Will Century Communities' (CCS) Debt Refinancing Strengthen Its Long-Term Financial Flexibility?

- Century Communities, Inc. recently completed a private offering of US$500 million in 6.625% senior unsecured notes due 2033 with attached guarantees, using the proceeds to redeem all of its outstanding 2027 senior notes.

- This refinancing move alters the company’s capital structure, potentially impacting interest costs and signaling a proactive approach to long-term debt management.

- We'll explore how this significant debt refinancing could influence Century Communities’ investment outlook and its ability to manage future margin pressures.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Century Communities Investment Narrative Recap

Century Communities shareholders generally need conviction in the company’s ability to grow community count and capitalize on sustained housing undersupply, even as affordability pressures and lower margins weigh on short-term results. The latest US$500 million debt refinancing could ease near-term interest expense but does not materially shift the main catalyst or the key risk: ongoing affordability challenges for homebuyers, which remain the most important factor impacting demand and pricing in the months ahead.

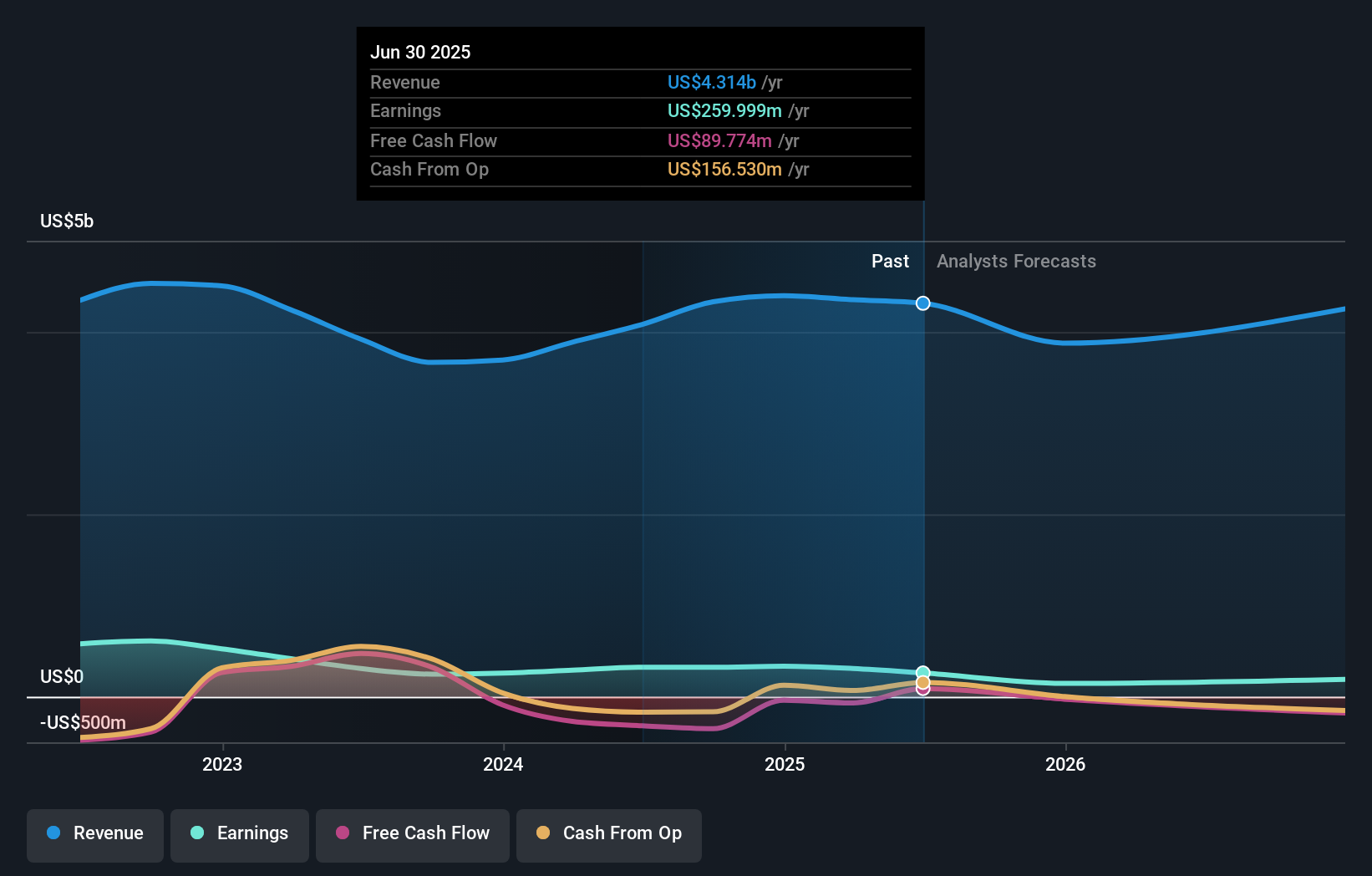

Among recent announcements, the company’s Q2 2025 earnings report is especially relevant. Management has revised full-year home delivery guidance downward to 10,000-10,500 homes and forecasts US$3.8-4.0 billion in sales revenue, highlighting that persistent demand headwinds remain at the forefront despite efforts to control costs or increase liquidity through refinancing.

But in contrast to the debt reduction news, margin pressure from ongoing cost inflation is an area investors should watch as...

Read the full narrative on Century Communities (it's free!)

Century Communities is projected to have $4.1 billion in revenue and $114.5 million in earnings by 2028. This outlook assumes a 1.9% annual decline in revenue and an earnings decrease of $145.5 million from the current earnings of $260.0 million.

Uncover how Century Communities' forecasts yield a $59.50 fair value, a 15% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided fair value estimates for Century Communities ranging from US$19.20 to US$59.50, based on 2 individual perspectives. Cost and margin pressures remain central in analyst commentary, showing why readers could benefit from examining diverse viewpoints on the company’s future performance.

Explore 2 other fair value estimates on Century Communities - why the stock might be worth as much as $59.50!

Build Your Own Century Communities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Century Communities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Century Communities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Century Communities' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal