Purple Innovation, Inc. (NASDAQ:PRPL) Looks Just Right With A 42% Price Jump

Purple Innovation, Inc. (NASDAQ:PRPL) shareholders have had their patience rewarded with a 42% share price jump in the last month. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.3% over the last year.

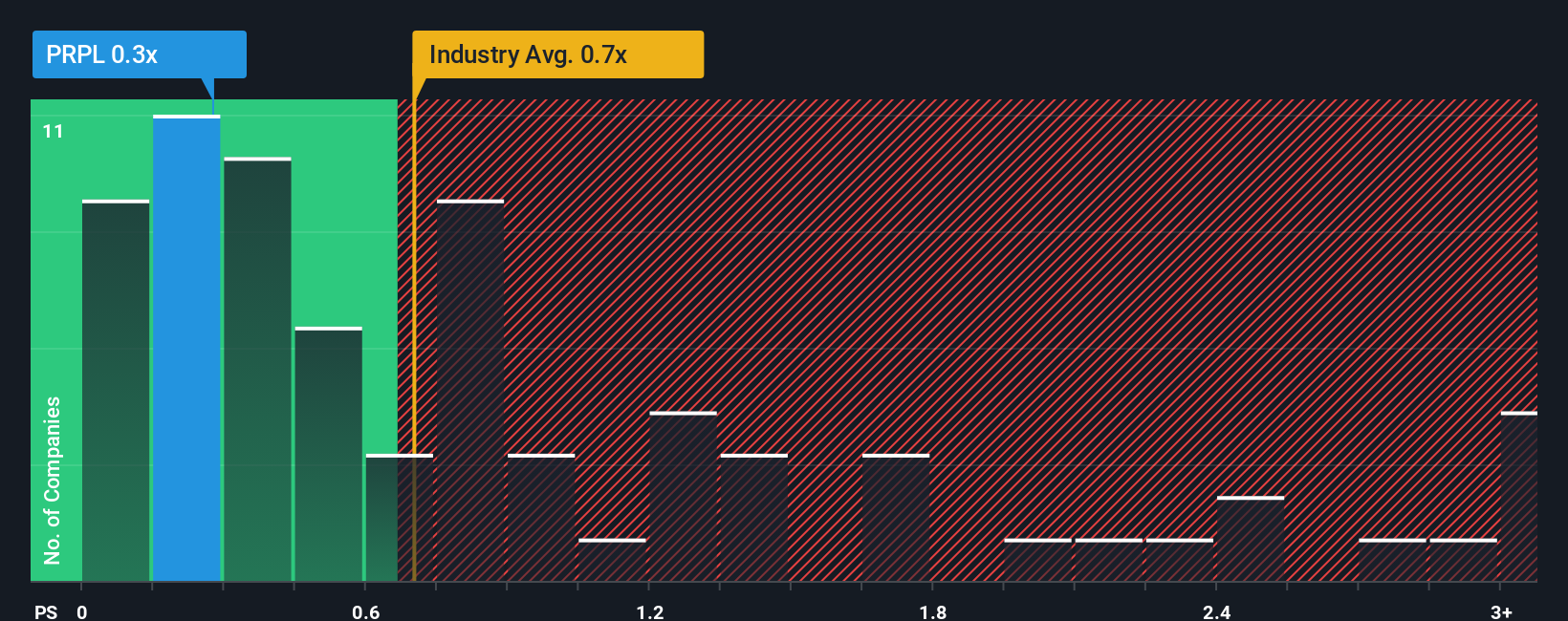

Although its price has surged higher, there still wouldn't be many who think Purple Innovation's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in the United States' Consumer Durables industry is similar at about 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Purple Innovation

What Does Purple Innovation's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Purple Innovation's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Purple Innovation's future stacks up against the industry? In that case, our free report is a great place to start.How Is Purple Innovation's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Purple Innovation's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. This means it has also seen a slide in revenue over the longer-term as revenue is down 29% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 8.9% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 7.0% per annum, which is not materially different.

In light of this, it's understandable that Purple Innovation's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Purple Innovation's P/S

Purple Innovation's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A Purple Innovation's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Consumer Durables industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Plus, you should also learn about these 3 warning signs we've spotted with Purple Innovation (including 1 which doesn't sit too well with us).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal