Howard Hughes Holdings (HHH): Exploring Valuation Following Bill Ackman’s Executive Chair Appointment and Increased Stake

Most Popular Narrative: 7.6% Undervalued

According to community narrative, Howard Hughes Holdings is currently seen as undervalued, with analysts pointing to significant long-term opportunity stemming from real estate and diversification moves.

The company's substantial undeveloped land bank in highly desirable markets positions it to capture long-term price appreciation and incremental cash flow as demand for premium, amenity-rich suburban and town-center communities intensifies. This is expected to enhance long-term revenue growth and intrinsic asset value.

Curious what’s fueling this “undervalued” call? The narrative focuses on projections for both top-line and profit growth, alongside the possibility of a future multiple more commonly associated with industry heavyweights. Just how strong are these forward-looking assumptions, and could they influence the stock even further? The answers may be more surprising than expected.

Result: Fair Value of $82.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts. However, execution risk related to the insurance acquisition or potential setbacks in key property markets could challenge the case for sustained long-term value. Find out about the key risks to this Howard Hughes Holdings narrative.Another View: What Does Our DCF Model Show?

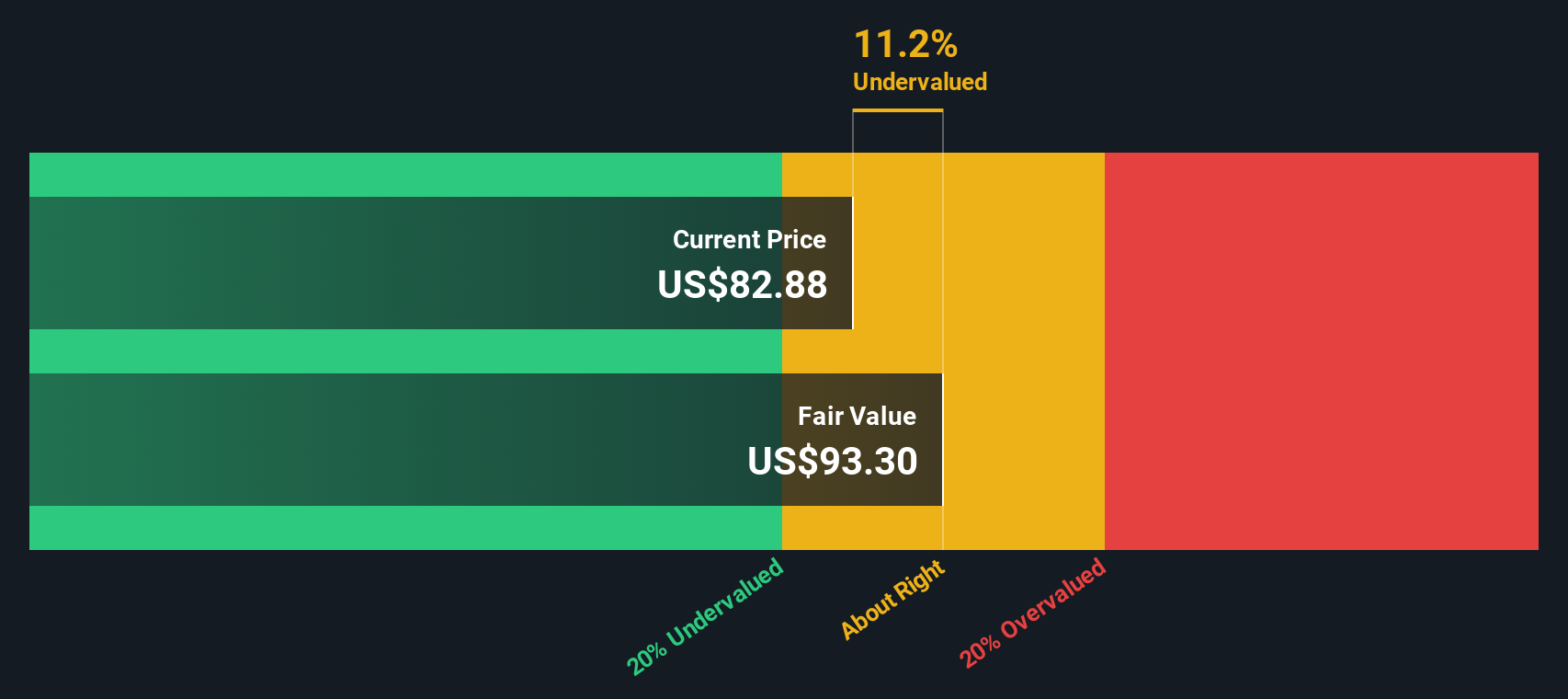

To balance the analyst consensus, our SWS DCF model takes a different approach by projecting future cash flows. This model also points to undervaluation, though it relies on its own assumptions about growth and risk. Which perspective will prove more reliable as the company evolves?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Howard Hughes Holdings Narrative

If you see things differently or want to dig into the details yourself, you can put together your own narrative in just a few minutes. Do it your way

A great starting point for your Howard Hughes Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t limit yourself to just one idea. Make sure you’re always a step ahead in the market. See where opportunity is building by acting on these powerful trends shaping tomorrow’s portfolio standouts:

- Uncover up-and-coming tech innovators shaking up the AI landscape by checking out AI penny stocks.

- Secure steady income and build resilience into your strategy by browsing dividend stocks with yields > 3%.

- Tap into compelling bargains with strong growth potential when you explore undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal