QuidelOrtho (QDEL): Valuation Insights After Debt Refinancing Boosts Financial Flexibility

If you are holding or eyeing QuidelOrtho (QDEL), you probably caught wind of the company’s fresh $3.4 billion credit agreement unveiled on August 21. By refinancing a substantial chunk of its debt, QuidelOrtho has not only extended maturity dates but also trimmed down required amortization payments. This move may not sound flashy, but it signals a clear intent: preserve flexibility, shore up the capital structure, and keep the focus on managing leverage as the company looks ahead to its next phase.

Zooming out, it has been a challenging ride for QuidelOrtho shareholders this year. The stock price is down nearly 38% since January and sits more than 37% lower than last summer. Momentum has not turned around yet, despite product launches and leadership additions such as the recent arrival of Erich Wolff to steer enterprise strategy. While the new Certified Analyzer Program could open doors in underserved regions, investors continue to weigh how these strategic moves translate into financial recovery, especially after a tough few years for the diagnostics sector.

This brings us to the pivotal question: does QuidelOrtho’s ability to refinance on favorable terms mean there is untapped upside in the share price, or is the market already pricing in future growth and risk?

Most Popular Narrative: 35% Undervalued

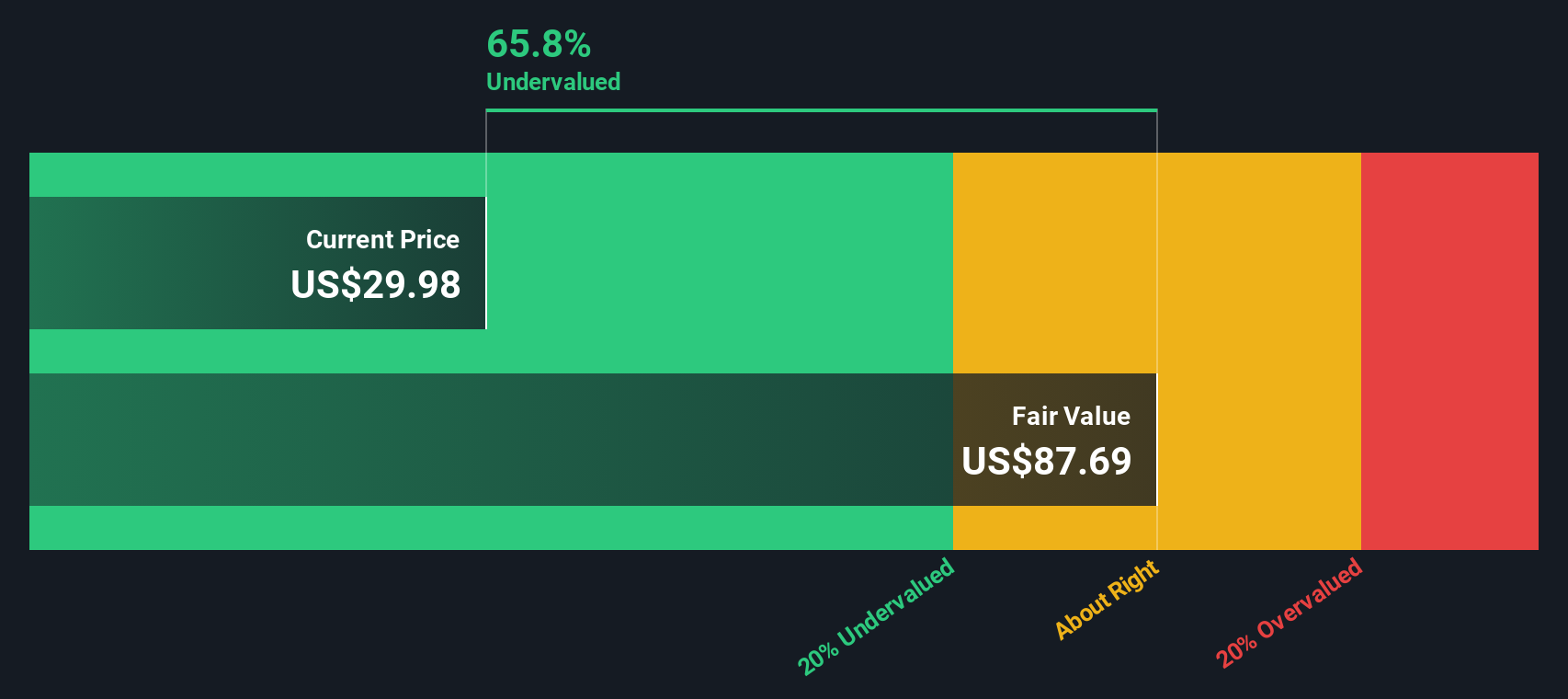

According to the community narrative, QuidelOrtho is considered notably undervalued relative to its future growth prospects and operational changes, based on current analyst consensus.

Expansion into international markets such as Latin America, Asia Pacific, and underpenetrated regions like China—where differentiated technology, low market share, and a large runway for immunoassay growth exist—positions QuidelOrtho to capture increased demand stemming from global health system focus on early detection and public health surveillance. This is expected to drive topline revenue growth.

What is fueling this optimistic outlook? The details lie in emerging growth markets, strategic platform decisions, and projected improvements in margins. To discover the key assumptions behind this narrative’s $43 target, see what experts identify as the main factors that could elevate QuidelOrtho’s prospects.

Result: Fair Value of $43.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent revenue drag from declining COVID-related sales and hurdles with product discontinuations could quickly challenge this optimistic outlook.

Find out about the key risks to this QuidelOrtho narrative.Another View: Our DCF Model Backs Up the Story

While the community focuses on growth and industry trends, our DCF model takes a close look at QuidelOrtho’s future cash flows. This approach also indicates that the shares may be undervalued. However, could market risks change the outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own QuidelOrtho Narrative

If you see things differently or want to dive into the numbers yourself, you can craft your personal narrative in just a few minutes. So why not do it your way?

A great starting point for your QuidelOrtho research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Opportunities?

Why settle for just one good idea? With so many dynamic markets in play, now is the perfect time to see what else is out there. Let Simply Wall Street’s screener connect you instantly with exciting stocks backed by market trends and fundamentals that others might miss if they hesitate.

- Tap into innovation and uncover the next wave of progress by searching for companies shaping healthcare through artificial intelligence using the healthcare AI stocks.

- Find reliable income sources and strengthen your portfolio with companies offering steady yields greater than 3 percent by heading straight to our dividend stocks with yields > 3%.

- Capitalize on the intersection of finance and technology by spotting firms at the forefront of crypto and blockchain advances through the cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal