Did Air Products and Chemicals' (APD) Cleveland Expansion Just Redefine Its Industrial Leadership Strategy?

- Air Products and Chemicals recently announced that its new air separation facility in Cleveland, Ohio is fully operational, delivering gaseous oxygen, nitrogen, and liquid argon to an onsite customer and the regional merchant market, while also reinvesting to extend existing plant life at the same site.

- This expansion not only strengthens Air Products’ long-term presence in a vital industrial region but also supports a diverse set of industries with enhanced supply reliability and capacity.

- We'll explore how Air Products' expanded production capabilities in Cleveland could influence its long-term earnings outlook and industry positioning.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Air Products and Chemicals Investment Narrative Recap

To be comfortable as a shareholder in Air Products and Chemicals, you need to believe in the company’s ability to convert heavy capital investments into steady revenue and margin expansion, especially in industrial gases and energy transition projects. The recent expansion in Cleveland expands capacity and reinforces supply reliability, but for now, does not appear to materially influence the biggest short-term catalyst, bringing large hydrogen and ammonia projects online, or alleviate the key risk from elevated capital expenditures and project timing uncertainties.

The most relevant recent announcement is Air Products’ successful supply contract and hydrogen sphere completion for NASA at Kennedy Space Center in August. This milestone complements Cleveland’s facility ramp-up by highlighting continued demand for core industrial gases and underscores the company’s ongoing push to secure long-term, high-profile supply agreements, which remain central to its earnings outlook as major capital projects mature.

On the other hand, investors should keep in mind that project delays or cost overruns on these multibillion-dollar initiatives could...

Read the full narrative on Air Products and Chemicals (it's free!)

Air Products and Chemicals' outlook anticipates $15.0 billion in revenue and $3.8 billion in earnings by 2028. This scenario assumes a 7.4% annual revenue growth rate and an earnings increase of $2.2 billion from current earnings of $1.6 billion.

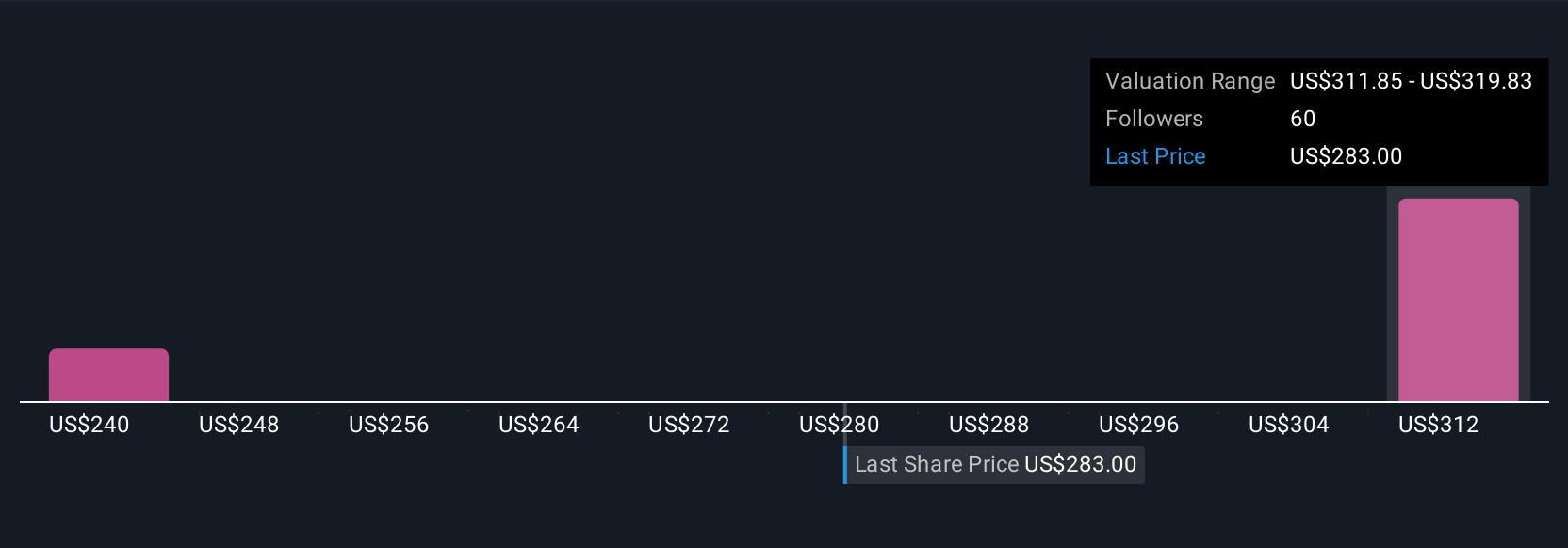

Uncover how Air Products and Chemicals' forecasts yield a $323.52 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Three individual fair value estimates from the Simply Wall St Community span US$301.30 to US$323.52. While community estimates vary, ongoing heavy capital expenditure requirements may influence future returns and overall company flexibility; be sure to consider alternative views.

Explore 3 other fair value estimates on Air Products and Chemicals - why the stock might be worth as much as 12% more than the current price!

Build Your Own Air Products and Chemicals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air Products and Chemicals research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Air Products and Chemicals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air Products and Chemicals' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal