How Investors Are Reacting To Himax Technologies (HIMX) Launching Advanced Dewarping Tech for Automotive HUDs

- Himax Technologies has announced the launch of its new HX8882-F13 timing controller, which introduces an industry-first, full-area selectable local dewarping feature tailored for automotive Head-Up Displays (HUDs) to improve image clarity and safety compliance.

- This product's precise dewarping capability and flexible, one-stop-shop architecture are already under evaluation by leading automotive players, underscoring Himax’s continued innovation and influence in advanced automotive display solutions.

- We'll explore how Himax's new targeted dewarping solution for HUDs could influence the company's long-term automotive technology growth narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Himax Technologies Investment Narrative Recap

To own shares of Himax Technologies, you typically need to believe in its ability to maintain leadership and innovation in automotive display silicon as vehicles become smarter and demand grows for differentiated safety and imaging features. While the launch of the HX8882-F13 timing controller further positions Himax in advanced HUD solutions, ongoing uncertainty about global trade policy and recent declines in automotive and display driver segment revenues remain the core near-term risks; the immediate financial impact of this product announcement is not yet material, with potential benefits likely to take time to be reflected in results.

Among recent announcements, the August 7 update confirms that Himax’s new automotive timing controller lineup has entered proof-of-concept use with key industry players, directly reinforcing the HUD product catalyst and the company's credibility as the leading automotive display chip supplier.

However, despite this progress, a crucial risk remains for investors to watch, particularly as continued weak visibility and order delays among panel and automaker customers could...

Read the full narrative on Himax Technologies (it's free!)

Himax Technologies' narrative projects $1.1 billion revenue and $139.3 million earnings by 2028. This requires 7.4% yearly revenue growth and a $65.1 million earnings increase from the current $74.2 million.

Uncover how Himax Technologies' forecasts yield a $9.31 fair value, a 15% upside to its current price.

Exploring Other Perspectives

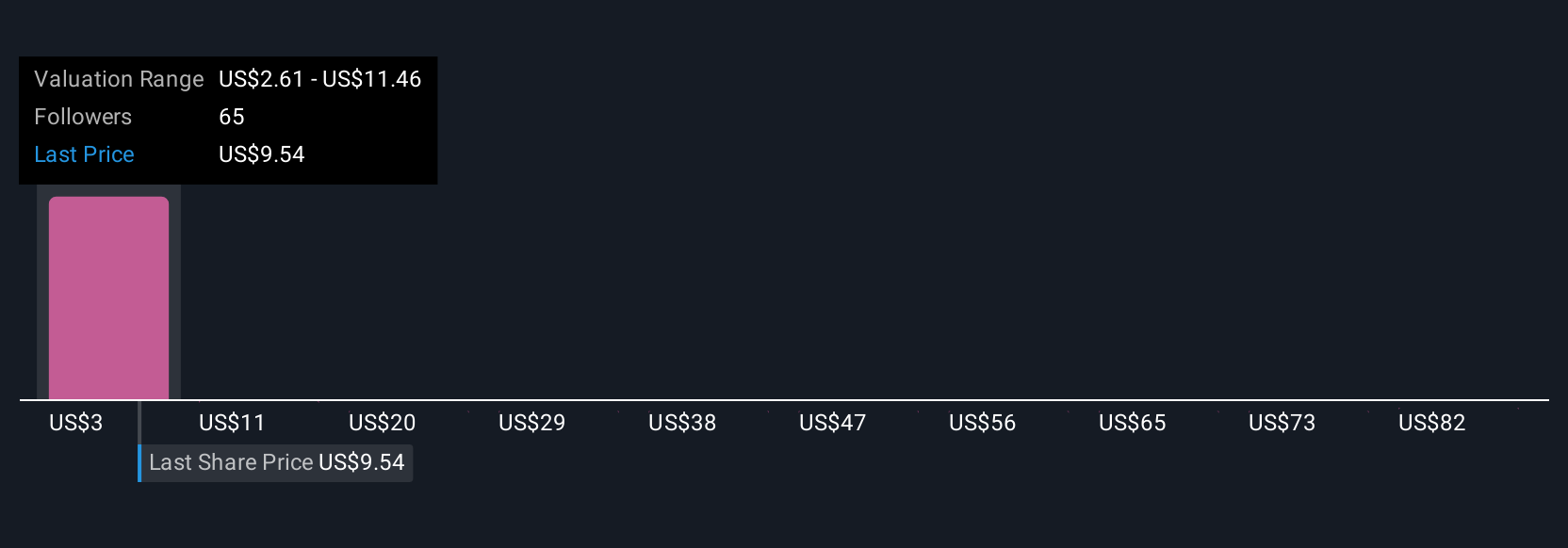

Eight members of the Simply Wall St Community set fair value estimates for Himax, ranging from US$1.52 to US$91.18 per share. While forecasts suggest ongoing leadership in next-generation automotive displays, the breadth of market opinion encourages you to weigh these differing perspectives as demand visibility and earnings trends evolve.

Explore 8 other fair value estimates on Himax Technologies - why the stock might be a potential multi-bagger!

Build Your Own Himax Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Himax Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Himax Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Himax Technologies' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal