Did Newmark Group's (NMRK) $425M Self-Storage Deal and $4B AI Venture Shift Its Investment Narrative?

- In recent weeks, Newmark Group arranged a US$425 million refinancing loan on behalf of Centerbridge Partners and Merit Hill Capital for a national portfolio of 78 self-storage properties, and also advised on a US$4 billion joint venture supporting the development of a major AI data center campus in Pennsylvania.

- These transactions showcase Newmark Group's central role in large-scale real estate financing and its expanding influence in the digital infrastructure sector.

- We'll explore how arranging a US$425 million refinancing for self-storage assets shapes Newmark Group's current investment narrative and future prospects.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Newmark Group Investment Narrative Recap

Being a shareholder of Newmark Group often comes down to believing in its ability to capitalize on the secular growth of alternative real estate asset classes like data centers, alongside its track record in large-scale financing deals. The recent US$425 million refinancing in self-storage and the US$4 billion AI data center transaction both reinforce the company's push deeper into high-demand segments, though neither materially alters the key short-term catalyst: sustained deal flow in digital infrastructure. These moves, however, do little to offset the main risk, potential industry-wide slowdowns if market saturation or cyclical shifts hit hot sectors like data centers, duplicating patterns seen in other sectors in the past.

The recently announced advisory role in the US$4 billion AI data center joint venture is particularly relevant, given Newmark’s evolving digital infrastructure business. This engagement supports the company’s strategy to grow fee-generating activities outside traditional office and retail segments, potentially cushioning revenue against fluctuations in core urban markets and closely aligning with the catalysts driving current investor interest.

But it's worth noting, if investor enthusiasm is grounded primarily in outpaced sector growth, the risk of a sudden reversal in digital infrastructure demand is something prudent investors should be aware of...

Read the full narrative on Newmark Group (it's free!)

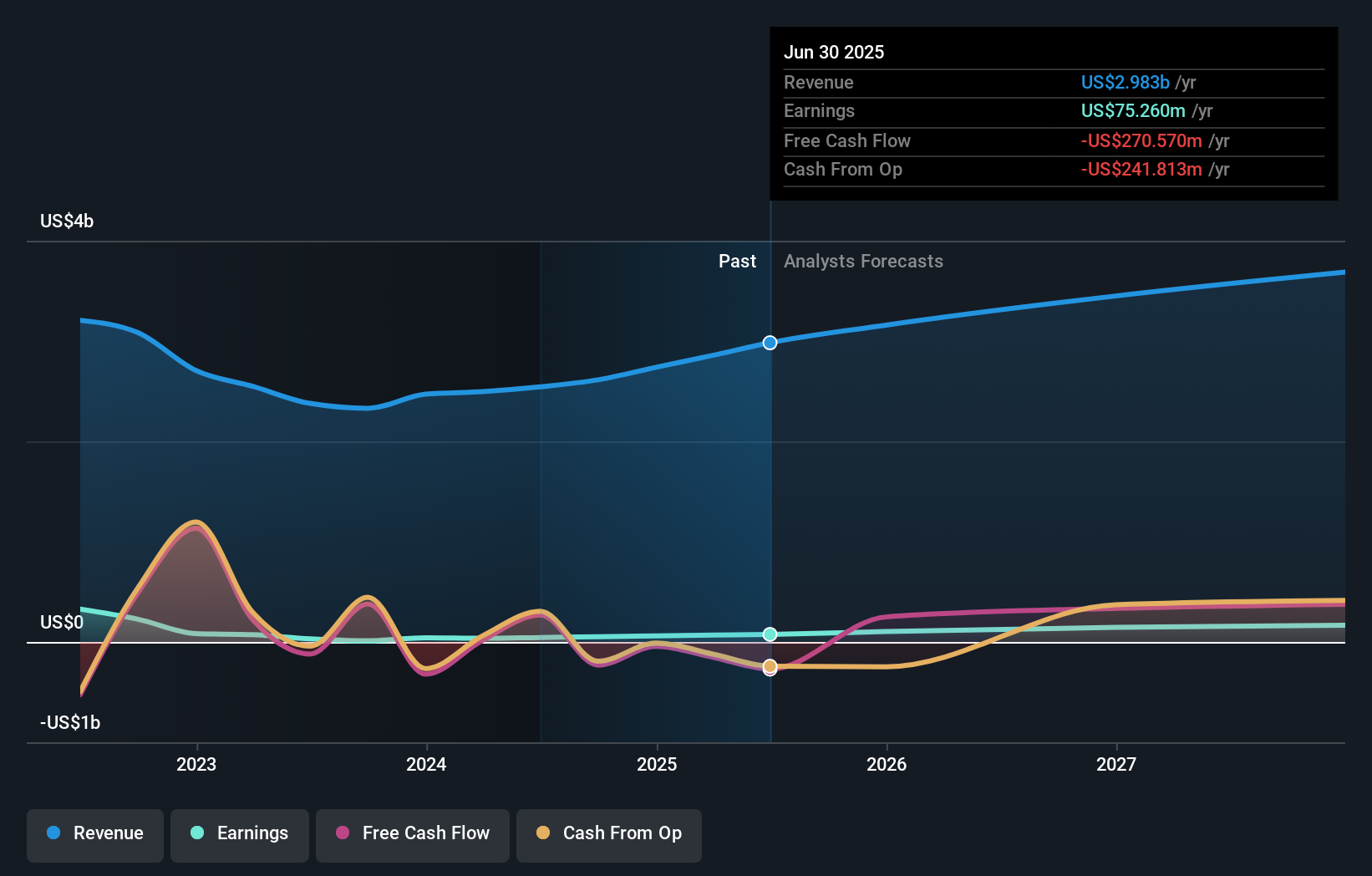

Newmark Group's outlook anticipates $3.8 billion in revenue and $201.7 million in earnings by 2028. This is based on an expected annual revenue growth rate of 8.2% and a $126.4 million increase in earnings from the current $75.3 million.

Uncover how Newmark Group's forecasts yield a $18.45 fair value, in line with its current price.

Exploring Other Perspectives

Two Simply Wall St Community members estimated Newmark’s fair value between US$11.81 and US$18.45, reflecting a broad range of outlooks. With sector slowdowns as a key risk, you may want to consider how shifting sentiment could impact outcomes and compare several viewpoints for a well-rounded view.

Explore 2 other fair value estimates on Newmark Group - why the stock might be worth as much as $18.45!

Build Your Own Newmark Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Newmark Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Newmark Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Newmark Group's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal