What Carlisle Companies (CSL)'s $7.5 Million Share Buyback Means For Shareholders

- Carlisle Companies announced in early September 2025 that its Board of Directors has authorized a new share repurchase program, allowing the company to buy back up to 7,500,000 shares.

- This repurchase initiative can signal management's confidence in future prospects and may support shareholder value through reduced share count and increased earnings per share.

- We’ll now examine how authorization of this sizeable buyback program reshapes Carlisle’s investment outlook and long-term growth assumptions.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

Carlisle Companies Investment Narrative Recap

To be a shareholder in Carlisle Companies, you need to believe that resilient end markets, especially commercial reroofing, will continue to provide recurring revenue, and that Carlisle’s margin expansion initiatives can offset current construction and pricing challenges. The newly announced 7,500,000-share repurchase program offers some support to near-term shareholder value, but it does not materially affect the biggest immediate risk: ongoing softness in new and existing construction activity driven by macroeconomic headwinds and limited pricing power.

Among recent company updates, the Board’s August 2025 decision to increase the quarterly dividend by 10% to US$1.10 per share stands out as most relevant to the buyback. Together, the dividend hike and the sizable repurchase authorization signal an ongoing commitment to returning capital to shareholders, though these initiatives do not fully address the fundamental risks facing Carlisle’s core markets and path to long-term growth.

By contrast, one risk that should be on every investor’s radar is the possibility that continued end-market weakness or extended periods of flat pricing could...

Read the full narrative on Carlisle Companies (it's free!)

Carlisle Companies' narrative projects $5.8 billion revenue and $997.0 million earnings by 2028. This requires 4.9% yearly revenue growth and a $193.1 million earnings increase from $803.9 million today.

Uncover how Carlisle Companies' forecasts yield a $425.57 fair value, a 7% upside to its current price.

Exploring Other Perspectives

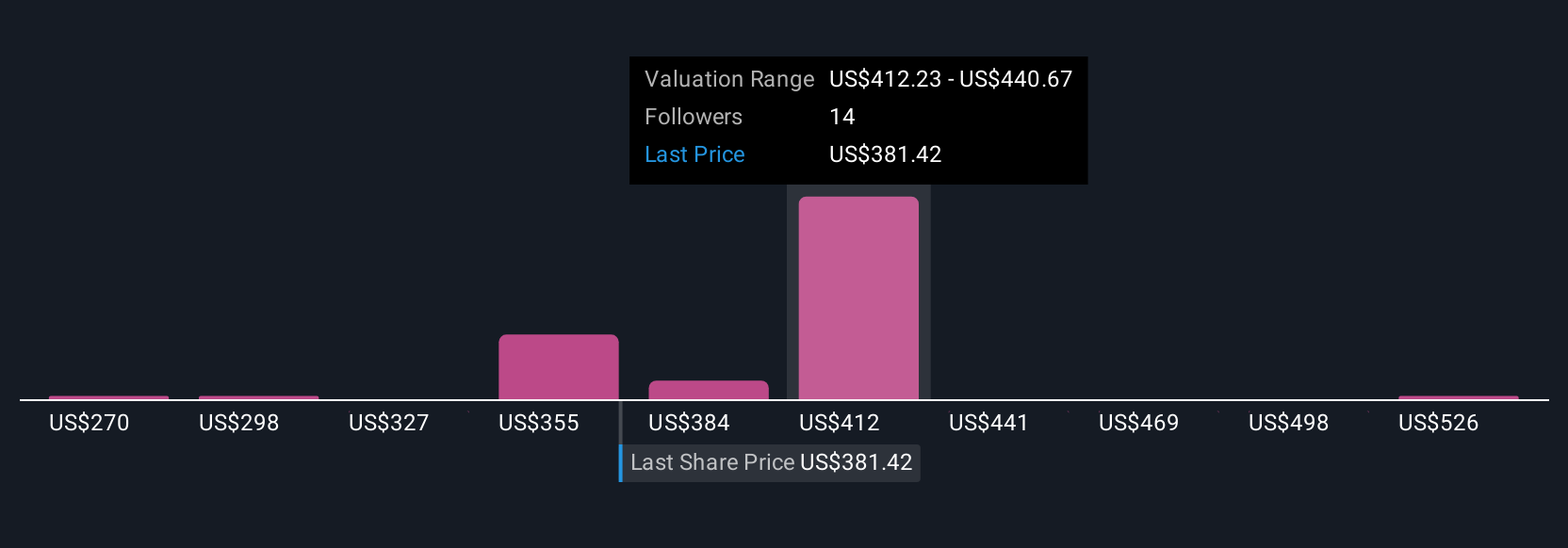

The Simply Wall St Community's 7 fair value estimates for Carlisle range from US$270 to US$554.45 per share, reflecting a wide spread in individual outlooks. While opinions on value differ, many are watching to see if Carlisle can deliver the margin expansion and recurring revenue needed to support sustained performance.

Explore 7 other fair value estimates on Carlisle Companies - why the stock might be worth 32% less than the current price!

Build Your Own Carlisle Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carlisle Companies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carlisle Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carlisle Companies' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal