Valmont Industries (VMI): Assessing Valuation After Strong EPS Growth and Signs of Sharper Management Alignment

If you’re holding or eyeing shares of Valmont Industries (NYSE:VMI), this week just made things a lot more interesting. The company announced a 35% jump in earnings per share for the past year, signaling a marked upswing in profitability. With insiders holding a sizeable ownership stake and management pay running below the average for similar companies, there’s growing chatter that Valmont Industries might be doing more than just playing it safe. Some believe the business could be positioned for lasting shareholder value.

Those positive fundamentals appear to be catching on outside company walls. Over the past year, Valmont Industries’ stock has pushed up by 32%, with a strong tailwind developing in recent months. The 17% gain over the past quarter suggests momentum is building, likely fueled by both last year’s profit boom and a broader sense of management discipline. These are two ingredients investors often reward. For anyone tracking the industrials sector, it’s a trend that stands out, especially with revenue and net income both logging strong annual growth.

With these gains and apparent alignment between leadership and owners, the question now is whether Valmont Industries is still trading below its true worth, or if the market’s rally has already factored in expectations for more growth ahead.

Most Popular Narrative: 4.6% Undervalued

According to community narrative, Valmont Industries is seen as modestly undervalued based on its earnings potential, margin expansion, and multi-year growth cycle in its core infrastructure and agriculture markets.

Infrastructure investment and the accelerating energy transition are driving unprecedented demand in utility and transmission, supported by record customer backlogs and industry-wide capacity constraints. Valmont's advanced investments in capacity, automation, and AI are expected to unlock between $350 million and $400 million in incremental annual revenue and support higher earnings and margins as this multi-year cycle unfolds.

Curious what it takes for Valmont to command a valuation above today’s price? One overlooked factor is the expected surge in both profitability and margin strength over the next several years. If you want to discover which forward-looking forecasts drive this bullish calculation, don’t miss the full rundown of the numbers and projections that power this standout valuation.

Result: Fair Value of $393.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent exposure to cyclical spending and potential margin pressure from rising material costs could quickly temper today's optimism around Valmont's valuation.

Find out about the key risks to this Valmont Industries narrative.Another Perspective: Multiples Tell a Different Story

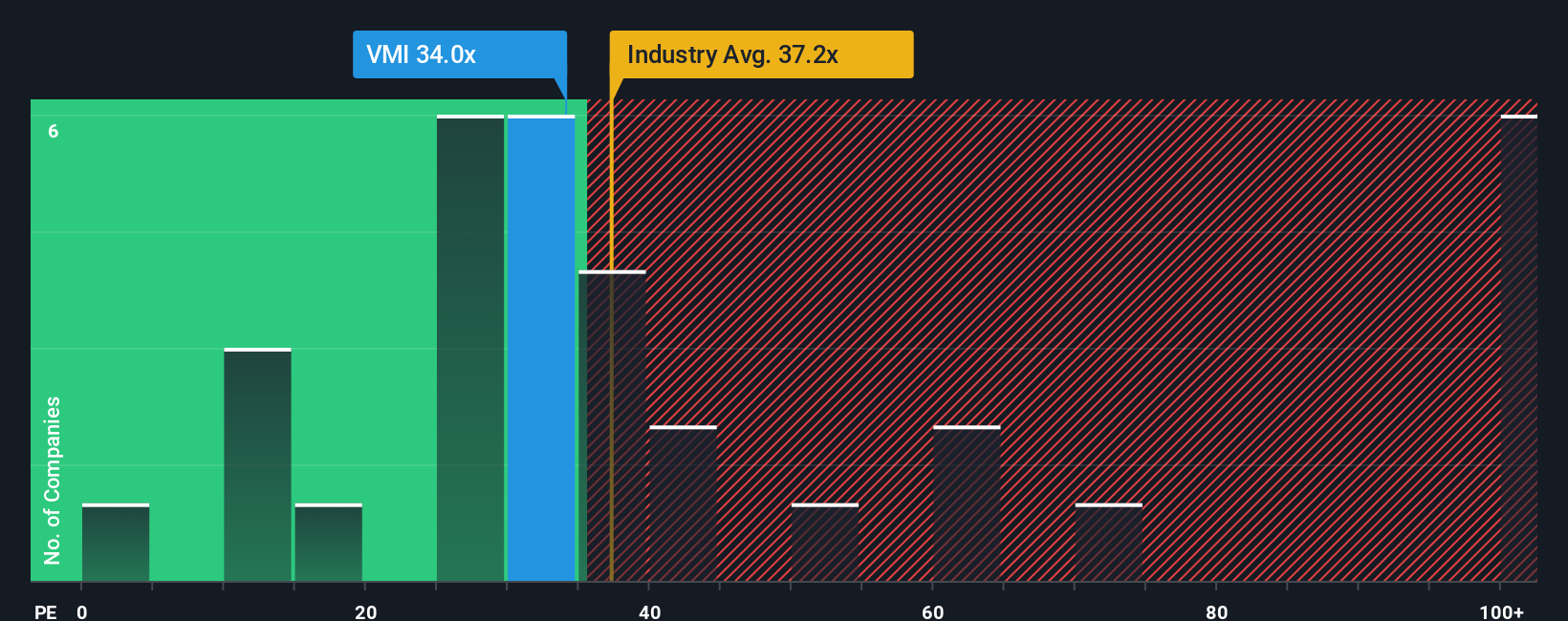

While the analyst consensus points to upside, a look at the most common valuation gauge sends a more cautious message. Using this method, Valmont appears expensive compared to its industry. The question remains: whose view will the market trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Valmont Industries Narrative

If you see things differently or want to dive into the numbers yourself, you can build your own view in just a few minutes. do it your way.

A great starting point for your Valmont Industries research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

If you want an edge in the market, do not stop at just one promising company. Increase your research power with ideas that match your goals and risk profile. Here are three strategic opportunities you should not miss on Simply Wall Street:

- Tap into reliable income streams by checking out stocks that offer dividend stocks with yields > 3%. This can potentially enhance your portfolio’s stability.

- Spot the future of medicine and innovation with leading-edge companies making advances in healthcare AI stocks for healthcare.

- Uncover strong growth prospects among penny stocks with strong financials that support their potential with solid financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal