Jacobs Solutions (J) Valuation Spotlight Following Major Global Infrastructure Contract Wins

Deciding what to do with Jacobs Solutions (NYSE:J) stock? You are not alone. In the past week, Jacobs has landed a trio of major infrastructure wins, including a 15-year public works renewal in Centennial, a pivotal design and consulting role for New York’s massive Interborough Express Light Rail Project, and leadership on Denmark’s ambitious Marselis Tunnel. These contracts span continents but share a common thread: locking in long-term revenues and positioning Jacobs as a go-to for major civic and transport projects. For investors, this spotlight on Jacobs' core strengths injects new momentum into the stock’s growth story.

So how has the market responded? Over the past year, Jacobs stock has climbed 22%, with much of that momentum picking up in the past three months. This recent string of contract wins builds on a steady reputation, but it comes at a time when investors are weighing consistent gains against future growth expectations. Looking back, Jacobs has stacked up nearly 89% in total return over five years, suggesting the company’s ability to secure and deliver on big projects continues to fuel shareholder value.

With the latest share price surge and these headline-grabbing new contracts, is Jacobs primed for another leap, or has the market already factored in these future opportunities?

Most Popular Narrative: 7.1% Undervalued

According to the most widely followed narrative, Jacobs Solutions is currently trading at a modest discount to its estimated fair value, suggesting the stock may offer an attractive opportunity based on future earnings potential.

Record-high backlog growth (up 14% year-over-year) in Water, Advanced Facilities, and Critical Infrastructure, driven by global infrastructure modernization, water scarcity, and data center expansion, provides strong visibility into multi-year revenue growth and supports confidence in accelerating top-line results into FY '26 and beyond.

Curious about why analysts think Jacobs is set for a jump? The story centers around ambitious growth targets, supported by a bullish mix of top-line expansion, margin lifts, and bold assumptions for future profits. Want to know which numbers are fueling this price target and what it says about the company’s outlook? Read on and discover what might surprise you about this valuation case.

Result: Fair Value of $155.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, reduced government infrastructure spending or budget delays could put pressure on Jacobs' revenue growth and challenge the current fair value narrative.

Find out about the key risks to this Jacobs Solutions narrative.Another View: Comparing to Industry Benchmarks

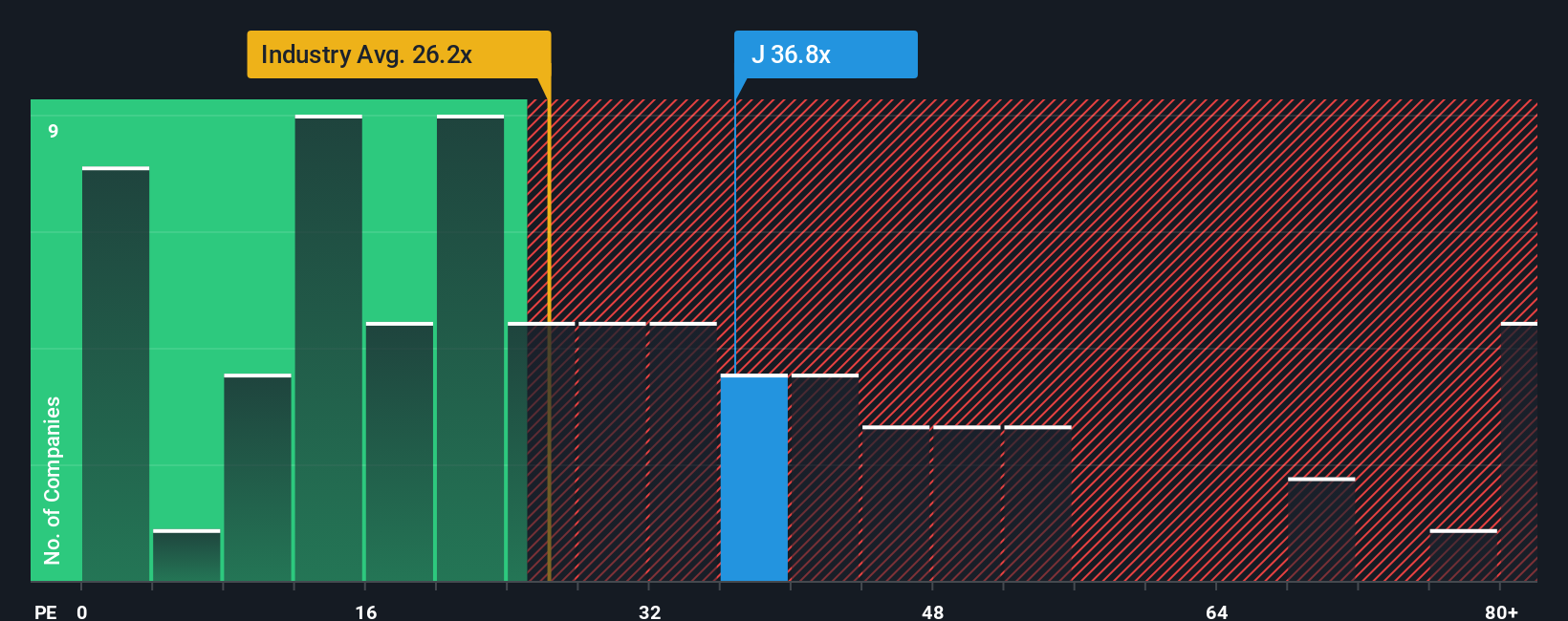

Our look at Jacobs Solutions using price-to-earnings compared to the industry paints a less optimistic picture. This approach suggests the stock is pricier than its peers. Does the market see hidden strengths others have missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Jacobs Solutions Narrative

If you have a different perspective or want to dig into the numbers yourself, you can craft a personalized analysis in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Jacobs Solutions.

Looking for More Investment Ideas?

Don’t limit your research to just one stock. Get ahead of the market by exploring fresh opportunities in sectors where tomorrow's big winners are emerging.

- Uncover fast-growing potential with penny stocks with strong financials that have fundamentals strong enough to stand out, even when market conditions get tough.

- Tap into the power of next-generation medicine by tracking innovation with healthcare AI stocks, connecting you with companies revolutionizing healthcare through artificial intelligence breakthroughs.

- Boost your portfolio’s income by seeking out dividend stocks with yields > 3%, where yields top 3% and offer the reliable returns savvy investors seek.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal