Daqo New Energy (NYSE:DQ): Evaluating Valuation After $100 Million Buyback Plan and Q2 Earnings Update

Most Popular Narrative: 14.5% Overvalued

The prevailing narrative among analysts and market watchers is that Daqo New Energy is trading above its estimated fair value, factoring in optimistic assumptions about future recovery and growth.

Recent regulatory interventions by Chinese authorities to curb irrational competition and enforce sales above production costs are expected to stabilize polysilicon prices and improve industry profitability. These measures directly support future revenue and margins for Daqo. Global momentum in solar installations, driven by policy incentives and increasing cost-competitiveness of solar power, remains robust. This positions Daqo to benefit from sustained long-term demand growth, which supports a recovery in sales volumes and top-line growth once market conditions normalize.

How do analysts justify this bold valuation? Their narrative relies on aggressive profit turnarounds, ambitious revenue rebounds, and return multiples that set the stage for big market moves. Want to see which forecasts drive the gap between current price and target? Dive deeper into the underlying numbers that shape this valuation story.

Result: Fair Value of $24.43 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent industry overcapacity or delays in regulatory support could undermine profitability and challenge the optimistic outlook reflected in current valuations.

Find out about the key risks to this Daqo New Energy narrative.Another View: Discounted Cash Flow Perspective

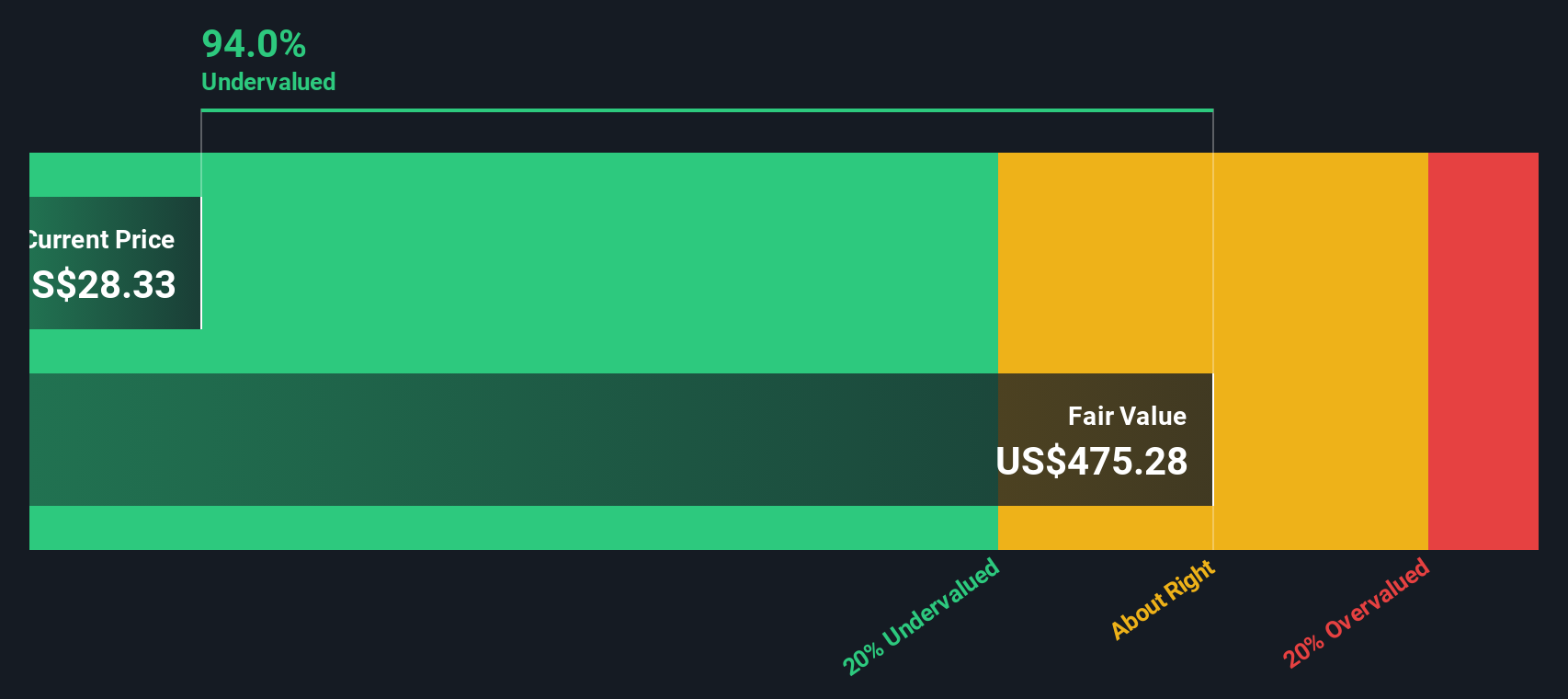

The SWS DCF model provides a very different view for Daqo New Energy, suggesting the stock may actually be deeply undervalued rather than overvalued. Is this model identifying something that others may be missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Daqo New Energy Narrative

If you see the story differently or want to dig into the numbers on your own, you can craft your own view in just a few minutes. Do it your way

A great starting point for your Daqo New Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don't limit your portfolio to just one story. Now is the perfect moment to scout other stocks with major potential using our tailored screeners. Miss these and you could be leaving great opportunities on the table.

- Unlock growth by scanning for tech disruptors in artificial intelligence. Spot emerging leaders through AI penny stocks making waves in the new economy.

- Boost your income stream instantly by targeting stocks that offer robust yields and consistent returns with dividend stocks with yields > 3%.

- Seize bargains the market has overlooked by zeroing in on serious value with undervalued stocks based on cash flows. Identify companies primed for strong cash-flow driven upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal