FirstCash Holdings (FCFS) Valuation in Focus After Upgrades and Analyst Optimism

FirstCash Holdings (FCFS) has landed on investors' watchlists after a series of upgrades to its earnings outlook and a fresh bump to its analyst ranking. The company recently earned a more optimistic consensus from the analyst community, reflecting improved expectations for its future performance. While upgrades like these do not guarantee future gains, they often serve as a signal to the market that something is shifting in the company's prospects, especially when combined with momentum in the stock price.

This renewed optimism has played out in the numbers. FirstCash Holdings has posted gains of over 40% so far this year and has outperformed both the broader market and its direct peers in business services. The stock has delivered a 24% total return over the past year, with a strong upward move in the past month alone. Upward revisions to earnings estimates for both the current and next fiscal years add fuel to buyer enthusiasm, especially when the wider sector has struggled.

With all this positive momentum, the big question now is whether FirstCash Holdings is actually trading at a bargain, or if the market has already factored in all the good news about its growth potential.

Price-to-Earnings of 22x: Is it justified?

Based on the price-to-earnings (P/E) multiple, FirstCash Holdings currently trades at 22 times its earnings. This figure is significantly higher than both its industry peers and the wider market averages.

The P/E ratio measures how much investors are willing to pay per dollar of earnings. It serves as a key indicator of valuation for mature, profit-generating companies such as FirstCash Holdings. Comparing this firm's P/E to those of its peers helps assess whether the stock could be overvalued or undervalued relative to sector norms.

With a P/E multiple nearly double that of the US Consumer Finance industry average, the market appears to be pricing in above-average growth or earnings quality. However, this type of premium typically requires strong and sustained performance to be considered justified.

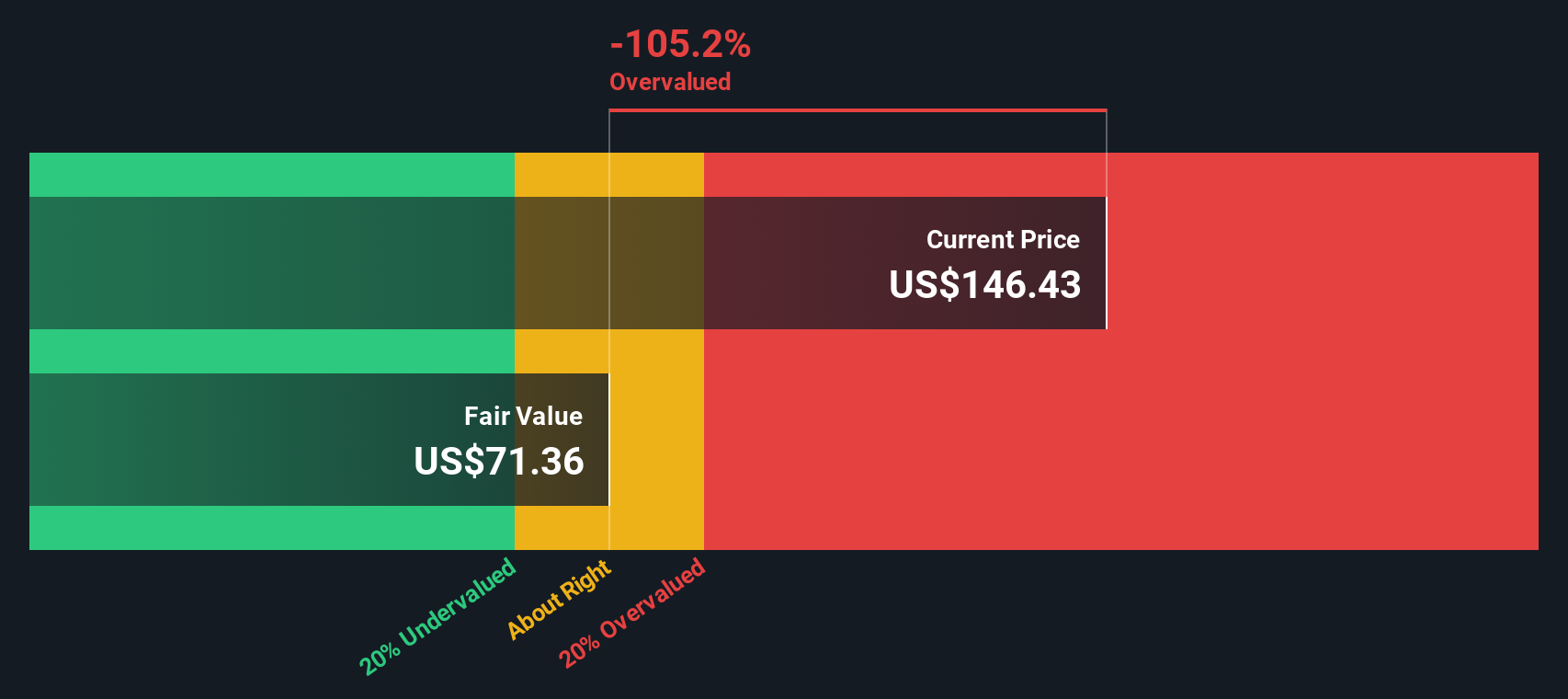

Result: Fair Value of $72.63 (OVERVALUED)

See our latest analysis for FirstCash Holdings.However, if revenue growth is slower than expected or if there is a reversal in net income improvement, the current valuation story for FirstCash Holdings could quickly be challenged.

Find out about the key risks to this FirstCash Holdings narrative.Another View: Discounted Cash Flow Test

The SWS DCF model uses a different approach to valuation and also finds FirstCash Holdings overvalued at recent prices. When two valuation tools reach the same conclusion, which perspective should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own FirstCash Holdings Narrative

Keep in mind, if our analysis does not align with your perspective or you prefer to dig into the numbers on your own, you can explore the data and create your own narrative in just a few minutes, or simply do it your way.

A great starting point for your FirstCash Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Expand your horizons and give yourself an edge by targeting quality stocks designed to match your investment style. Don’t let the best prospects pass you by. Here are three engaging ways to power up your watchlist today:

- Uncover the potential of companies leading the charge in medical technology by checking out healthcare AI stocks. See which healthcare innovators are leveraging artificial intelligence to transform patient care.

- Strengthen your portfolio with a steady stream of income when you review dividend stocks with yields > 3% for stocks consistently delivering yields above 3%, which may appeal to those seeking reliability.

- Stay ahead of market trends by spotting attractively priced growth stories among undervalued stocks based on cash flows. Here you can explore undervalued stocks based on superior cash flow performance and genuine upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal