Assessing Post Holdings (POST) Valuation: Is the Recent Downtrend Creating an Opportunity?

If you have been tracking Post Holdings (POST) lately, you are probably wondering what might be behind the changing sentiment around the stock. Even without a single headline-grabbing event, the recent movement in the share price has many investors re-examining their thesis. Is this just noise, or is there something more going on beneath the surface that demands a closer look?

The past year has seen Post Holdings put up mixed results on the trading front. The stock slipped by nearly 9% over the last twelve months, with losses deeper than that in the year to date. Shares have drifted lower across nearly every timeframe, despite the company posting solid annual gains in both revenue and net income. That pattern raises questions about whether the market is discounting the company’s fundamentals or simply anticipating future headwinds.

After a year of steady declines, is Post Holdings quietly becoming a bargain, or has the market accurately priced in everything investors need to know about its future prospects?

Most Popular Narrative: 16.6% Undervalued

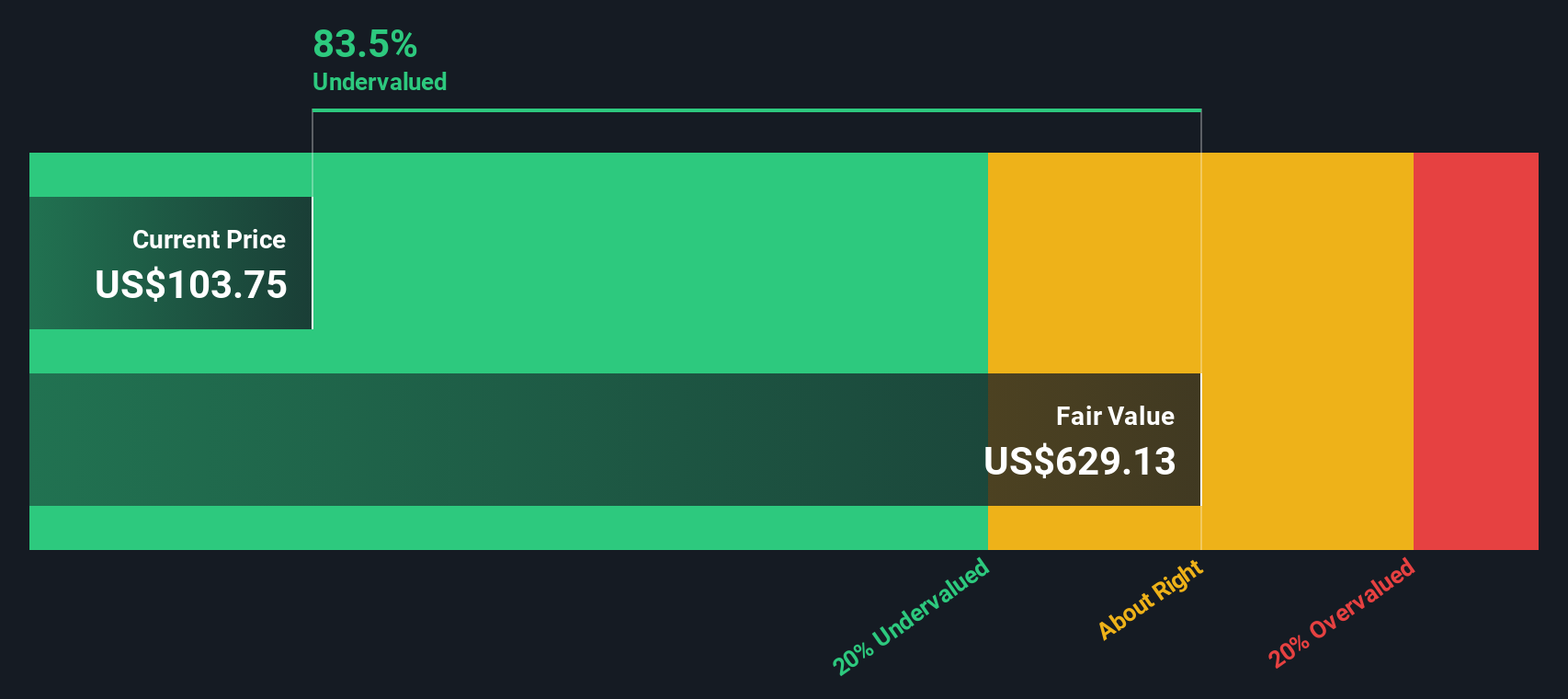

The prevailing outlook suggests that Post Holdings may be trading below its fair value, with analysts highlighting a notable discount to consensus expectations. This perceived undervaluation has caught the attention of both seasoned and new investors.

Post Holdings is positioned to benefit from increasing consumer demand for convenient, high-protein, and nutrition-oriented foods. This is evident in the strong volume growth of UFIT and innovation efforts focused on new high-protein cereal and granola products. These trends are expected to drive a premium brand mix and support both top-line revenue growth and margin expansion.

Curious about what is fueling this bullish fair value calculation? Perhaps it is ambitious growth targets, or perhaps something even more unexpected. Is Wall Street betting big on a game-changing shift in product mix or operational strategy, and how aggressive are these underlying projections? The real drivers behind this number might surprise you.

Result: Fair Value of $127.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing volume declines and rising input costs could present challenges to Post Holdings’ growth story, putting future revenue and profit projections at risk.

Find out about the key risks to this Post Holdings narrative.Another View: The SWS DCF Model

While the analyst price target points to potential undervaluation, our SWS DCF model offers a separate cash flow-based perspective and also views Post Holdings as undervalued. Do the numbers tell the full story, or is the market seeing something the models miss?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Post Holdings Narrative

If you see things differently or want to dig into the numbers on your own terms, you can assemble a custom narrative in just a few minutes, Do it your way.

A great starting point for your Post Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself an edge on your investing journey by looking beyond Post Holdings. These unique stock collections can help you spot overlooked opportunities you do not want to miss.

- Tap into powerful cash-flow potential with our collection of companies flagged as great value opportunities by our undervalued stocks based on cash flows.

- Uncover future healthcare leaders in artificial intelligence, where cutting-edge advancements are reshaping patient care through the healthcare AI stocks.

- Chase steady payouts and build your income portfolio with companies offering strong yields, highlighted in our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal