A Look at SQM (NYSE:SQM) Valuation After Q2 Results Highlight Lithium Weakness and Iodine Strength

Most Popular Narrative: 10.3% Undervalued

According to the most widely followed narrative, Sociedad Química y Minera de Chile (SQM) is considered undervalued, with its fair value set above the current market price. This perspective ties the company’s future upside closely to expected growth drivers and strategic resilience.

Expansion of lithium and specialty chemical production capacity positions the company for sustained revenue and margin growth. This is further supported by strong demand and tight global supply. Operational efficiency, diverse product streams, and rising barriers to entry protect the company's competitive strength and earnings resilience in the face of market volatility.

Curious how analysts project SQM’s fair value? It’s not just about rising demand. There is a specific set of bold growth projections and margin improvements included in this valuation. These numbers could surprise even seasoned investors. Want the full breakdown behind the headline figure? The most popular narrative spells out the key quantitative assumptions powering that optimistic target.

Result: Fair Value of $50.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, especially if lithium prices stagnate or if regulatory hurdles in Chile delay expansion plans and disrupt long-term growth expectations.

Find out about the key risks to this Sociedad Química y Minera de Chile narrative.Another View: Market Peers Send a Different Signal

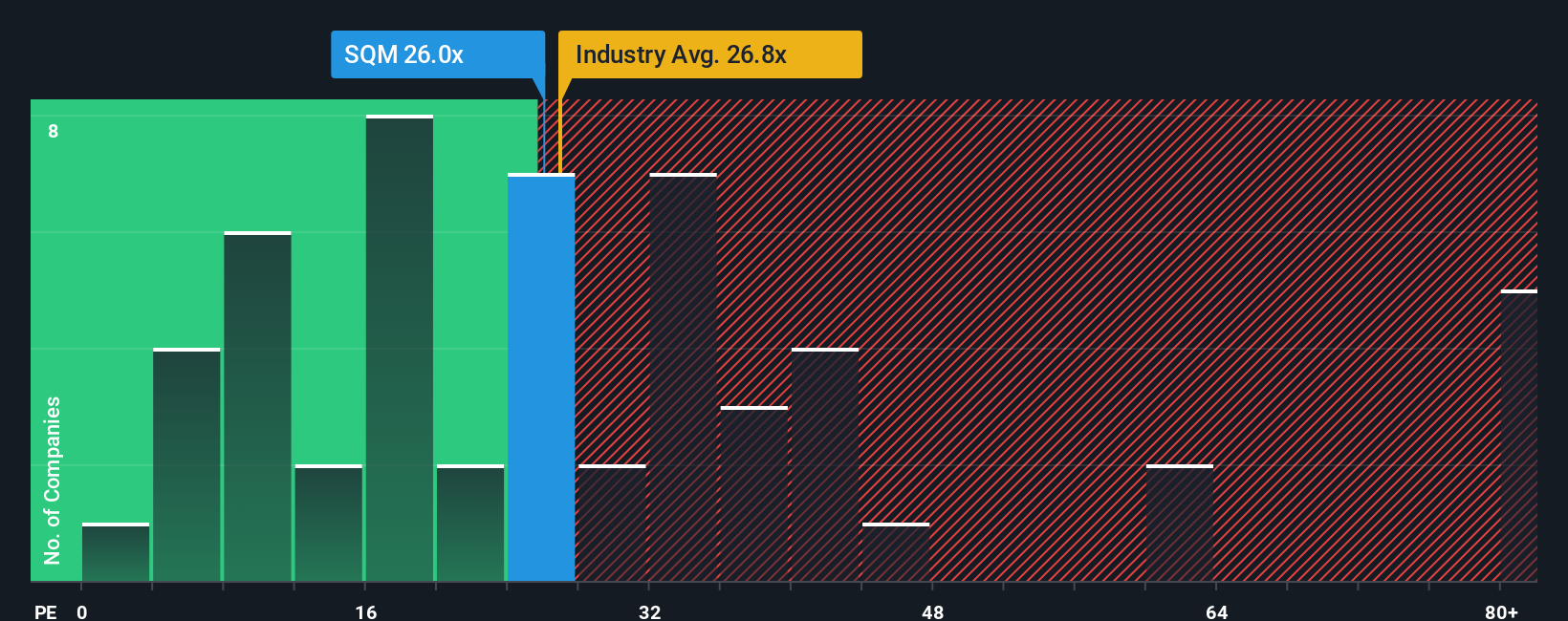

A look at where shares trade compared to similar companies paints a less optimistic picture. By this method, SQM actually appears more expensive than the industry average. Could the recovery already be fully priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sociedad Química y Minera de Chile Narrative

If you see things differently or want to dig into the details yourself, you can shape your own take on SQM in just a few minutes. Do it your way.

A great starting point for your Sociedad Química y Minera de Chile research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Do not leave opportunity on the table. Expand your portfolio by checking out other handpicked stock ideas. These powerful screens can fast-track you to the next big winner.

- Tap into unbeatable value with companies poised for growth by using our undervalued stocks based on cash flows.

- Get ahead of tech’s next wave by scouting game-changing innovators in artificial intelligence through AI penny stocks.

- Unlock steady income potential from market leaders offering attractive yields with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal