Nelnet (NNI): Assessing Valuation as Rate Cut Optimism Drives Shares to Record Highs

Savvy investors watching education finance stocks may have noticed shares of Nelnet (NNI) reaching fresh heights, after Federal Reserve Chair Jerome Powell’s comments signaled that interest rates could be cut soon. That news triggered a 4.8% jump for Nelnet, a move that stands out compared to typical trading days. The market’s reaction highlights the degree of confidence investors have in Nelnet’s financial outlook when borrowing costs might drop, even if nothing fundamental about the company itself has changed overnight.

Zooming out, this is not the first positive run for Nelnet. The stock has gained 17% for the year and is up 59% over three years, beating the broader market by a clear margin. Momentum appears to be building, with shares rallying more than 11% over the past three months and setting new all-time highs just above $130. This strength comes alongside modest revenue gains, without any notable news outside of the recent Fed-driven optimism.

With all that upward movement, the natural question is whether Nelnet is undervalued and still has room to grow, or if investors today are simply paying up for the possibility of future rate cuts. Could there be more upside, or is everything already reflected in the current price?

Price-to-Earnings of 14.3x: Is it justified?

Based on its price-to-earnings (P/E) ratio, Nelnet appears more expensive than its peers in the US Consumer Finance industry. The P/E ratio stands at 14.3x, which is higher than the industry average of 10.3x. This indicates that investors are currently willing to pay a premium for Nelnet’s earnings.

The P/E ratio measures how much investors are paying for each dollar of the company’s earnings. This metric is popular because it offers a quick snapshot of market sentiment regarding future growth or profitability potential. For a diversified financial company like Nelnet, the ratio is especially relevant because it reflects expectations around both stability and earnings trajectory.

A premium P/E may suggest optimism about future growth, but it can also indicate that the stock is priced for perfection. If Nelnet does not deliver significant earnings expansion, there is a risk that its stock is currently overvalued relative to its industry.

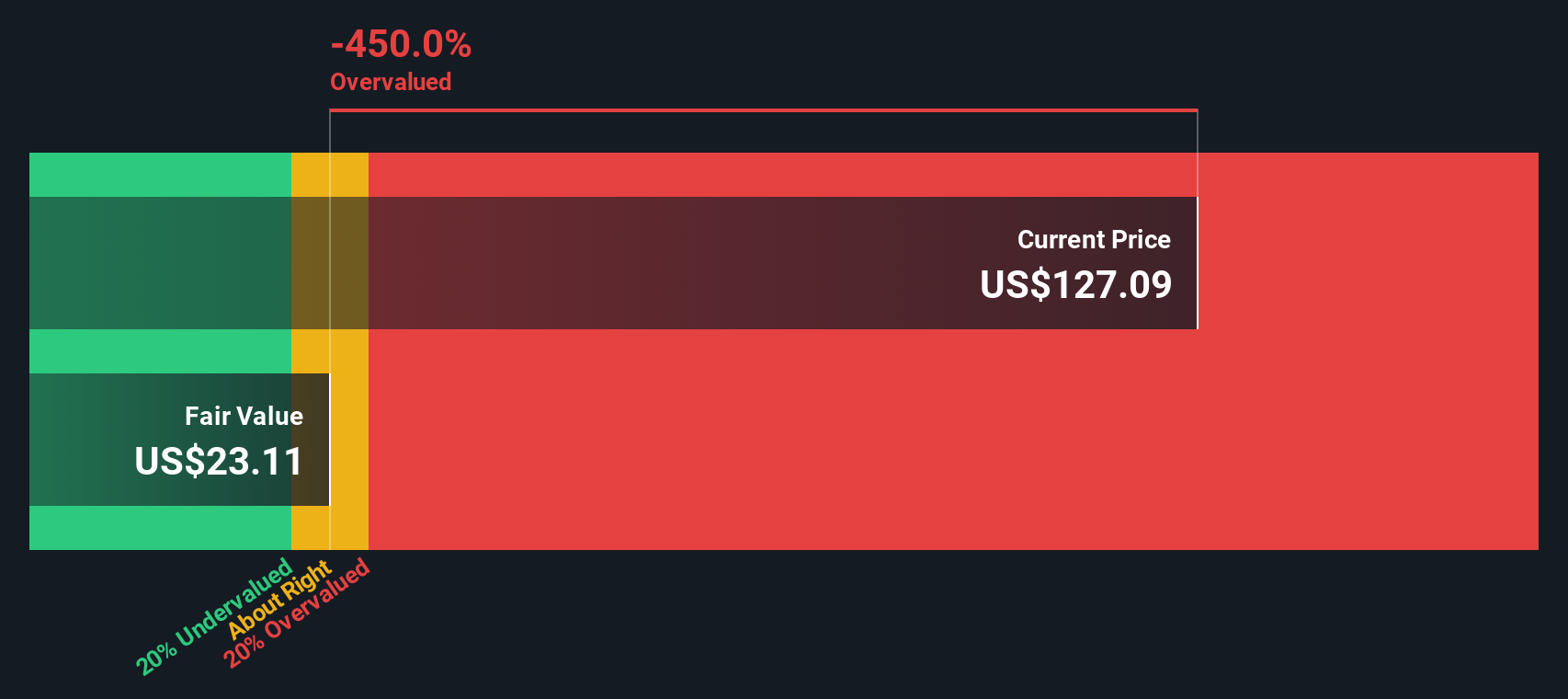

Result: Fair Value of $130 (OVERVALUED)

See our latest analysis for Nelnet.However, persistent revenue growth remains modest, and unexpected shifts in lending regulation could quickly dampen investor enthusiasm for Nelnet’s shares.

Find out about the key risks to this Nelnet narrative.Another View: Discounted Cash Flow Model

Looking at Nelnet with our DCF model provides a different perspective. While the market may seem optimistic, this approach suggests the stock could actually be trading above its estimated fair value. Which perspective makes more sense?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Nelnet Narrative

If you have a different perspective or want to dig deeper into the numbers, you can shape your own take in just a few minutes and do it your way.

A great starting point for your Nelnet research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more timely investment ideas?

If you want to get ahead of the market, do not settle for just one stock. With the Simply Wall Street screener, you can instantly find other exciting opportunities tailored to what really matters for smart investors. New trends and top picks are just a click away, so do not miss the next big winner.

- Tap into tomorrow’s breakthroughs by scanning the innovators shaking up artificial intelligence with AI penny stocks.

- Secure steady growth and extra income by identifying companies offering impressive yields through dividend stocks with yields > 3%.

- Spot hidden bargains with the tool highlighting stocks undervalued based on projected cash flows via undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal