Global Ship Lease (NYSE:GSL): Exploring Valuation After Upgraded Earnings Outlook and Sector-Beating Performance

Most Popular Narrative: 15.9% Undervalued

According to the community narrative, Global Ship Lease is currently trading below what is considered its fair value, based on future earnings and a comprehensive analyst consensus. The most widely supported valuation approach suggests that the market is underappreciating the company’s medium-term prospects, even as some business metrics are expected to soften.

The increasing complexity and inefficiency of global container supply chains, driven by shifting trade patterns, decentralization of manufacturing, and ongoing geopolitical disruptions, is boosting demand for midsize and smaller containerships. GSL's focus in these vessel classes positions the company to benefit through sustained high utilization and favorable charter rates, directly supporting future revenue growth and earnings visibility.

How can Global Ship Lease have falling earnings but still claim to be undervalued? There is a catch in the analyst math. Want to see which controversial assumptions and forward-looking profit metrics are fueling this hefty price target? The unique logic behind this valuation might just surprise you.

Result: Fair Value of $35.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the outlook could quickly shift if global trade disruptions persist or if weaker charter rates lead to a sudden compression of margins and earnings.

Find out about the key risks to this Global Ship Lease narrative.Another View: Discounted Cash Flow Model

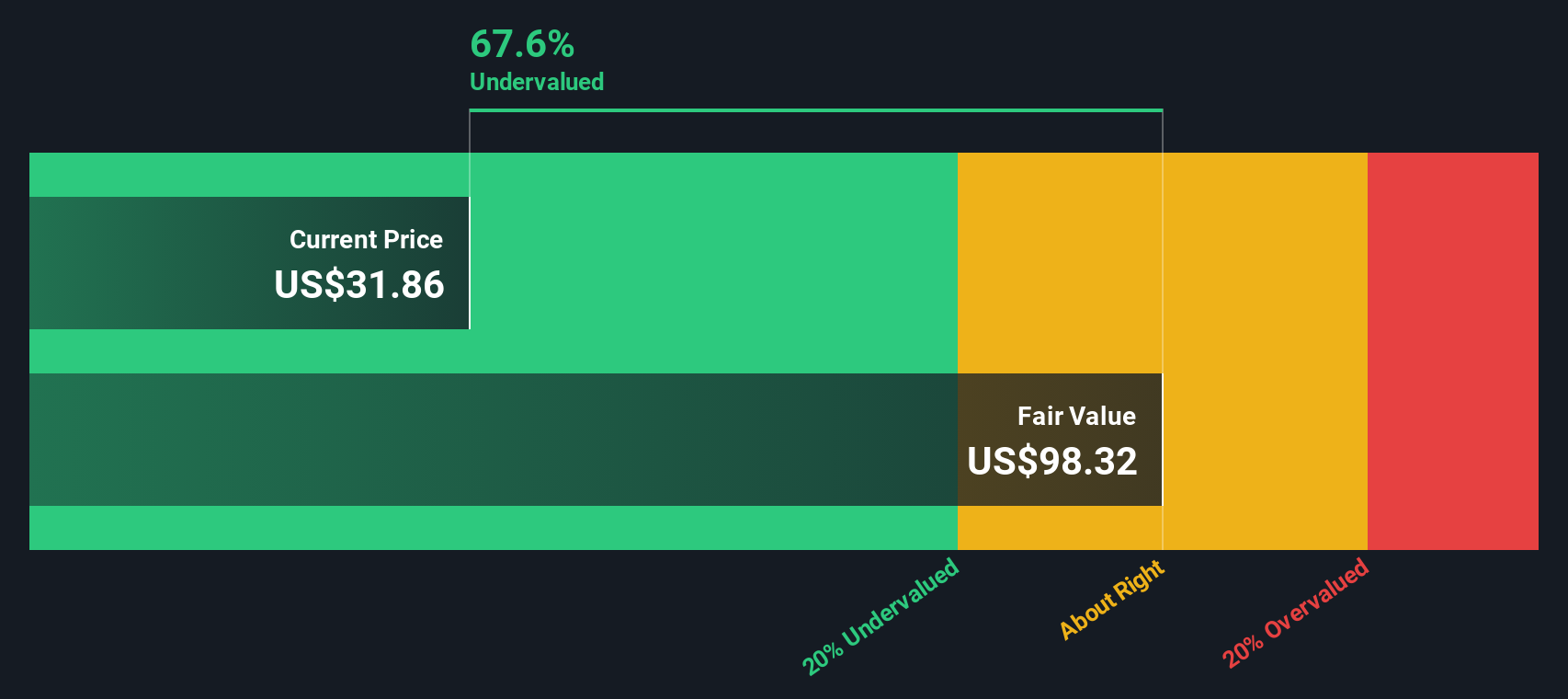

Looking at Global Ship Lease through the lens of our DCF model provides a different perspective. This method suggests the company could be significantly more undervalued than what analyst price targets indicate. Which view tells the real story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Global Ship Lease Narrative

If you have a different perspective or want to challenge these assumptions, you can review the numbers for yourself and craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Global Ship Lease research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Smart investors know that opportunity doesn’t end with just one stock. If you’re hungry for more ways to grow your wealth and sharpen your portfolio, use these targeted tools to uncover promising companies across the market. Don’t let the most exciting potential pass you by.

- Unearth tomorrow’s technology giants by searching for standout opportunities among artificial intelligence innovators through our AI penny stocks.

- Boost your income strategy by focusing on companies offering robust yields. Start with our exclusive section on dividend stocks with yields > 3%.

- Get ahead of the market by tracking hidden gems trading below their true value using our powerful undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal