Assessing Danaos (NYSE:DAC) Valuation Following Persistent Earnings Declines and Bleak Growth Forecasts

Assessing Danaos (NYSE:DAC) After Another Earnings Decline

If you own or follow Danaos (NYSE:DAC), you have probably noticed the renewed debate swirling around the stock after recent analysis put the company’s profit trends front and center. Danaos’s earnings have been trending lower in recent years, and forecasts now point to an even sharper rate of decline ahead compared to the overall market. This pattern has left some investors wondering whether the current pessimism is justified, or if this might be the kind of low-expectations environment that seasoned value hunters look for.

The conversation around Danaos comes against the backdrop of a year with steady but unspectacular movement in the share price. The stock is up 29% over the past year and has notched a 12% gain in the past 3 months. These returns suggest that, while negative sentiment around declining profits persists, there may still be pockets of optimism or short-term momentum supporting the valuation. It is also worth noting that Danaos’s long-term performance remains well above average, even as growth prospects appear dimmer today.

So with Danaos trading at what many consider a modest valuation, is this a moment to seize on a bargain? Or are markets simply pricing in an earnings slide that is far from over?

Most Popular Narrative: 5.6% Undervalued

The most widely followed narrative suggests Danaos shares trade at a modest discount to estimated fair value, based on earnings and margin forecasts. According to analysts, the company's strong contract backlog and disciplined capital allocation give investors some confidence. However, future estimates reflect cautious assumptions about growth and prevailing industry risks.

Investor optimism around persistently high global e-commerce activity and consumer demand is fueling expectations for sustained growth in containerized shipping volumes. If these expectations are overestimated, it could lead to overly bullish revenue projections. There may be heightened confidence that lengthening global supply chains and shifts in manufacturing locations (for example, from China to Southeast Asia or India) will structurally boost container shipping demand. This could potentially result in market overestimation of future revenue visibility and backlog value.

Is Danaos really positioned for resilience, or are some market assumptions too optimistic? The analyst narrative quietly hinges on just a handful of pivotal projections, including margins, future earnings, and long-term growth. Curious whether this valuation stands up to scrutiny? The real drivers behind the “fair value” might surprise you. Do the numbers hide a downside risk, or is there more upside left?

Result: Fair Value of $101.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.Still, strong contract coverage and disciplined capital allocation could help Danaos outperform expectations, even if shipping demand softens or costs rise.

Find out about the key risks to this Danaos narrative.Another View: What Does Our DCF Model Say?

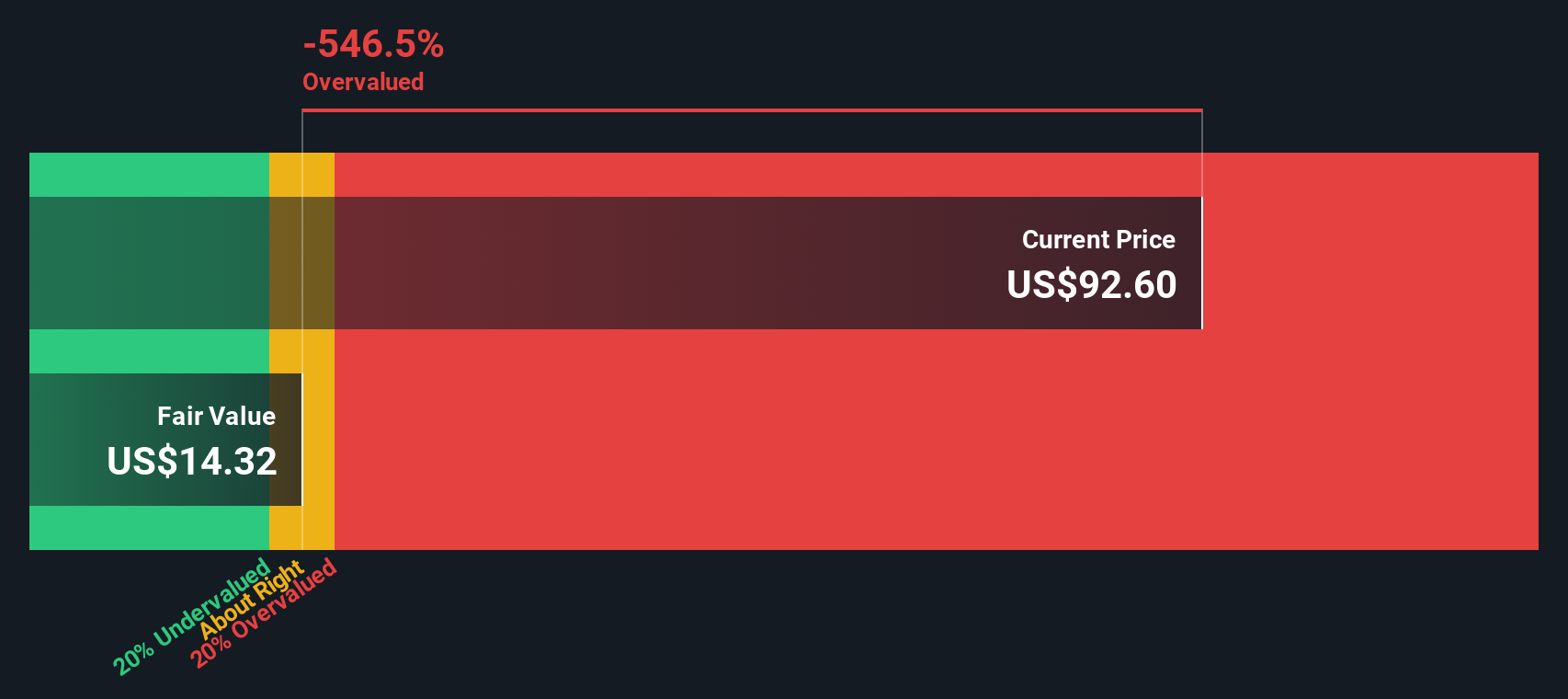

While the prevailing narrative uses analyst price targets based on future earnings, our SWS DCF model tells a different story. It suggests Danaos may actually be overvalued. Can two respected approaches really send such different signals?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Danaos Narrative

If you want a different perspective or would rather rely on your own analysis, you can easily build your personal narrative in just a few minutes. Do it your way.

A great starting point for your Danaos research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Opportunities?

Serious investors always stay ahead by searching for fresh angles. Don’t miss out on standout sectors and powerful market trends you can act on right now.

- Tap into high-yield potential and uncover companies offering dividend stocks with yields > 3% to enjoy steady income while markets fluctuate.

- Seize the momentum in artificial intelligence and find emerging leaders shaping tomorrow by checking out AI penny stocks.

- Spot undervalued gems trading below their worth and target new opportunities using our selection of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal