Assessing Ally Financial (ALLY) Valuation After Strong Earnings and Renewed Investor Focus on Fundamentals

Ally Financial (ALLY) is getting some fresh attention after posting solid quarterly results, and the market has taken notice. Investors weighing what to do next are contending with mixed signals; the sharp climb in the share price suggests renewed optimism, but the fundamentals are still up for debate. The excitement around the earnings report has clearly shifted sentiment, at least in the short term, as more eyes turn to Ally’s financial health and future growth story.

Looking at the bigger picture, Ally Financial’s stock has outperformed the S&P 500 over the past six months, building momentum following its earnings beat. That said, over the past year, progress has been steadier, with returns still trailing the five-year performance where longer-term investors have seen sizable gains. Under the surface, though, long-term revenue growth and tangible book value per share have moved at a moderate pace, which may cause cautious investors to pause before jumping in.

So, is Ally Financial at an interesting valuation that could mean room to run, or is the market already factoring in all foreseeable growth risks and rewards?

Most Popular Narrative: 11% Undervalued

According to the most widely followed narrative, Ally Financial’s shares are trading at a discount to what analysts believe is its fair value, indicating potential room for upside if company targets are achieved.

"The accelerating demand for digital banking and app-based financial services is enabling Ally's all-digital business model to acquire and retain customers more efficiently. This supports ongoing net customer growth and drives higher deposit stability, which should support long-term revenue and net margin expansion as the cost advantages of digital scale deepen."

Curious about how Ally’s digital transformation could power earnings far beyond most expectations? The latest narrative relies on an ambitious outlook backed by surging growth assumptions and a profit trajectory that could shake up industry benchmarks. Wondering what specific forecasts and future multiples are driving this 11% fair value boost? Get ready to discover the figures that could change your perspective on Ally’s potential.

Result: Fair Value of $46.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as increased competition and a shift away from traditional auto lending could threaten Ally’s growth narrative and weigh on future profitability.

Find out about the key risks to this Ally Financial narrative.Another View: Market-Based Comparison Raises Eyebrows

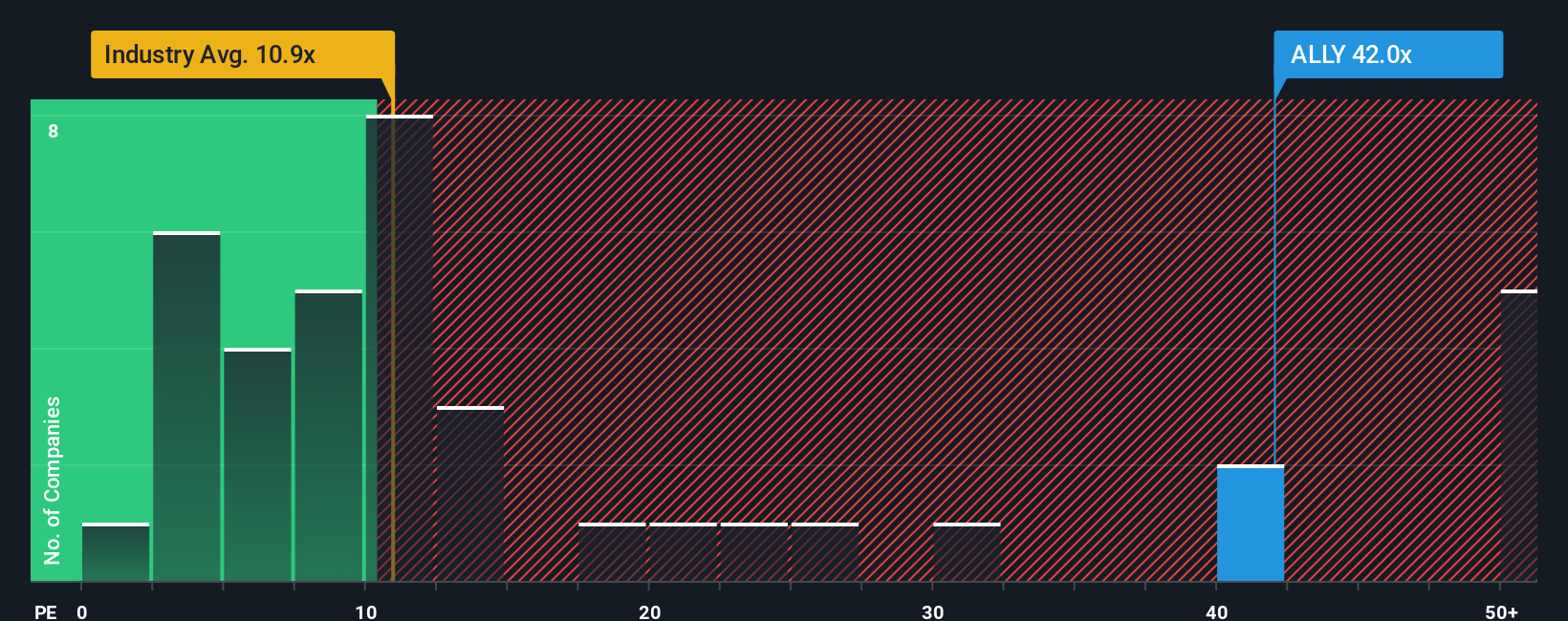

While analyst forecasts suggest Ally Financial may be undervalued, a market-based approach presents a different perspective. Comparing its price-to-earnings ratio with industry averages indicates the stock appears expensive. Is this a warning sign, or is the market factoring in elements the models do not capture?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ally Financial Narrative

If you want to dig deeper or reach your own conclusions, you can quickly assemble your own perspective with the tools at your fingertips: Do it your way.

A great starting point for your Ally Financial research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunities pass you by. Put your money to work where innovation and potential are shaping tomorrow’s winners. Start your next search with these powerful tools:

- Uncover high-yield opportunities by scanning for companies offering dividend stocks with yields > 3% and watch your portfolio’s passive income stay ahead of the curve.

- Supercharge your investments by targeting breakthroughs at the intersection of medicine and technology through healthcare AI stocks, and ride the wave of healthcare’s future leaders.

- Take advantage of overlooked gems trading below their cash flow value by seeking out undervalued stocks based on cash flows to ensure you never miss a hidden bargain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal