Will Securing a Spot on SPaTS3 Framework Boost AECOM's (ACM) Earnings Visibility?

- AECOM has recently announced it was awarded a place on National Highways' Specialist Professional and Technical Services 3 (SPaTS3) framework in the UK, in partnership with Arup, as part of a group of six suppliers on a project worth up to £495 million over six years.

- This appointment extends AECOM's longstanding collaboration with major UK transport authorities and underscores its ongoing role in delivering large-scale infrastructure and advisory services for government clients.

- We'll explore how securing a place on this major long-term UK infrastructure framework could bolster AECOM's earnings visibility and contract pipeline.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

AECOM Investment Narrative Recap

Owning AECOM means believing in consistent demand for large-scale infrastructure and advisory services, especially from government clients. The recent SPaTS3 UK framework win enhances contract visibility, but does not directly offset the current key risk: potential revenue volatility if government infrastructure budgets tighten or priorities shift, particularly heading into future election cycles.

Of recent announcements, AECOM’s appointment as the project management consultant for The Avenues - Riyadh stands out for its scale and international reach. This further reinforces the company’s efforts to grow its backlog and diversify contract exposures, which can help moderate near-term revenue risks from regional budget constraints.

However, in contrast, investors should carefully watch how changes in public sector budget allocations could affect project pipelines and...

Read the full narrative on AECOM (it's free!)

AECOM's narrative projects $18.8 billion revenue and $955.0 million earnings by 2028. This requires 5.4% yearly revenue growth and an earnings increase of $280.3 million from current earnings of $674.7 million.

Uncover how AECOM's forecasts yield a $133.18 fair value, a 5% upside to its current price.

Exploring Other Perspectives

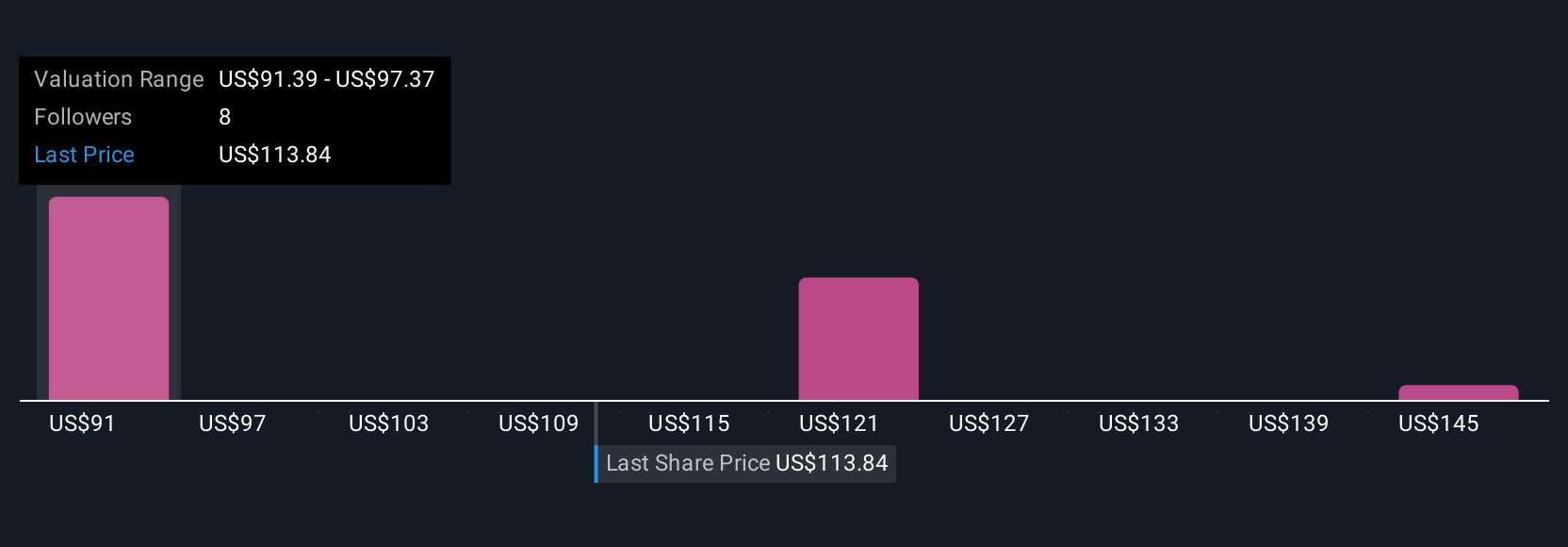

With four fair value estimates from the Simply Wall St Community ranging from US$86.84 to US$151.14, private investors highlight both ends of the valuation spectrum. Against this, the risk of shifting public infrastructure budgets remains a critical element that could influence future contract flow and operating results, discover how other investors weigh these factors.

Explore 4 other fair value estimates on AECOM - why the stock might be worth as much as 19% more than the current price!

Build Your Own AECOM Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AECOM research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free AECOM research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AECOM's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal