Top Dividend Stocks To Consider In September 2025

As U.S. markets experience fluctuations following recent record highs and the anticipation of a Federal Reserve rate cut, investors are closely monitoring dividend stocks for their potential to provide steady income amidst economic uncertainty. In this environment, selecting dividend stocks with strong fundamentals and consistent payout histories can offer stability and resilience in an ever-changing market landscape.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| OTC Markets Group (OTCM) | 4.38% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 3.52% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.78% | ★★★★★★ |

| Ennis (EBF) | 5.41% | ★★★★★★ |

| Employers Holdings (EIG) | 3.01% | ★★★★★☆ |

| Dillard's (DDS) | 4.51% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.35% | ★★★★★★ |

| Chevron (CVX) | 4.45% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.36% | ★★★★★☆ |

| Archer-Daniels-Midland (ADM) | 3.24% | ★★★★★☆ |

Click here to see the full list of 125 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

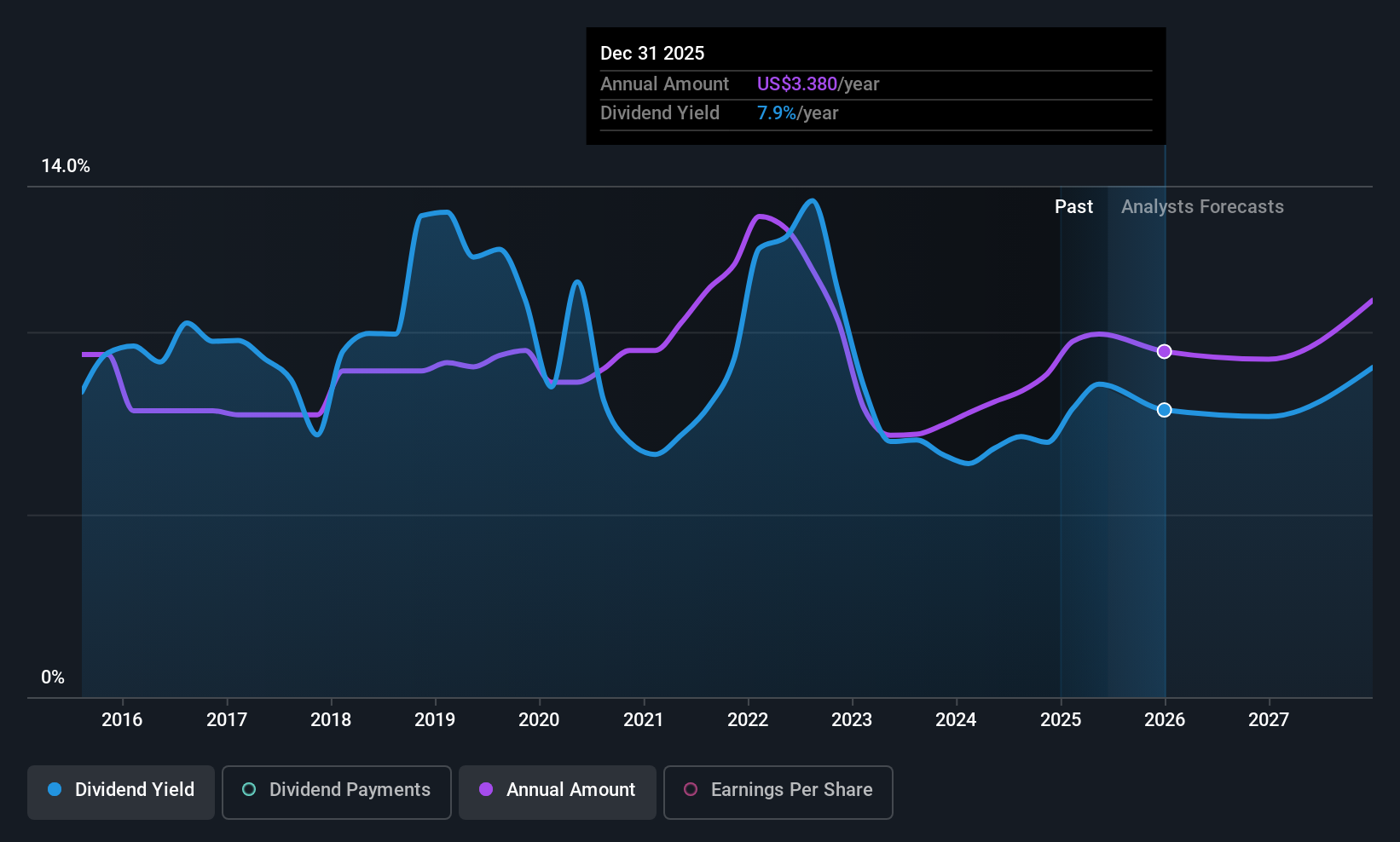

Artisan Partners Asset Management (APAM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Artisan Partners Asset Management Inc. is a publicly owned investment manager with a market cap of approximately $3.74 billion.

Operations: Artisan Partners Asset Management generates its revenue primarily from the Investment Management Industry, totaling $1.14 billion.

Dividend Yield: 7.7%

Artisan Partners Asset Management offers a high dividend yield of 7.71%, placing it in the top 25% of US dividend payers. Despite its attractive yield, the company's dividends have been volatile over the past decade, although they are currently covered by both earnings and cash flows with payout ratios around 81%. Recent earnings growth supports sustainability, yet historical instability may concern some investors seeking consistent income streams.

- Dive into the specifics of Artisan Partners Asset Management here with our thorough dividend report.

- Upon reviewing our latest valuation report, Artisan Partners Asset Management's share price might be too pessimistic.

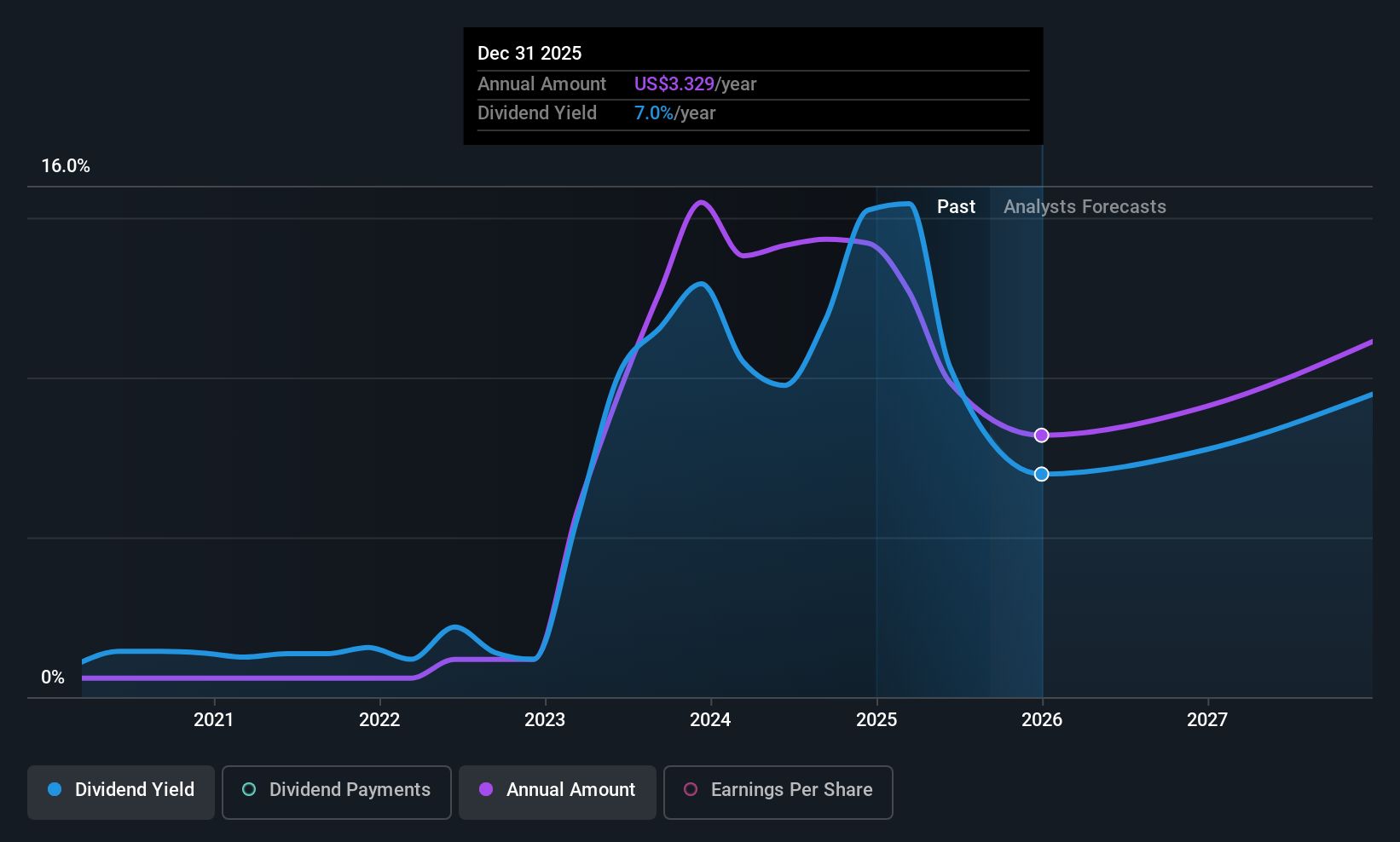

International Seaways (INSW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: International Seaways, Inc. owns and operates a fleet of oceangoing vessels for transporting crude oil and petroleum products in the international flag trade, with a market cap of $2.31 billion.

Operations: International Seaways generates revenue from two main segments: Crude Tankers, contributing $390.91 million, and Product Carriers, accounting for $407.93 million.

Dividend Yield: 7.0%

International Seaways offers a strong dividend yield of 6.99%, ranking in the top 25% of US payers, though its dividends have been volatile over its six-year history. The company's low payout ratio of 9.9% indicates dividends are well-covered by earnings, but recent insider selling and declining profit margins from last year may raise concerns about future stability. Recent announcements include regular and supplemental dividends totaling $0.77 per share, alongside a fixed-income offering for senior unsecured notes due 2030.

- Unlock comprehensive insights into our analysis of International Seaways stock in this dividend report.

- Our comprehensive valuation report raises the possibility that International Seaways is priced lower than what may be justified by its financials.

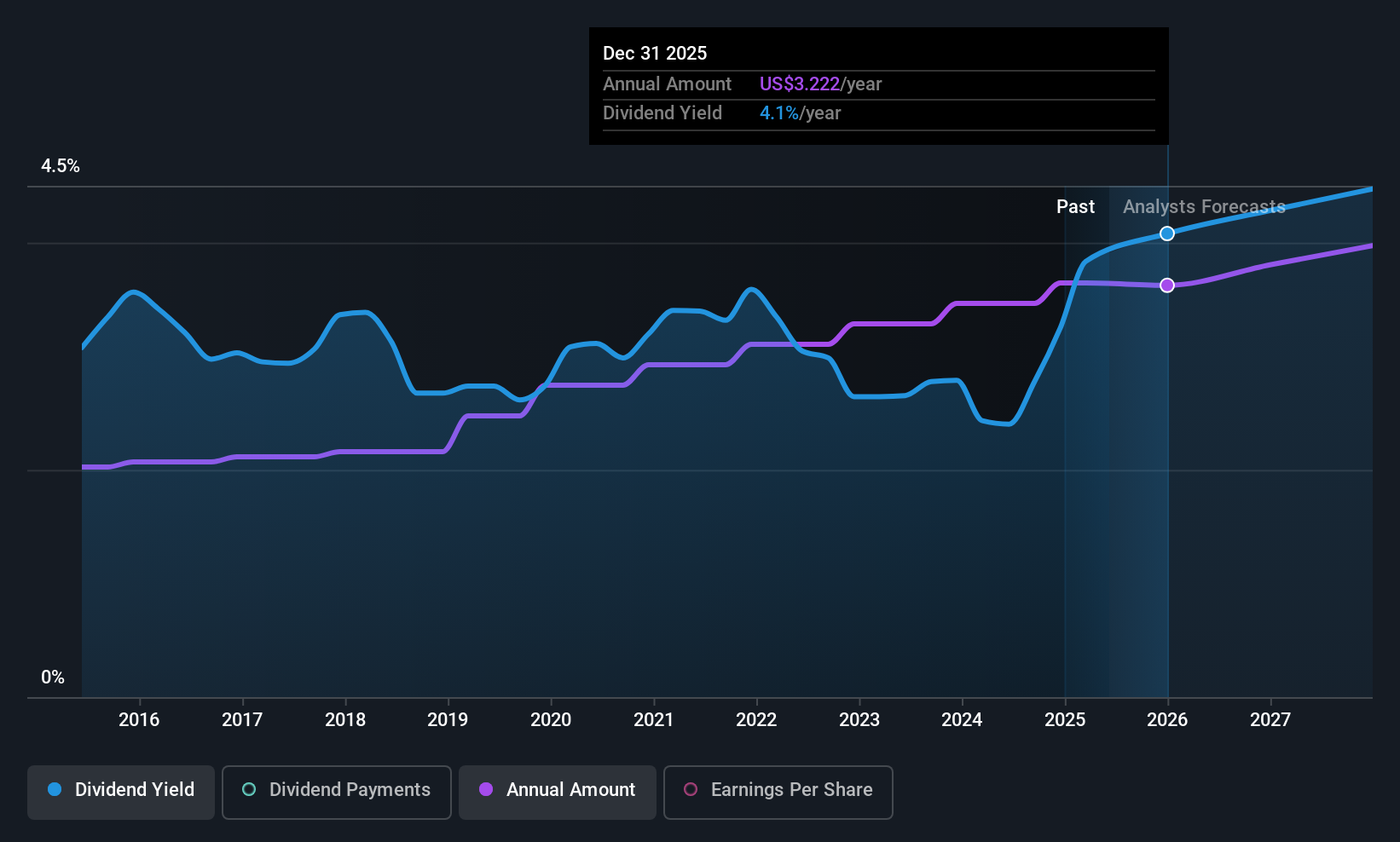

Merck (MRK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Merck & Co., Inc. is a global healthcare company with operations worldwide and has a market cap of $211.59 billion.

Operations: Merck & Co., Inc.'s revenue is primarily derived from its Pharmaceutical segment, which generated $56.67 billion, and its Animal Health segment, contributing $6.12 billion.

Dividend Yield: 3.8%

Merck's dividend, yielding 3.82%, has grown steadily over the past decade and remains well-covered by earnings and cash flows, with a payout ratio of 48.6%. Although its yield is lower than top-tier US payers, Merck's consistent dividend history offers reliability. Recent strategic developments include a $1.75 billion fixed-income offering and significant advancements in clinical trials for cancer treatments, which may influence future financial performance without directly impacting current dividend stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Merck.

- Insights from our recent valuation report point to the potential undervaluation of Merck shares in the market.

Key Takeaways

- Reveal the 125 hidden gems among our Top US Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal