected earnings growth and margin expansion catalysts.

Continued investment in automation, digital transformation, and operational efficiency programs (such as the Carlisle Operating System) are driving productivity improvements and significant cost savings. These initiatives are expected to result in at least 200+ basis points of long-term margin expansion for underperforming segments, positively impacting net margins and free cash flow.

Earnings upgrades. Margin uplift. Major strategic moves. Which of these assumptions is powering the analysts’ bullish view? You might be surprised how much rides on long-term growth rates, relentless efficiency gains, and some intriguing financial forecasts. If you think you know what justifies the fair value, think again.

Result: Fair Value of $425.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in construction markets and limited pricing power could challenge Carlisle’s ambitious growth trajectory, which may put pressure on future margins and profitability.

Find out about the key risks to this Carlisle Companies narrative.Another View: The SWS DCF Model

While the analyst price target points to upside, our DCF model offers a different perspective on Carlisle Companies’ fair value. This method takes all future cash flows into account, and its conclusion challenges the consensus. Which approach do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Carlisle Companies Narrative

If you see things differently or like to dig into the numbers on your own terms, it only takes a few minutes to build your personal take on Carlisle Companies. So why not Do it your way?

A great starting point for your Carlisle Companies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let fresh market opportunities pass you by. Use the Simply Wall Street Screener to quickly spot stocks aligned with your investing goals and strategies.

- Enhance your passive income strategy and tap into a list of dividend payers by heading straight to dividend stocks with yields > 3%, offering attractive yields above 3%.

- Catalyze your portfolio’s growth potential with AI penny stocks, leading the charge in innovative artificial intelligence breakthroughs and next-generation technologies.

- Secure better value for your money by reviewing undervalued stocks based on cash flows, based on their strong cash flow fundamentals before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal