Leggett & Platt (LEG): Assessing Valuation After Aerospace Sale and Upgraded Earnings Outlook

Most Popular Narrative: 3.6% Overvalued

The latest consensus narrative views Leggett & Platt as slightly overvalued, with the fair value modestly below the current market price, based on its projected earnings growth and operational improvements.

“Recent and proposed enforcement of tariffs on imported mattresses and components, combined with aggressive targeting of transshipment and non-compliant imports, is expected to create a more level playing field for domestic producers. This should drive higher demand for Leggett & Platt's U.S.-made bedding components and steel rod/wire, contributing to stronger revenue and gross margin expansion as price pressures from foreign dumping recede.”

Curious about how tightening regulations and a revamped cost structure could change everything? This narrative’s fair value calculation is anchored on sharp margin expansion and fresh profit benchmarks. Details that might surprise even industry veterans. Want to know which figures are driving the story and how they could impact the future value? Find out what makes this valuation call so compelling.

Result: Fair Value of $9.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in residential bedding demand and aggressive industry discounting could undermine forecasts and present challenges for Leggett & Platt's expected margin expansion.

Find out about the key risks to this Leggett & Platt narrative.Another View: Discounted Cash Flow Perspective

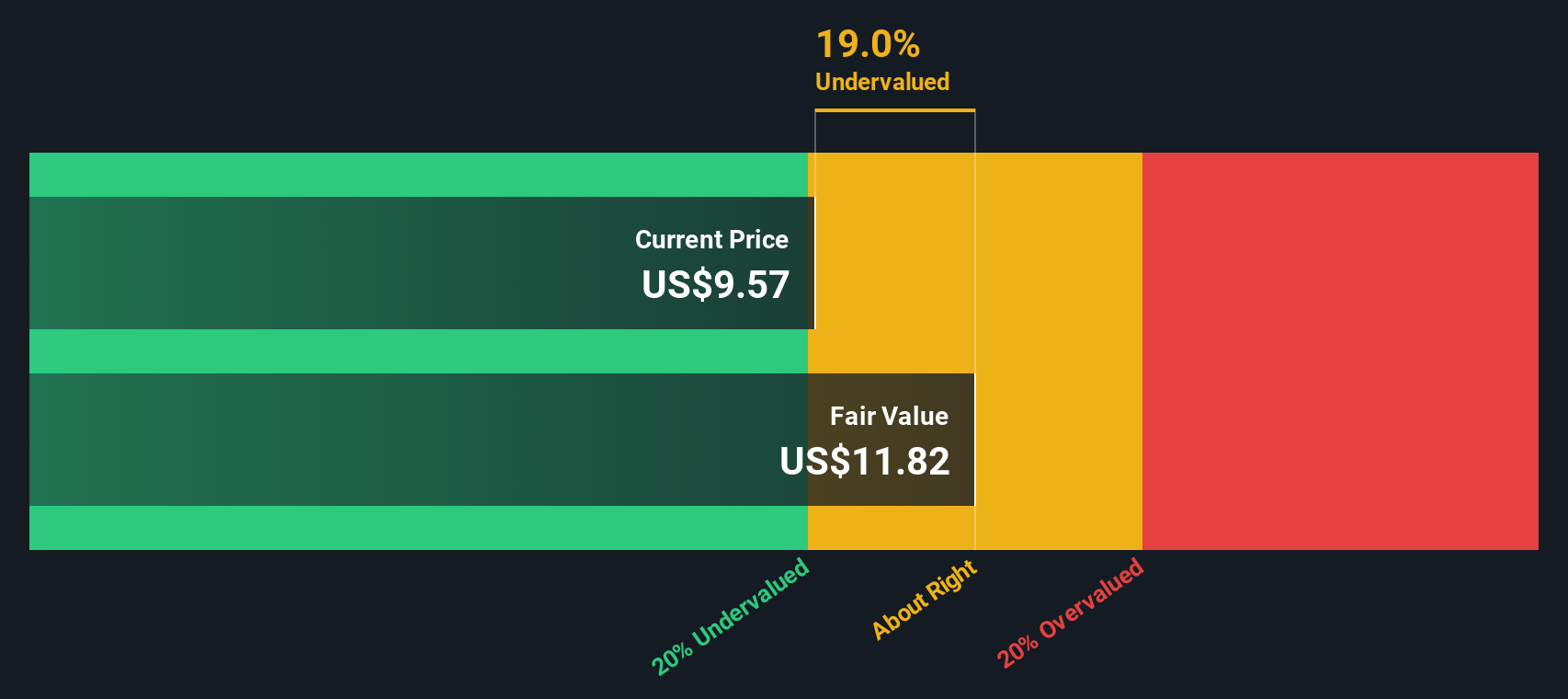

While the analyst consensus relies on company earnings and comparable ratios, our SWS DCF model provides a different perspective and suggests the shares are actually undervalued. Could the market be missing some hidden potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Leggett & Platt Narrative

If you have a different take or want to dig into the details yourself, you can shape your own Leggett & Platt story in just a few minutes: Do it your way.

A great starting point for your Leggett & Platt research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio. Smart investors always scan the market for standout opportunities. Get ahead of the crowd by checking out some of these handpicked themes:

- Spot undervalued gems in the market and boost your potential returns with undervalued stocks based on cash flows as your shortcut to stocks where value still leads the way.

- Boost your quest for reliable passive income by checking out dividend stocks with yields > 3%, where strong yields and financial strength meet opportunity.

- Ride the wave of innovation and catch early movers in the next tech evolution with AI penny stocks at your fingertips for a front-row seat to AI breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal