How StoneX Group’s (SNEX) BMG Payments Partnership Could Shape Its Global Growth and Competitive Edge

- StoneX Group Inc.'s Payments Division recently announced a partnership with Bank Mendes Gans (BMG) to provide advanced cross-border payment services in over 140 currencies and 180 countries, utilizing StoneX's API-driven technology and extensive payment network.

- This collaboration gives BMG direct access to diverse and underserved currency corridors and introduces efficiencies such as faster settlements, payment data validation, and broader global reach.

- Let's explore how StoneX’s integration of its payments technology platform into BMG’s operations enhances its long-term growth prospects and competitive differentiation.

Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

What Is StoneX Group's Investment Narrative?

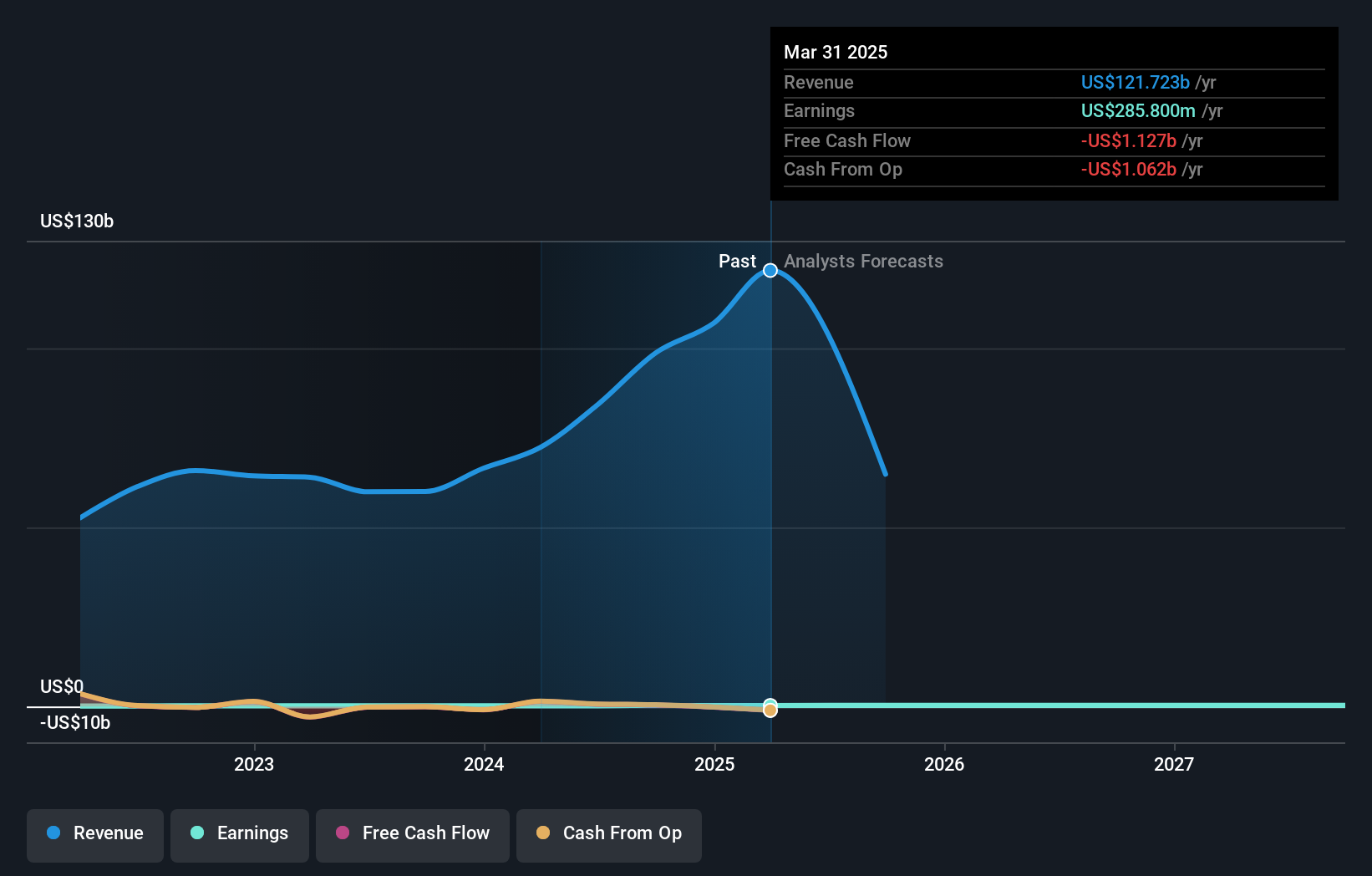

For anyone considering StoneX Group as an investment, the big picture centers on its capacity to leverage technology and partnerships in expanding its payments and capital markets businesses globally. The recent integration with Bank Mendes Gans could be a meaningful short-term catalyst, potentially driving new revenue streams and strengthening the company’s positioning in underserved markets. This move may also address some prior concerns about StoneX’s ability to differentiate itself as competition intensifies in the cross-border payments space. At the same time, execution risk around new integrations and ongoing profitability pressures remain important to monitor, especially given the very low net profit margins and higher relative valuation compared to peers. The partnership appears incremental rather than transformative, so the main business risks and catalysts highlighted before this news, such as margin pressure, evolving regulation, and the limits of earnings growth, are still front and center, but could shift if the BMG rollout exceeds expectations.

But investor optimism may need to be balanced against execution risk in global integration. StoneX Group's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on StoneX Group - why the stock might be worth as much as 13% more than the current price!

Build Your Own StoneX Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StoneX Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free StoneX Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StoneX Group's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal