International Seaways (INSW): A Fresh Look at Valuation Following New Bond Offering

Most Popular Narrative: 12.5% Undervalued

The most widely followed narrative suggests that International Seaways is currently trading at a notable discount to its fair value, indicating significant upside potential if key forecasts are met.

Fleet modernization and strong financial flexibility position the company to capitalize on environmental regulation shifts and market opportunities. Structural shifts toward decarbonization and regulatory pressures threaten revenue stability, financial flexibility, and asset value due to declining demand, compliance costs, and volatile market exposure.

Curious what is fueling this striking undervaluation call? The narrative points to a strategic mix of operational shifts and internal financial firepower that unlock future value. There are aggressive expectations around how growth, profits, and fleet renewal could support a price surge, but only if bold assumptions hold true. The specifics behind these projections might surprise even seasoned investors. Want the inside scoop on exactly what is driving the optimism?

Result: Fair Value of $53.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, some risks remain, such as weakened global demand for oil shipping or costly new regulations. These factors could limit upside and challenge the bullish view.

Find out about the key risks to this International Seaways narrative.Another View: What Does the DCF Say?

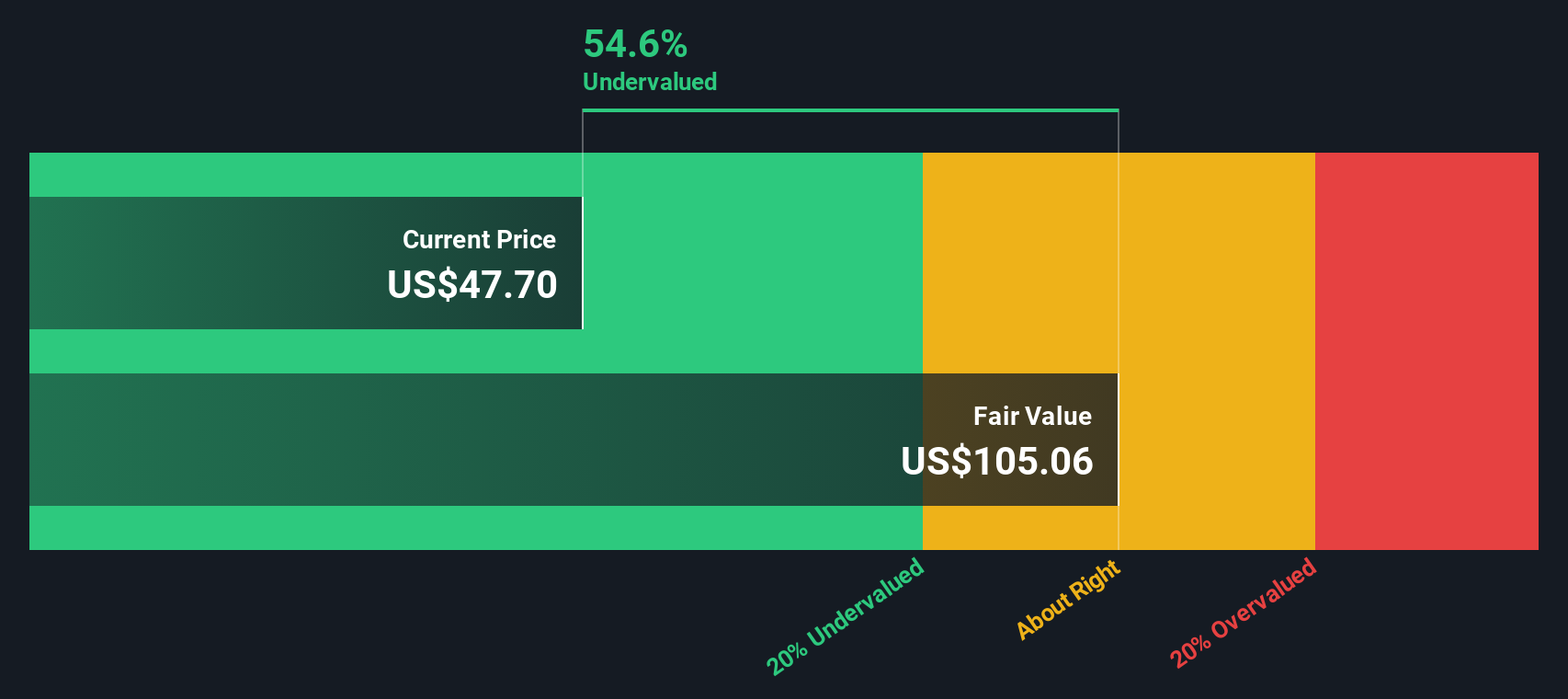

Taking a step back from analyst price targets, our DCF model paints an even more bullish picture and suggests International Seaways could be significantly undervalued. But how reliable is any model when conditions rapidly change?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own International Seaways Narrative

If these perspectives do not quite align with your own, or if you want to run the numbers yourself, you can easily build your own narrative in just a few minutes. Do it your way

A great starting point for your International Seaways research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that spotting the next winner is all about casting a wide net. Don’t let new opportunities pass you by. Use these powerful tools to uncover your next move.

- Tap into up-and-coming market disruptors by using penny stocks with strong financials to see which small-cap companies could deliver outsized returns.

- Get ahead of the innovation curve and seize emerging trends by checking out the latest AI penny stocks shaping tomorrow’s economy.

- Supercharge your search for hidden bargains with undervalued stocks based on cash flows and spot quality stocks priced below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal