Will Dillard's (DDS) Inventory Discipline Counterbalance Shifting Sales in Key Departments?

- Earlier this month, Dillard's released its second quarter 2025 Form 10-Q, reporting a slight increase in net sales fueled by strong juniors’ and children’s apparel growth, but also showing decreased sales in cosmetics and home furnishings.

- An interesting insight is management's focus on inventory control and risk management, addressing inflation and potential trade restrictions that could affect future operations.

- We'll explore how Dillard's commitment to inventory control and risk management shapes its current investment narrative.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

What Is Dillard's Investment Narrative?

To be invested in Dillard’s today, you need to believe the company can maintain resilience even as growth in select categories offsets softness elsewhere. The latest quarter brought marginal gains in juniors’ and children’s apparel, but also flagged declining sales in cosmetics and home furnishings, a sign that category strength is uneven. Dillard’s continues to emphasize inventory control and exclusive brand expansion, two levers that management hopes will shield margins in a trickier inflationary retail climate. The recently reported results confirm stable sales, but slightly lower net income, suggesting diligent cost management is only partly offsetting sector headwinds. With dividends rising and a steady buyback program, short-term catalysts remain focused on operational efficiency and loyalty-building brand strategy. On the risk side, heightened competition and trade uncertainties could weigh on future earnings, warranting close attention in the months ahead. The impact of the latest news seems incremental, rather than a sharp pivot in either risk or reward.

Yet, potential trade restrictions still loom as a critical watchpoint for shareholders.

Exploring Other Perspectives

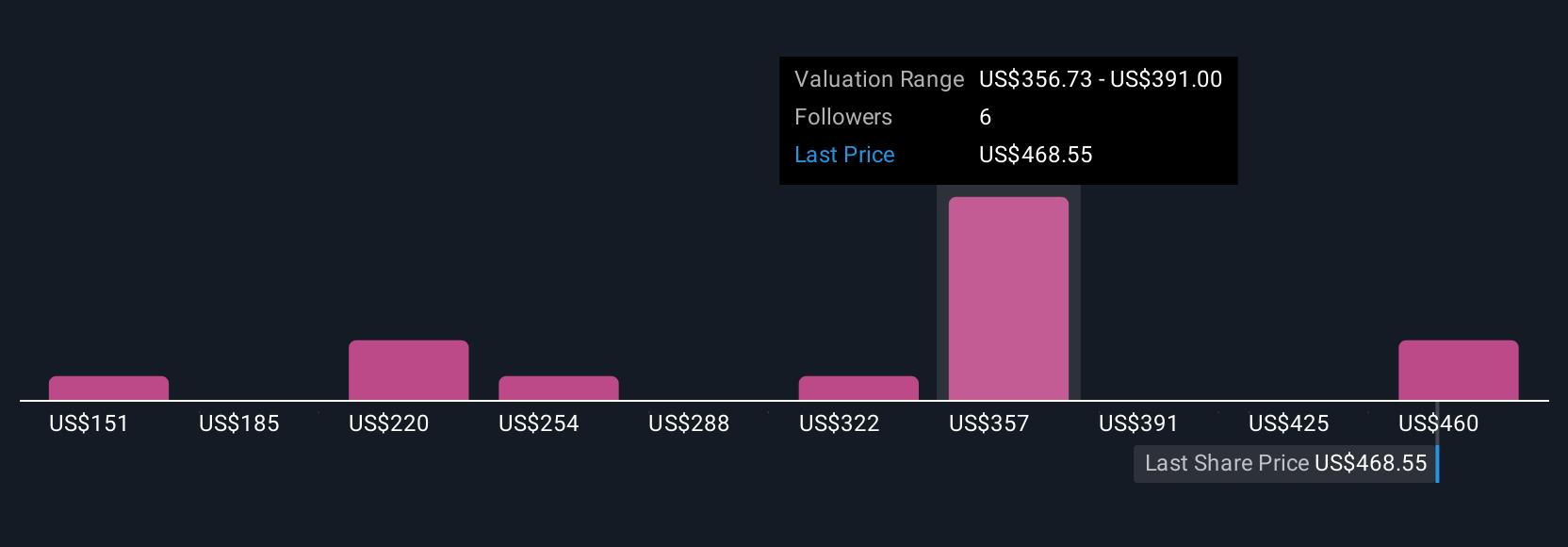

Explore 8 other fair value estimates on Dillard's - why the stock might be a potential multi-bagger!

Build Your Own Dillard's Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dillard's research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dillard's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dillard's overall financial health at a glance.

No Opportunity In Dillard's?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal