Taking a Fresh Look at Robert Half (RHI) Valuation Following Recent Share Price Moves

There has been some movement in Robert Half (RHI) shares recently, and if you keep an eye on companies in the staffing and recruiting space, this could prompt a closer look. While there is no major event driving headlines today, shifts like these often spark fresh interest among investors assessing whether the market’s reaction matches the underlying fundamentals. Sometimes a stretch of price swings, even without a blockbuster news item, is enough to make you review a stock with new eyes.

Despite a modest uptick over the past month, Robert Half’s stock has faced pressure over the last year, with the share price sliding nearly 39% in that period. Current performance reflects a longer-term challenge, as three- and five-year returns also lag behind the market. The latest month’s gain stands out after an otherwise tough stretch and prompts questions about whether investors are beginning to reconsider the company’s outlook or simply reacting to shifting risk appetites in the industry.

With the recent bounce, is Robert Half finally tapping into untapped value, or is the market already anticipating growth that has yet to materialize?

Most Popular Narrative: 17.7% Undervalued

The most popular narrative sees Robert Half as undervalued, projecting significant potential upside based on future earnings growth, margin expansion, and a discounted share price.

As businesses continue investing in digitization and business transformation, including technology modernization, AI readiness, ERP upgrades, and cybersecurity, the demand for skilled technology and finance talent is expected to remain strong. This positions Robert Half to benefit from a growing total addressable market and drive future revenue growth.

Curious about what’s fueling this bullish outlook? The narrative hinges on bold, future-focused assumptions. These include improved profitability, declining share counts, and a multiple that could reset how investors value Robert Half. Eager to see the numbers and projections that back up this valuation? The full narrative reveals the key calculations behind the price target.

Result: Fair Value of $43.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent revenue declines and rising operating costs could undermine margin gains. This may complicate the bullish thesis if these headwinds persist.

Find out about the key risks to this Robert Half narrative.Another View: What Does Our DCF Model Suggest?

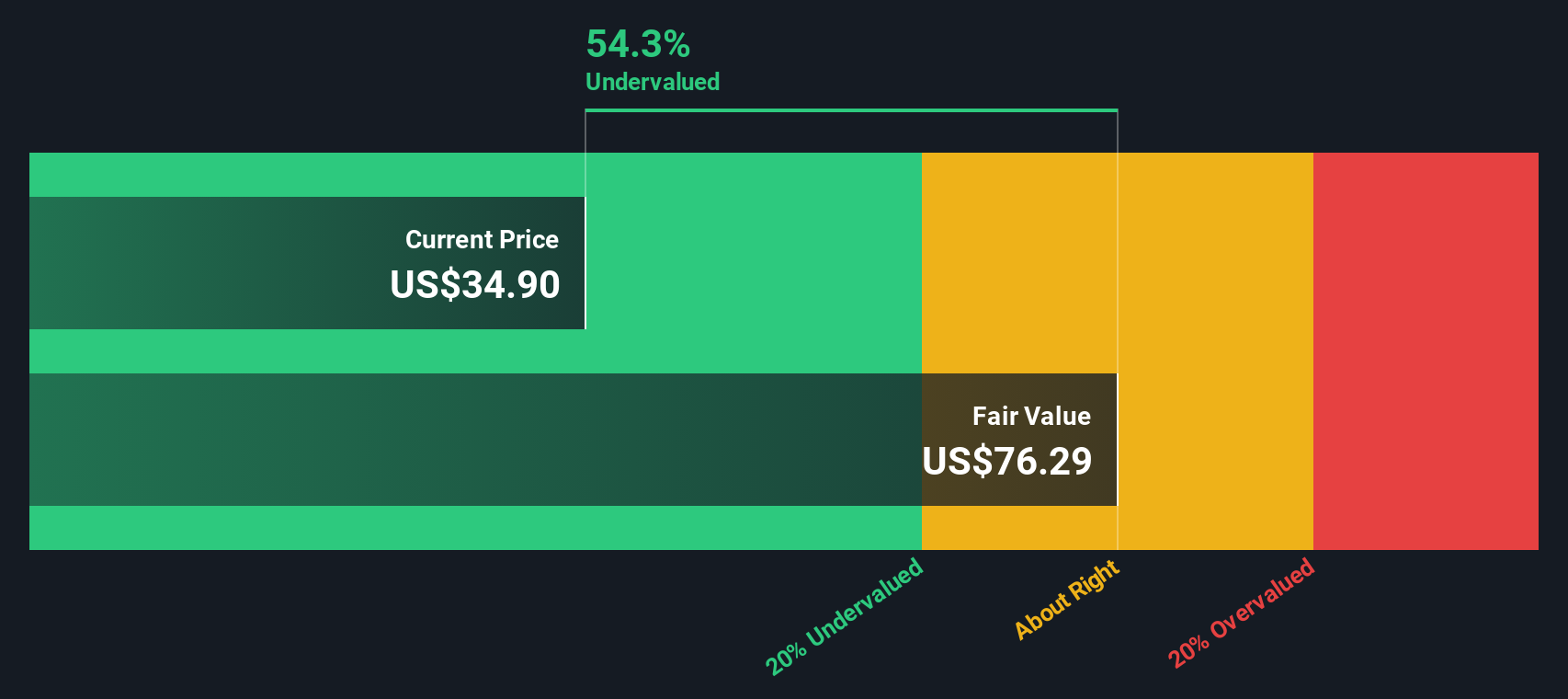

To check the first valuation, let's look at our SWS DCF model. This approach, focusing on estimated future cash flows, also points toward undervaluation. But can numbers tell the whole story? Is there more to consider?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Robert Half Narrative

If you have a different perspective or want to put your own analysis to the test, you can quickly build your own view in just a few minutes. Do it your way

A great starting point for your Robert Half research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Sharpen your investment strategy and get ahead by targeting stocks using specialized Simply Wall Street screeners. If you skip these ideas, you risk missing the next big winner.

- Tap into stocks with strong income potential and secure your portfolio with dividend stocks with yields > 3% that consistently offer attractive yields above 3%.

- Ride the technology wave by seeking out market disruptors revolutionizing AI-driven industries, all highlighted with AI penny stocks.

- Seize bargains others overlook in sectors with untapped upside by reviewing the latest undervalued stocks based on cash flows tailored to firm financial fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal