Will Teekay Tankers’ (TNK) Strong Balance Sheet Offset Softer Q2 Results?

- Teekay Tankers recently reported its Q2 2025 results, showing lower revenues and net income but meeting expectations while maintaining US$650 million in cash and no long-term debt.

- This strong liquidity position, combined with positive tanker market fundamentals amidst rising oil demand and limited vessel supply, continues to support confidence in the company's future prospects.

- We’ll now explore how Teekay Tankers’ balance sheet strength shapes its current investment story following the latest quarterly results.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Teekay Tankers Investment Narrative Recap

To be a shareholder in Teekay Tankers, you generally have to believe in a supportive tanker market boosted by long-haul oil trade and constrained vessel supply helping offset ongoing revenue and earnings pressure. The recent Q2 2025 results, while showing lower revenues and profits, did not materially affect the immediate outlook for the company’s core catalyst, tight shipping market fundamentals remaining intact, as well as the main risk, which is persistent volatility in oil demand trends and trade flows.

Among the recent company announcements, the uninterrupted $0.25 per share quarterly dividend stands out as most relevant right now, signaling continued commitment to capital returns and reflecting management’s confidence in cash generation, even amid reduced earnings. This is especially pertinent as investors eye the sustainability of these payouts in the context of market catalysts and revenue headwinds. The real question, however, is how prepared the company remains for a possible shift if...

Read the full narrative on Teekay Tankers (it's free!)

Teekay Tankers’ outlook forecasts $464.3 million in revenue and $238.5 million in earnings by 2028. This is based on an annual revenue decline rate of 22.5% and a $43.8 million decrease in earnings from the current figure of $282.3 million.

Uncover how Teekay Tankers' forecasts yield a $53.33 fair value, a 10% upside to its current price.

Exploring Other Perspectives

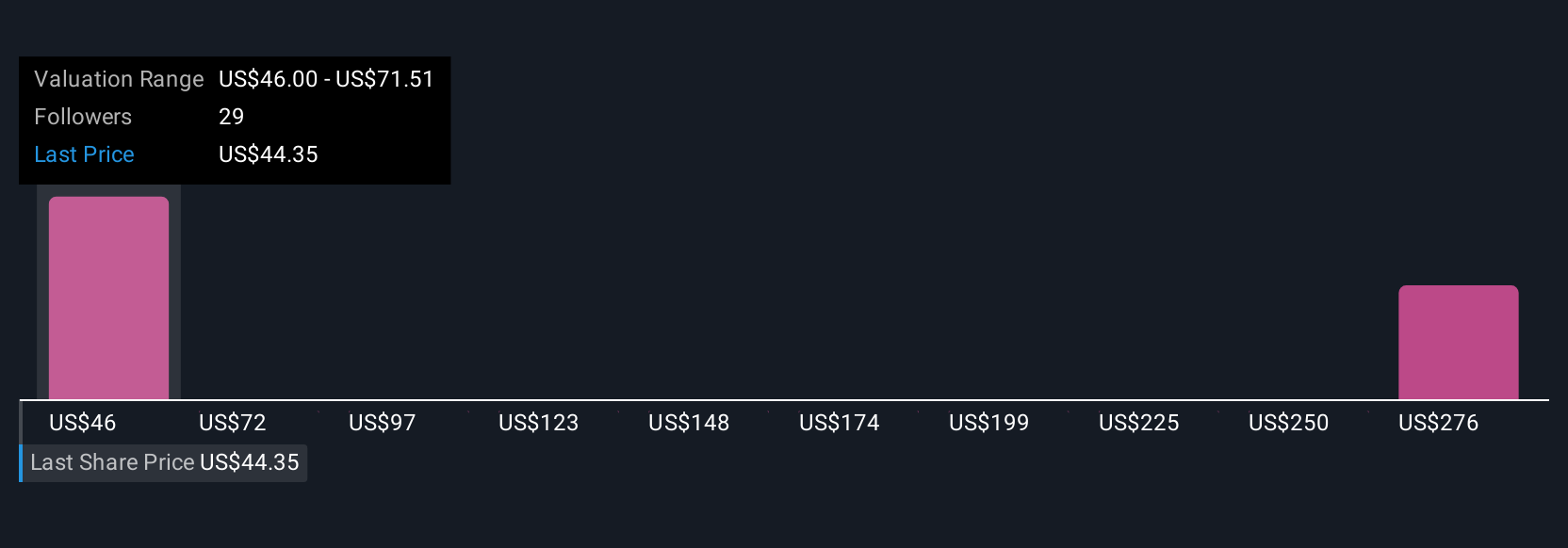

Five recent fair value estimates from the Simply Wall St Community range widely, from US$46 to US$301, echoing divergent opinions about future performance. With volatility in oil demand among universal concerns, you should explore how these different perspectives shape deeper debate around Teekay Tankers’ forward prospects.

Explore 5 other fair value estimates on Teekay Tankers - why the stock might be worth over 6x more than the current price!

Build Your Own Teekay Tankers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teekay Tankers research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Teekay Tankers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teekay Tankers' overall financial health at a glance.

No Opportunity In Teekay Tankers?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal