How Investors Are Reacting To Dycom Industries (DY) Strong Q2 Results and Upbeat 2026 Outlook

- Dycom Industries reported strong second quarter results in August 2025, with sales reaching US$1.38 billion and net income of US$97.48 million, along with positive earnings guidance for the third quarter and fiscal 2026.

- One interesting insight is that Dycom’s 2026 revenue outlook does not include any storm restoration work, highlighting confidence in its core operations and recurring contract revenue growth.

- We'll explore how Dycom’s robust revenue and earnings growth guidance shapes the outlook for its long-term investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Dycom Industries Investment Narrative Recap

For Dycom Industries, the case for being a shareholder relies on belief in sustained demand for fiber and data center infrastructure, supported by long-term contracts with large telecom clients. The recent earnings beat and strong revenue guidance reinforce the company's backlog visibility in the near term, but do not materially reduce the risk from high customer concentration, as spending decisions by major clients can still impact results quickly.

The company's updated fiscal 2026 revenue outlook, which notably excludes storm restoration work, highlights management's growing confidence in organic, recurring business. This focus on core operations aligns with current industry catalysts and provides reassurance regarding revenue durability, despite ongoing dependencies on a few large customers for the majority of sales.

Yet, in contrast to upbeat guidance, investors should also be aware of the concentration risk that remains with Dycom’s key telecom partners...

Read the full narrative on Dycom Industries (it's free!)

Dycom Industries' outlook forecasts $6.6 billion in revenue and $394.4 million in earnings by 2028. This scenario assumes annual revenue growth of 10.8% and an earnings increase of $162.5 million from the current $231.9 million.

Uncover how Dycom Industries' forecasts yield a $297.89 fair value, a 16% upside to its current price.

Exploring Other Perspectives

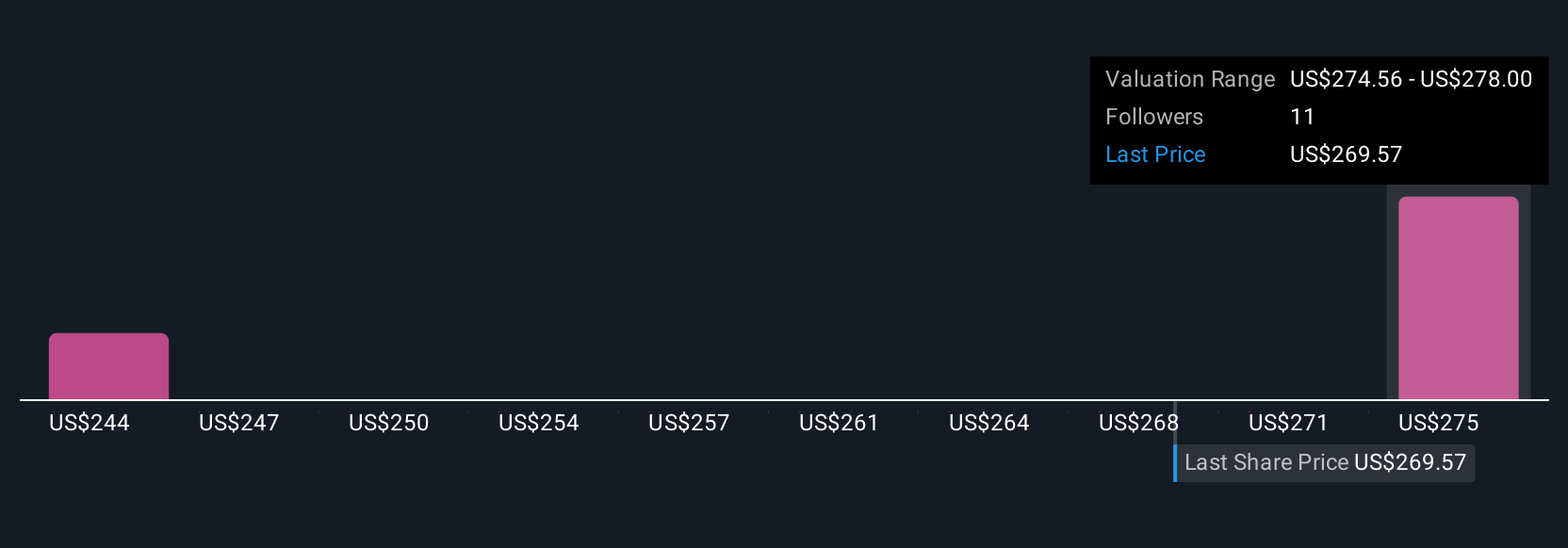

Simply Wall St Community members produced fair value estimates for Dycom ranging from US$205.76 to US$297.89, based on just two distinct forecasts. Given the firm's heavy revenue reliance on a few telecom clients, this diversity in opinion highlights how views on contract risk and future growth can lead to sharply different outlooks for the business.

Explore 2 other fair value estimates on Dycom Industries - why the stock might be worth 20% less than the current price!

Build Your Own Dycom Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dycom Industries research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dycom Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dycom Industries' overall financial health at a glance.

No Opportunity In Dycom Industries?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal