Insperity (NSP): Evaluating Valuation Following Strategic Brand Deal With Tiger Woods

Insperity (NSP) just unveiled a notable move with a multiyear brand partnership involving Tiger Woods and his related ventures. With Woods stepping into the role of brand ambassador and Insperity sponsoring some of his foundation’s high-visibility events, this alliance represents a focused effort to raise Insperity’s profile in the HR solutions space. For investors, whenever prominent figures like Tiger Woods become closely associated with a business, the natural question is whether this marks the beginning of meaningful momentum or simply generates attention-grabbing headlines.

The enthusiasm surrounding this announcement, coupled with a newly declared dividend, comes at a challenging time for the stock. Over the past year, shares have fallen almost 39%, and the decline is even more pronounced when looking further back. Despite modest gains in the past week, the overall trend has been downward as growth concerns and changing risk perceptions shape discussions about Insperity’s outlook. This partnership could inject new energy, but investors appear cautious, potentially waiting to see results from marketing efforts before regaining confidence.

After a year of significant declines, could this partnership attract value-focused buyers, or has the market already priced in Insperity’s next phase? Let’s examine the valuation landscape.

Most Popular Narrative: 3.7% Undervalued

According to community narrative, analysts see Insperity as modestly undervalued, largely hinging on several forward-looking financial assumptions and strategic ambitions.

The upcoming launch of Insperity HRScale, a joint solution with Workday, targets a broader and more lucrative mid-market segment. This initiative leverages both advanced HR technology and comprehensive services and is expected to drive higher revenue growth and improved operating leverage as premium pricing and larger average client size become possible.

Want to know the bold assumptions powering this “undervalued” call? The secret lies in projected profit leaps and strategic partnerships that could change everything. Which financial moves and partnership bets underpin this fair value? The details behind this valuation might just surprise you.

Result: Fair Value of $57.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent benefit cost inflation or delays in the Workday partnership rollout could limit margin gains and cast doubt on optimistic growth targets.

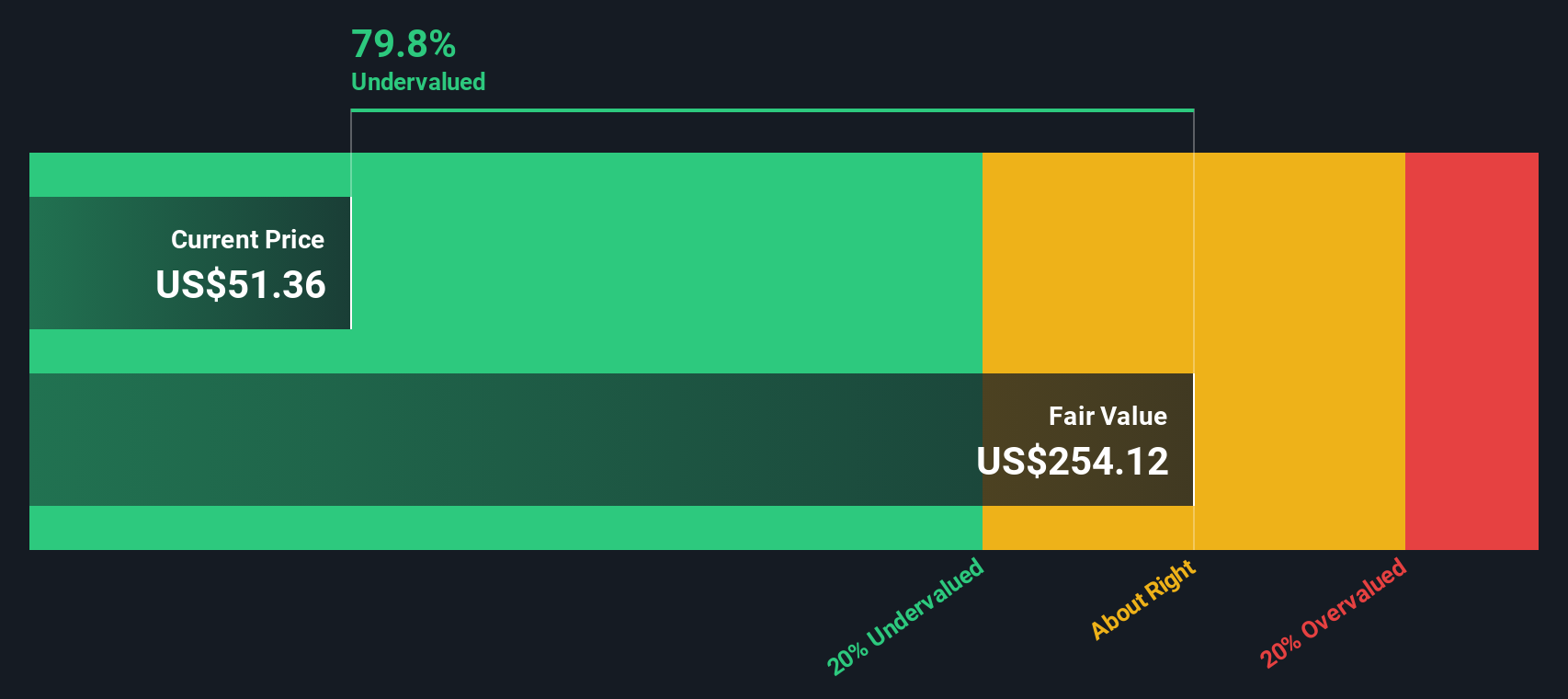

Find out about the key risks to this Insperity narrative.Another View: Our DCF Model Sees More Value

While the market often focuses on how Insperity is priced relative to similar companies, our DCF model takes a longer-term approach by weighing its cash flows. This method indicates the company may be even more undervalued. Which view will the market trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Insperity Narrative

If you see things differently or want to dive into the numbers yourself, it’s quick and simple to build your own perspective. Just do it your way.

A great starting point for your Insperity research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Capitalize on market opportunities now instead of watching from the sidelines. With a world of actionable ideas at your fingertips, you can spot overlooked gems and potential winners. Branch out today with these handpicked strategies and make your next investment move with confidence.

- Boost your income potential and tap into a selection of dividend-paying stocks with yields above 3% by reviewing dividend stocks with yields > 3%.

- Seize the momentum in artificial intelligence with curated picks of emerging AI innovators through AI penny stocks.

- Position your portfolio at the forefront of financial transformation and scan through leading cryptocurrency and blockchain-driven companies via cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal