Matson (MATX): Assessing Valuation After Q2 Surprise and Upgraded Full-Year Outlook

Most Popular Narrative: 22.7% Undervalued

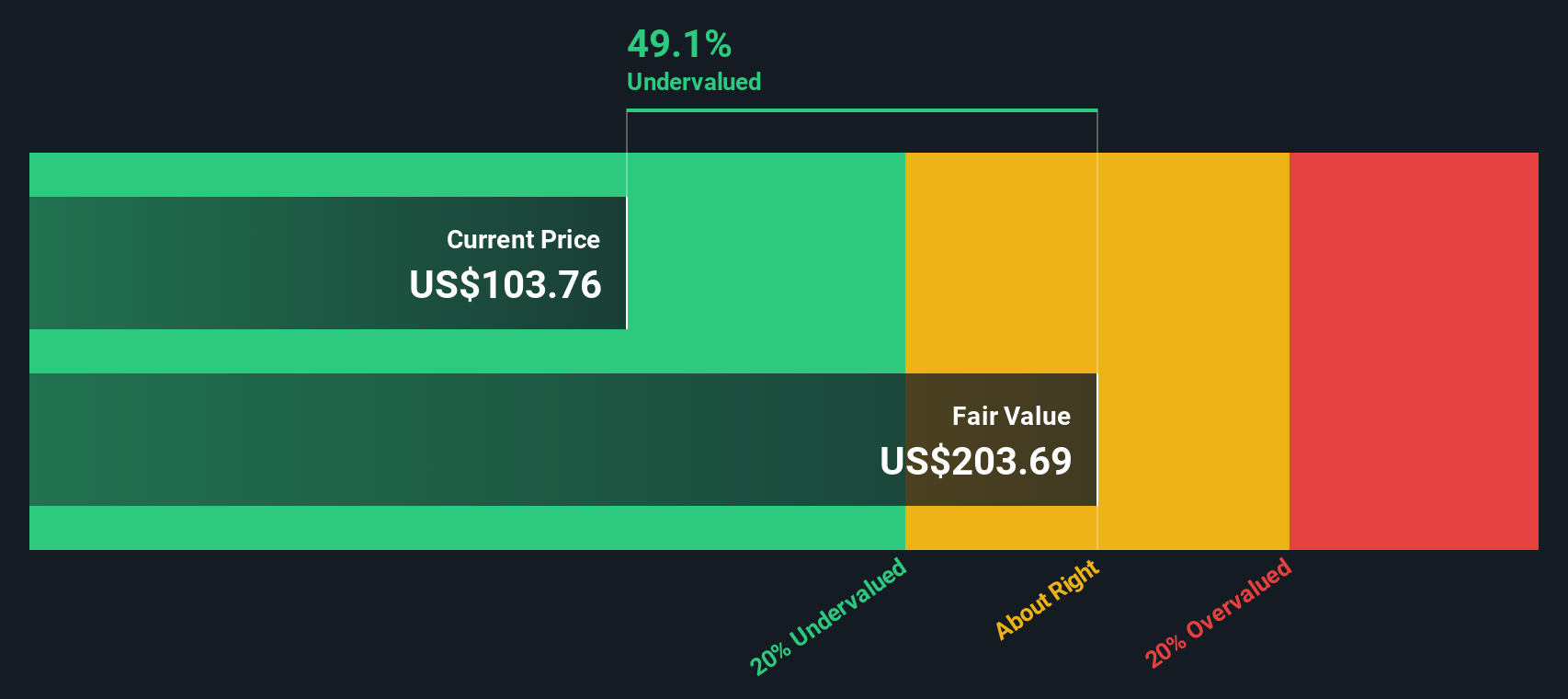

According to community narrative, Matson is currently viewed as significantly undervalued by the market, with analysts estimating its fair value to be notably higher than the prevailing share price. This verdict rests on projections of future earnings, profit margins, and industry dynamics outlined in the narrative.

Investments in fleet modernization and LNG-ready vessels enhance Matson's operational efficiency and regulatory readiness. These investments reduce long-term operating costs and are likely to secure higher net margins as emissions standards tighten across the industry.

Want to know what’s powering this bullish price target? It isn’t just conversations about modernization or earnings. The narrative relies on high-stakes future forecasts, bold assumptions about the direction of margins and competitive advantages, and a profit multiple that may surprise even seasoned investors. Curious how analysts reconcile declining forecasts with such a premium value? The answer is found in the narrative’s numbers, so read on to see what drives this valuation.

Result: Fair Value of $137.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if global trade volatility persists or if Matson’s concentrated trade routes falter, these risks could easily reverse the current undervalued outlook.

Find out about the key risks to this Matson narrative.Another View: SWS DCF Model Suggests Even Deeper Value

While analysts argue Matson is undervalued based on future earnings compared to market price, our DCF model presents an even stronger case for undervaluation. This approach uses long-term cash flows rather than focusing solely on one year’s profits. Could the market be too bearish, or is there more risk than meets the eye?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Matson Narrative

If you have a different take or want to dive deeper into Matson’s numbers yourself, it only takes a few minutes to shape your own view. Just do it your way.

A great starting point for your Matson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Markets move quickly, and missing the next wave of growth can be costly. Tap into top ideas tailored for today’s market with a few clicks. Don’t let great stocks pass you by. Let Simply Wall Street surface new opportunities that match your goals and risk appetite.

- Capitalize on stable returns and long-term payouts by targeting companies offering dividend stocks with yields > 3%, which could help boost your portfolio’s income stream.

- Unlock potential gains in the tech frontier by backing AI penny stocks that are driving breakthroughs and powering tomorrow’s intelligent solutions.

- Spot exceptional value before the crowd by seeking out undervalued stocks based on cash flows with strong fundamentals and attractive price points based on cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal