Does OneMain’s New $800 Million Debt Issue Signal a Shift in Capital Flexibility Strategy for OMF?

- In the past week, OneMain Holdings, through its subsidiary OneMain Finance Corporation, issued US$800 million in senior notes due 2033 to support general corporate purposes, potentially including debt repurchases or repayments.

- This move highlights OneMain’s proactive approach to managing its financial structure as it works to maintain flexibility and market positioning.

- To better understand the implications of this new debt issuance, we'll explore its impact on OneMain Holdings' overall investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

OneMain Holdings Investment Narrative Recap

To hold OneMain Holdings, investors need to believe in the company’s ability to profitably serve nonprime borrowers while managing elevated credit risk as economic conditions shift. The recent US$800 million senior notes issuance is not expected to materially change the main short-term catalyst, steady loan demand among nonprime consumers, or the key risk, which remains heightened exposure to credit losses if borrower quality deteriorates further.

One of the most relevant recent updates was management’s July 2025 move to raise full-year revenue growth guidance to the high end of 6% to 8%, reflecting strong origination growth and stable net charge-off trends in the first half of the year. While the new debt financing could enhance OneMain’s financial flexibility for funding receivables or potential buybacks, these actions do not address the ongoing risk tied to funding costs for non-bank lenders if market conditions tighten. But with rising interest expense and competition from digital alternatives, investors should be aware that...

Read the full narrative on OneMain Holdings (it's free!)

OneMain Holdings' outlook anticipates $6.8 billion in revenue and $1.3 billion in earnings by 2028. This implies a 34.9% annual revenue growth rate and an earnings increase of $636 million from the current $664 million.

Uncover how OneMain Holdings' forecasts yield a $65.21 fair value, a 6% upside to its current price.

Exploring Other Perspectives

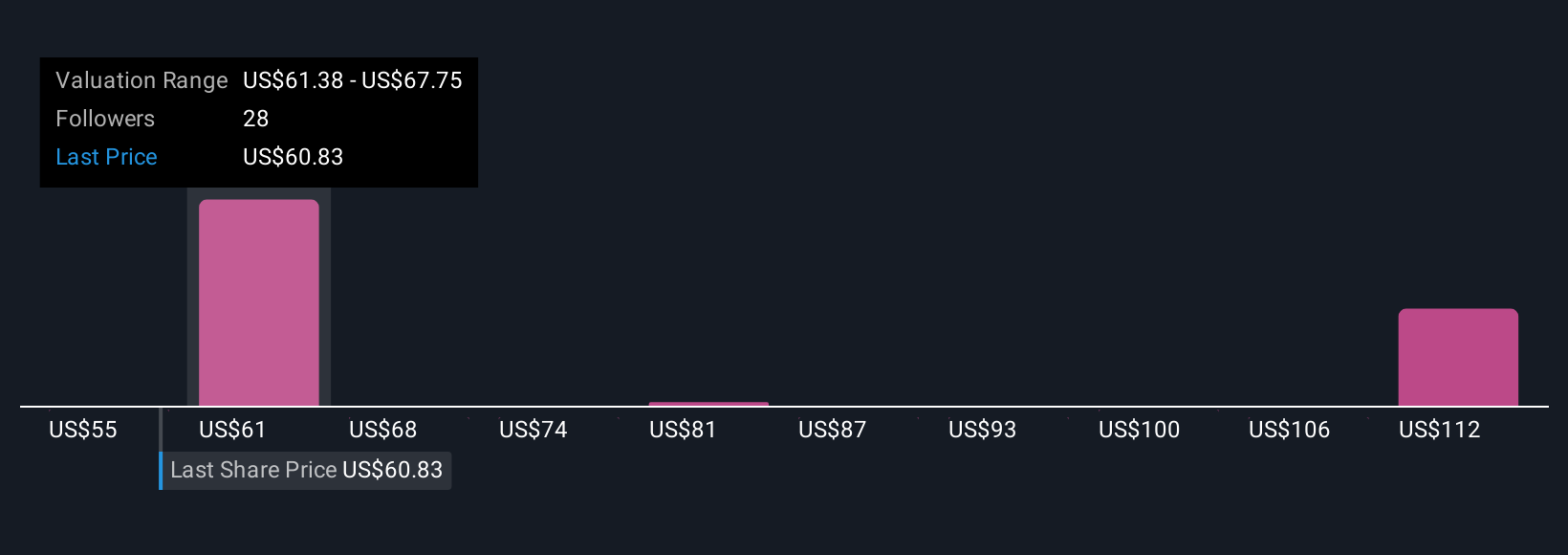

Six members of the Simply Wall St Community value OneMain between US$55 and US$118.77 per share, revealing significant differences of opinion. With high charge-offs persisting, you can review these varied perspectives to gain a broader understanding of OneMain’s future performance.

Explore 6 other fair value estimates on OneMain Holdings - why the stock might be worth 11% less than the current price!

Build Your Own OneMain Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OneMain Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free OneMain Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OneMain Holdings' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal