How Investors Are Reacting To Insperity (NSP) Naming Tiger Woods as Brand Ambassador

- Insperity, Inc. recently announced a multiyear brand partnership with Tiger Woods, TGR Ventures, TGR Foundation, and the Jupiter Links of TMRW Golf League, naming Woods as a brand ambassador and committing to support several educational and golf-related charitable events.

- This collaboration highlights Insperity's enhanced marketing efforts and the alignment of its business growth initiatives with Woods' reputation for excellence and innovation.

- We'll now examine how Tiger Woods' involvement as a brand ambassador could influence Insperity's evolving investment narrative and mid-market strategy.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Insperity Investment Narrative Recap

To be a shareholder in Insperity, you have to believe that demand for outsourced HR solutions among SMBs will stay resilient and that the company can outpace rising employee benefits costs and margin pressure with pricing discipline and new offerings. While the Tiger Woods partnership enhances brand visibility and could support future growth, it does not directly address the critical short-term catalyst: the upcoming launch and success of Insperity HRScale for the mid-market segment. The main risk of cost escalation outpacing pricing adjustments remains largely unchanged by this announcement.

The most relevant recent update is the board's consistent affirmation of a US$0.60 per share quarterly dividend, despite recent periods of negative net income. This ongoing dividend demonstrates management's confidence but also puts a spotlight on the pressure to improve profitability as costs remain a challenge. However, it's worth noting that...

Read the full narrative on Insperity (it's free!)

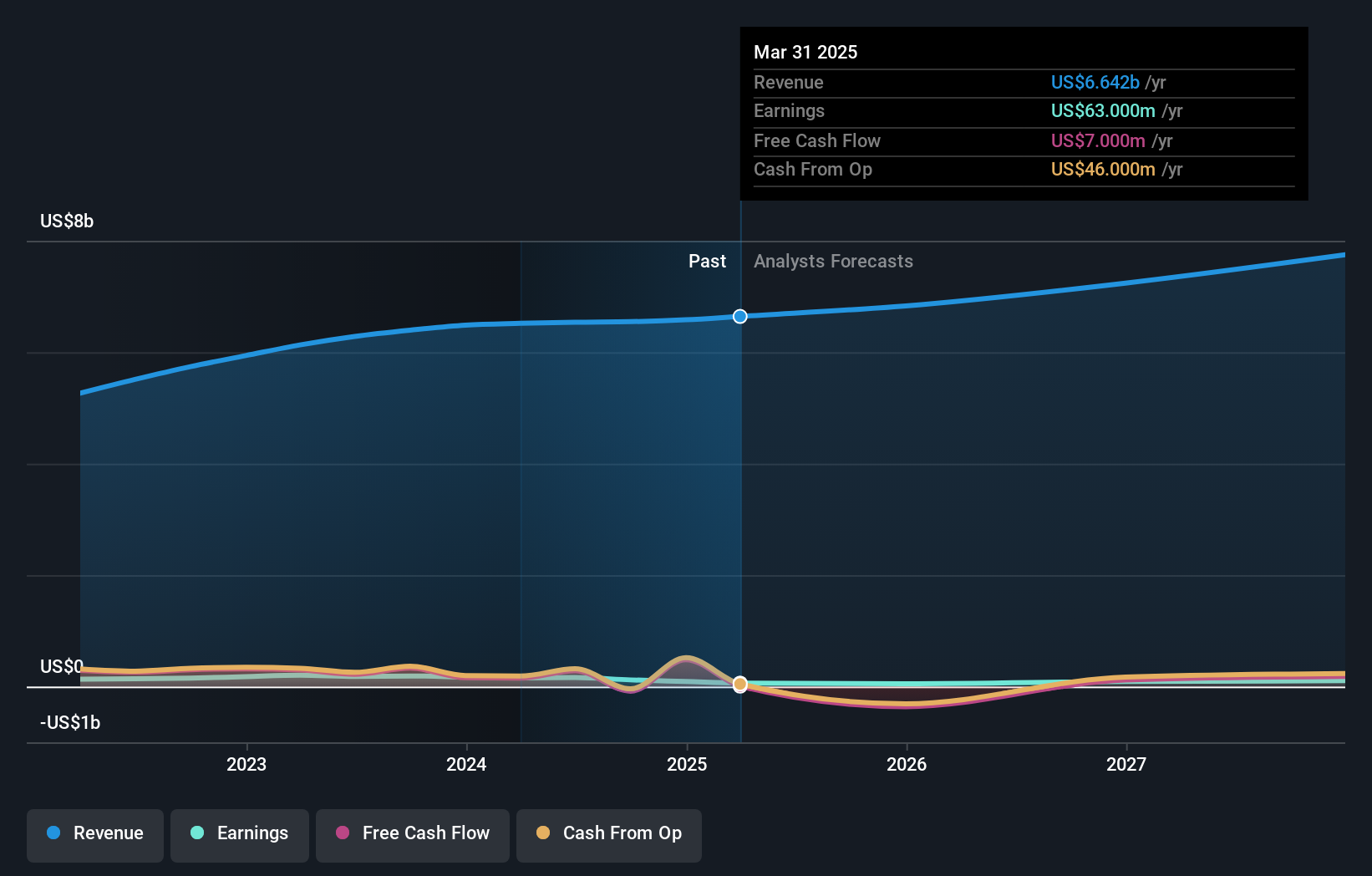

Insperity's outlook anticipates $7.7 billion in revenue and $109.6 million in earnings by 2028. This is based on a projected annual revenue growth rate of 5.0% and an increase in earnings of $69.6 million from the current $40.0 million.

Uncover how Insperity's forecasts yield a $57.75 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Insperity span from US$57.75 to US$258.50, drawing on two independent perspectives. While some see significant upside, keep in mind that persistent increases in employee healthcare and benefit costs could weigh on future earnings and require close attention among all market participants.

Explore 2 other fair value estimates on Insperity - why the stock might be worth just $57.75!

Build Your Own Insperity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Insperity research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Insperity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Insperity's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal