Perdoceo Education (PRDO): Assessing Valuation After Steady Gains and Strong Insider Commitment

If you are watching Perdoceo Education (PRDO), the latest move in the stock might have caught your eye. After reporting steady growth in both revenue and earnings, and with insiders owning a sizable chunk of the company, market confidence seems to be building around Perdoceo’s long-term direction. The recent uptick in the stock could be a response to investors recognizing not just the operational progress but also a management team clearly incentivized to keep things on track for shareholders like you.

Looking back, Perdoceo Education’s share price is up nearly 50% over the last year and up 28% year-to-date. There has been a solid 17% climb just over the past month, suggesting momentum is on the rise. The pattern is similar over three and five years, which may indicate that this is more than a short-term blip. Management’s focus on profitability, paired with rising sales and aligned insider interests, has given the market reasons to rethink the company’s growth potential.

With this kind of momentum, here is the big question: are investors getting in early on a longer-term growth story, or has the market already priced in every bit of good news?

Most Popular Narrative: 16.6% Undervalued

According to community narrative, Perdoceo Education is seen as significantly undervalued. Analyst consensus suggests the current trading price does not fully reflect the company’s projected growth trajectory, anticipated earnings, and disciplined cost management.

“Demonstrated scalable operating model and disciplined cost control, reflected in robust free cash flow, increasing operating income, and EPS, enable ongoing shareholder returns via buybacks and dividends. This also creates capacity for further industry consolidation and selective M&A, positioning the company for long-term earnings growth.”

What’s fueling these bullish forecasts? There is a bold playbook behind the scenes that hinges on key future earnings and revenue assumptions. Want to find out the numbers and financial leaps that back up this analyst price target? There is more beneath the surface than just momentum. See how this undervaluation is calculated.

Result: Fair Value of $40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, surging student acquisition costs or unexpected regulatory setbacks could quickly undermine enrollment gains and squeeze margins. These factors may challenge the current optimism around Perdoceo’s outlook.

Find out about the key risks to this Perdoceo Education narrative.Another View: What Does Our DCF Model Say?

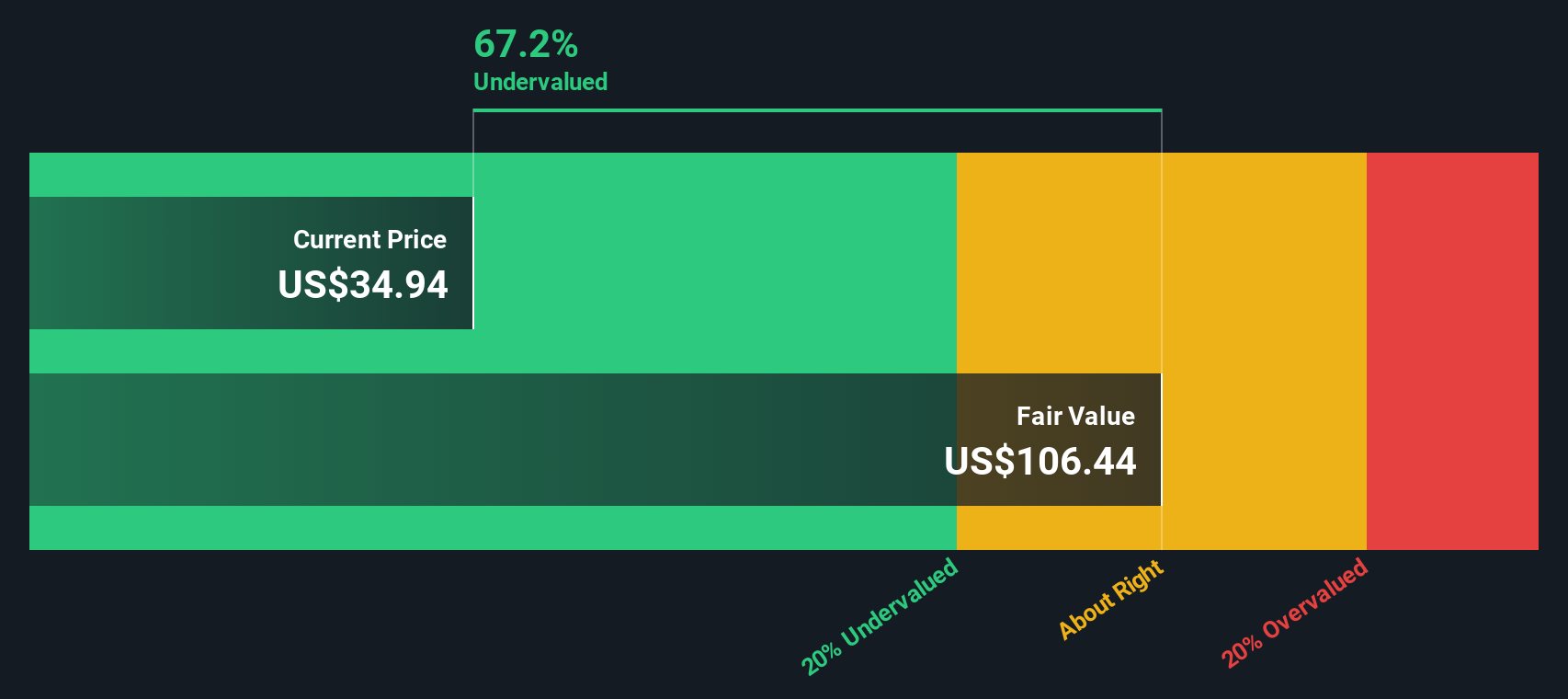

While analysts see upside based on earnings and future growth, our DCF model takes a different approach to valuing Perdoceo. This method indicates the stock is trading well below its fair value, which raises questions about market skepticism or hidden risks. Which method do you trust most?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Perdoceo Education Narrative

If you think the story could unfold differently, or if you like to draw your own conclusions from the numbers, you can shape your own perspective in just a few minutes and do it your way.

A great starting point for your Perdoceo Education research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Seize your edge in the market with some of the smartest stock opportunities curated for you. Whether you are seeking hidden value, future-defining tech, or steady income in your portfolio, these handpicked ideas will help you move with confidence. Don’t let another opportunity pass you by.

- Tap into tomorrow’s technology by uncovering standout companies at the forefront of artificial intelligence with AI penny stocks.

- Boost your portfolio’s resilience by targeting leading businesses that consistently offer yields above 3 percent using dividend stocks with yields > 3%.

- Capitalize on value by identifying stocks the market has overlooked with undervalued stocks based on cash flows. Unlock new opportunities others might miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal