Did Enova International's (ENVA) Expanded Credit Facility Just Shift Its Investment Narrative?

- In recent days, Enova International amended its secured asset-backed revolving credit facility with Bank of Montreal, increasing the total commitment to US$825 million, extending the maturity date to August 28, 2029, and reducing interest rates to improve financial flexibility and operational capacity.

- This move is accompanied by positive analyst commentary citing strong earnings, strategic growth initiatives, and robust financial health as reasons for their upbeat outlook on the company.

- With greater financial flexibility from the expanded credit facility, we'll look at how this strengthens Enova's investment narrative and future prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Enova International Investment Narrative Recap

To be a shareholder in Enova International, you need to believe in the accelerating shift towards online lending and the company's ability to leverage advanced analytics to capture this demand, particularly with its focus on nonprime and small business borrowers. The recent amendment to Enova's credit facility, increasing its borrowing capacity and reducing interest rates, enhances financial flexibility but does not significantly alter the primary short-term catalyst of continued origination growth. The greatest immediate risk remains the potential impact of any tightening in consumer credit regulation, which could constrain core revenue streams.

Among recent announcements, Enova’s Q2 2025 earnings report stands out, highlighting both strong year-over-year growth in revenue and net income. This financial momentum supports confidence in near-term lending growth, aligning with analysts' view that expanded credit access and digital efficiency are major positive drivers. However, the high level of debt and reliance on cheap credit access mean that any adverse shift in funding markets could quickly impact profitability.

Yet, when it comes to future returns, investors should also pay close attention to the risk posed by potential changes in lending laws, because...

Read the full narrative on Enova International (it's free!)

Enova International's outlook anticipates $5.7 billion in revenue and $426.8 million in earnings by 2028. This scenario calls for 60.7% annual revenue growth and a $170.6 million increase in earnings from the current level of $256.2 million.

Uncover how Enova International's forecasts yield a $131.12 fair value, a 9% upside to its current price.

Exploring Other Perspectives

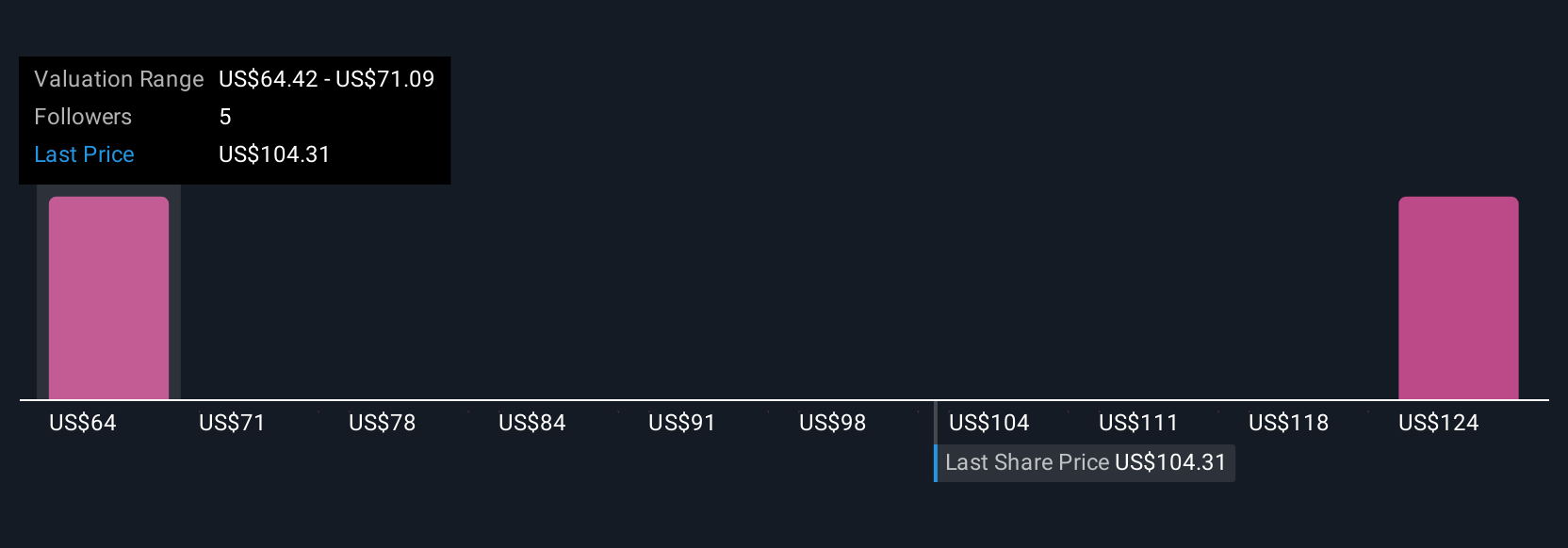

Fair value estimates from the Simply Wall St Community range from US$64.42 to US$131.13 based on 3 different analyses. Against this wide spread of investor opinions, the company’s expanded credit facility underscores how access to capital remains a vital factor affecting future performance.

Explore 3 other fair value estimates on Enova International - why the stock might be worth 46% less than the current price!

Build Your Own Enova International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enova International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Enova International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enova International's overall financial health at a glance.

No Opportunity In Enova International?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal