Should Olin’s (OLN) Winchester Segment Outperformance Offset Concerns About Recent Quarterly Losses?

- Olin reported a second-quarter 2025 net loss of US$1.3 million, or a penny per share, while posting a 6.9% year-over-year revenue increase that surpassed expectations, primarily driven by strong military sales and project revenues in its Winchester segment.

- Despite the loss, Olin maintained a disciplined capital allocation approach and provided a confident EBITDA outlook for the third quarter, highlighting resilience amid challenging markets.

- We’ll now explore how Olin’s Winchester segment growth and strong revenue performance influence the company’s overall investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Olin Investment Narrative Recap

To own shares in Olin, it helps to believe that disciplined capital allocation and resilient earnings from strategic segments like Winchester can offset the pressures facing its chemical divisions. The recent second-quarter loss, while modest, does not materially change the key short-term catalyst, margin recovery in its core chemicals business, or lessen the biggest risk from sustained global overcapacity and weak EDC prices, which continue to weigh heavily on Olin’s outlook.

One recent announcement that ties into Olin’s short-term catalysts is the declaration of another US$0.20 quarterly dividend on August 12, 2025. Continued dividend payments amid challenging quarters reinforce management’s efforts at providing shareholder returns, but they may also be tested if softness in core chemical prices and volume persists.

But while the Winchester segment is showing strength, investors should be mindful of how prolonged weakness in global EDC and caustic soda demand could...

Read the full narrative on Olin (it's free!)

Olin's narrative projects $7.4 billion revenue and $375.3 million earnings by 2028. This requires 3.6% yearly revenue growth and a $389.4 million increase in earnings from -$14.1 million today.

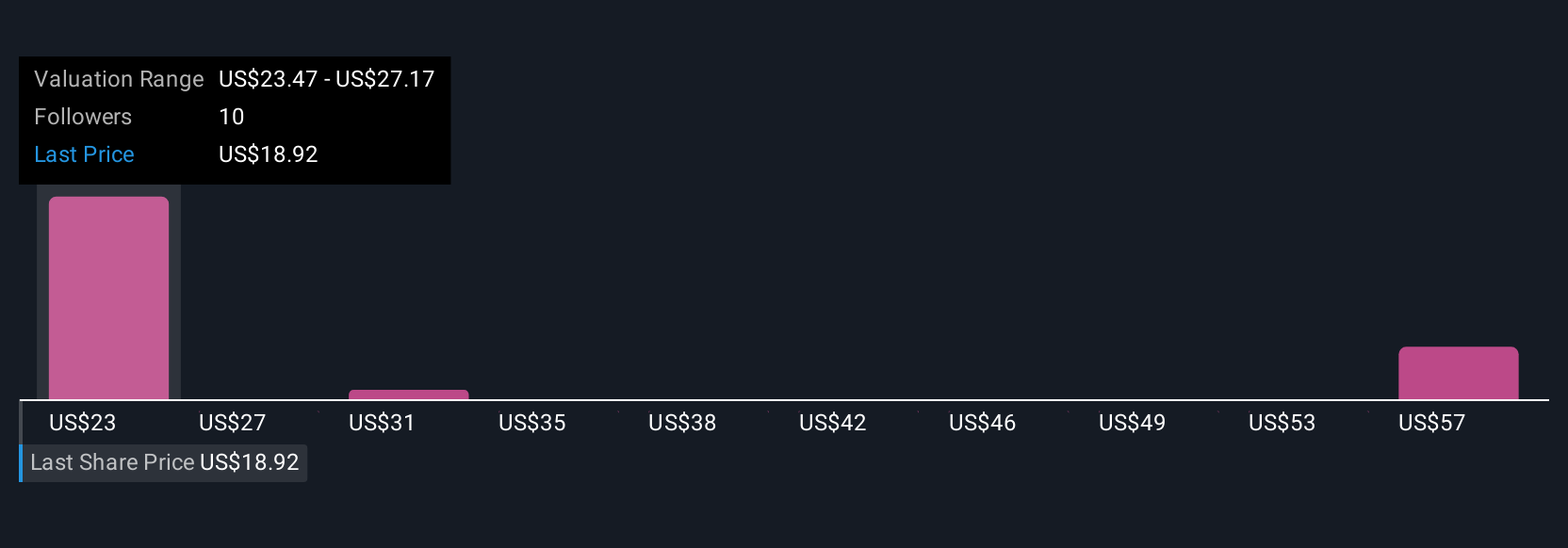

Uncover how Olin's forecasts yield a $23.47 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community users provided three fair value estimates for Olin, ranging from US$23.47 up to US$65.59 per share. With industry overcapacity lingering as a core risk, these wide valuation targets highlight just how differently market participants are thinking about the path forward, explore their reasoning for a broader view.

Explore 3 other fair value estimates on Olin - why the stock might be worth over 2x more than the current price!

Build Your Own Olin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Olin research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Olin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Olin's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal